Momentum is gaining within the artificial intelligence ecosystem

Key points:

- Relative strength continues to lean toward risk-on areas, particularly growth-oriented groups

- Stocks within the artificial intelligence ecosystem are consistently yielding new opportunities

- Home improvement stocks show poor relative strength and technical damage

Relative trends suggest that investors should favor growth, technology, and AI

Growth stocks and sectors have been steadily strengthening, a trend captured by our strategies, trend scores, and summary statistics.

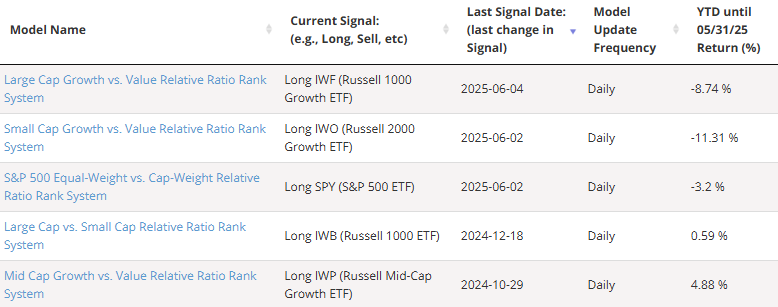

As shown in the table below, relative strength timing systems, featured on the strategies page of the website, currently favor growth ETFs over value across large, mid-, and small-cap market capitalizations.

Drilling down into sectors, we find that offensive growth-focused areas, such as communication services, consumer discretionary, and technology, maintain relative strength buy signals.

While still positive, consumer staples, real estate, and financials have weakened notably and are at risk of triggering sell signals. Industrials remain the only value/cyclical sector with a constructive setup.

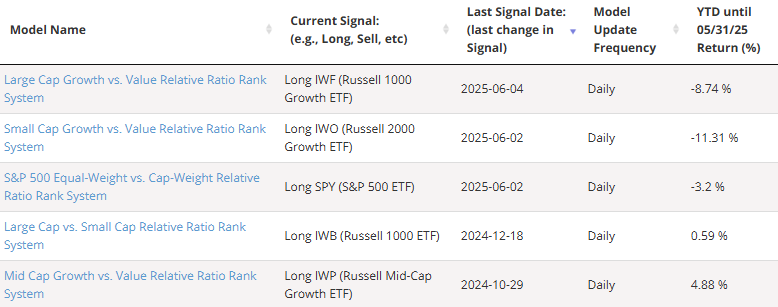

Because a handful of mega-cap stocks can influence relative trends for an index or ETF, it's critical to examine the market message from individual stocks that comprise a sector.

On the website's sector summary page, the highest concentration of stocks with trend and relative trend scores of eight or higher is found in the communications services, industrials, technology, and financial sectors, reinforcing the relative strength timing system's exposure to these groups. Furthermore, technology has shown notable improvement recently.

Breakouts show a clear trend toward the AI ecosystem

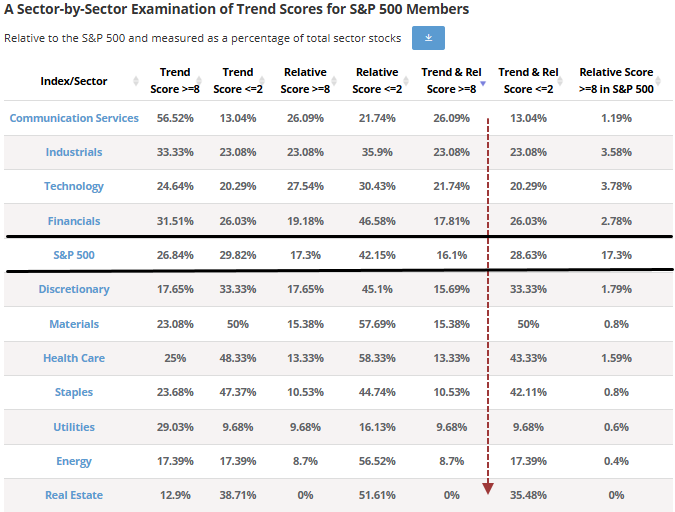

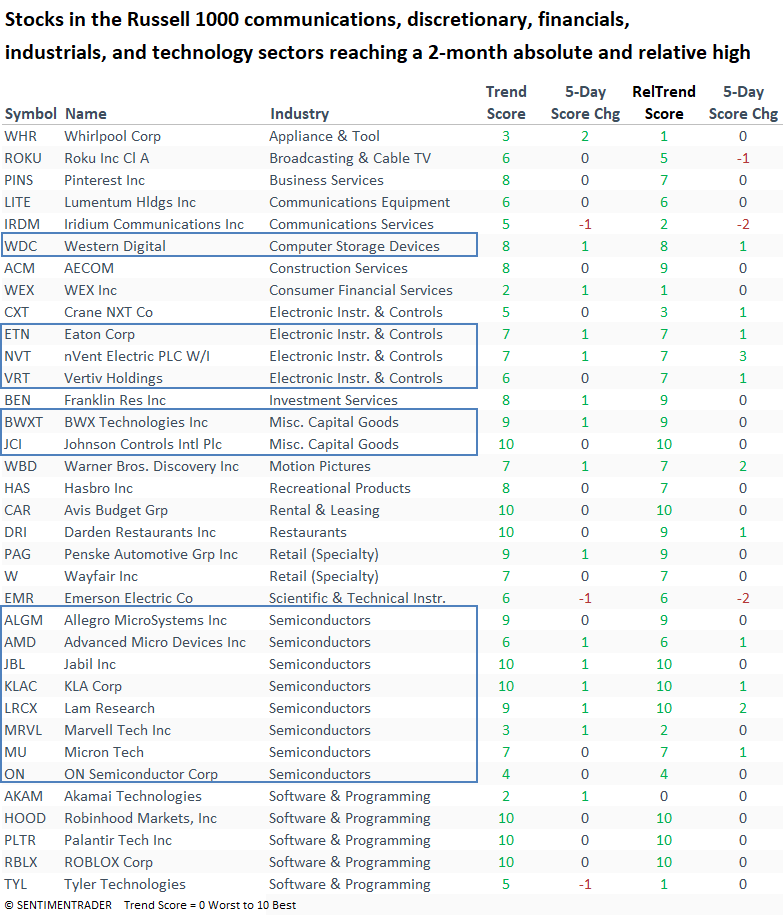

On Monday, a cyclical sector breakouts list revealed a clear and accelerating trend toward companies tied to AI infrastructure and data center expansion.

The stocks include not only storage providers like Western Digital but also a broad range of suppliers that support the physical and operational demands of hyperscaler and enterprise data centers, such as those for cooling, security, fire safety, and building automation systems.

Semiconductors were also featured prominently, underscoring their foundational role in powering AI workloads and data-center compute capacity. Altogether, the list reflects how the AI buildout is driving strength across multiple layers of the infrastructure ecosystem.

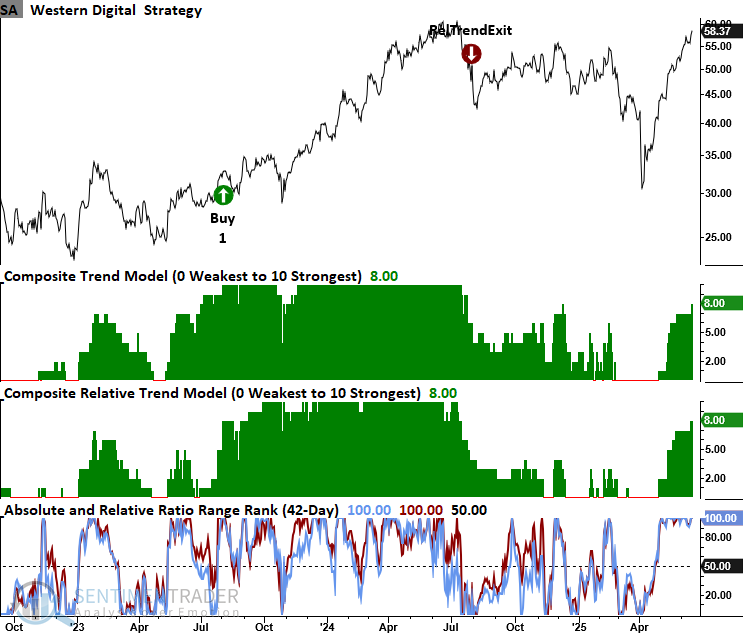

Western Digital (WDC), a key player in data storage solutions and a beneficiary of accelerating data center demand, is on the cusp of triggering a trend score buy signal. This potential shift in trend strength would align it with Seagate Technology, which I highlighted in a previous report after it confirmed a bullish signal.

The potential addition of Western Digital underscores the growing momentum in the storage hardware sector as investments in cloud and AI infrastructure expand.

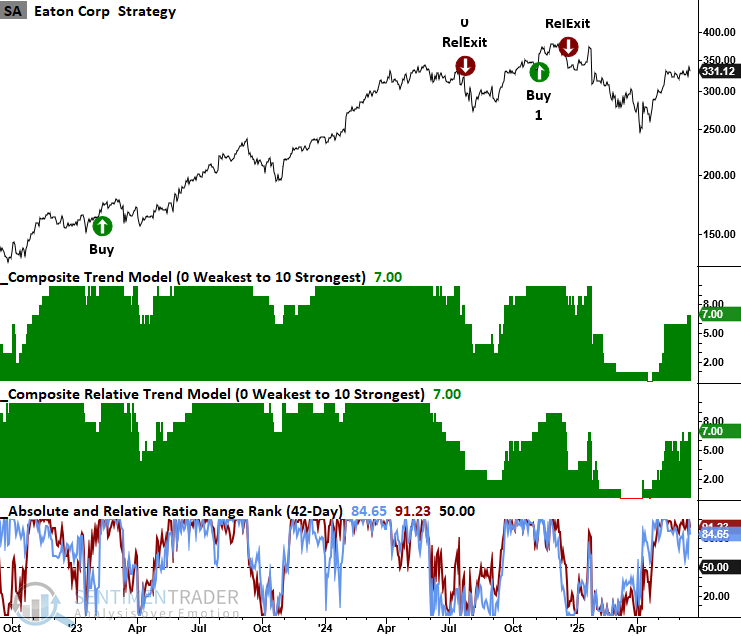

Eaton Corp (ETN), which supplies power solutions for data center cooling and backup, has traded sideways for a year. An alert could be triggered if trend scores improve by one more point and the stock reaches a 2-month high in both absolute and relative terms.

Vertiv Holdings (VRT), a competitor to Eaton in data centers, particularly in the areas of power management, cooling, and infrastructure solutions, should be on your radar as it approaches a potential trend score alert.

Home improvement is an area to avoid

In my report, "An increasing number of stocks are showing bullish trend score conditions," I highlighted several stocks in the housing industry that displayed unfavorable trend conditions, suggesting this was an area investors should avoid.

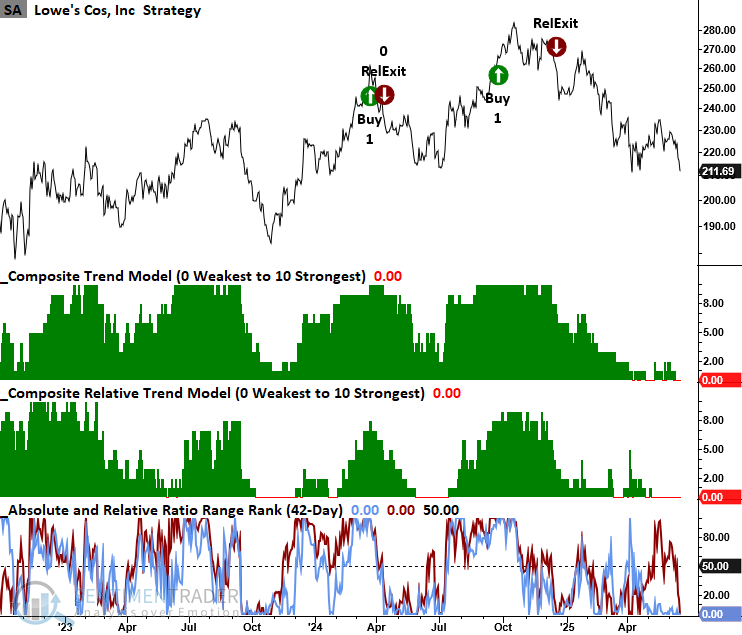

Lowe's, a bellwether in the home improvement retail sector, holds a trend and relative trend score of zero as it sinks to multi-month absolute and relative lows. This breakdown strengthens the case for avoiding exposure to housing-related stocks or selectively initiating short positions, depending on one's risk tolerance.

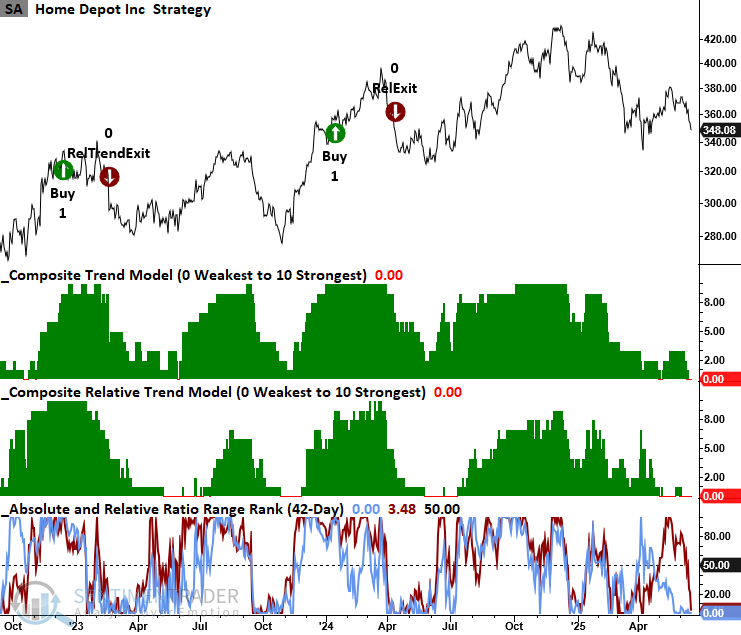

Similar to Lowe's, Home Depot currently maintains a trend and relative score of zero, as it approaches multi-month lows on both an absolute and relative basis.

What the research tells us...

Growth has emerged as the dominant style factor across all market capitalizations, with a resurgence largely fueled by the technology sector, particularly companies within the expanding AI ecosystem. This leadership has not only lifted traditional growth names but also extended to select industrial stocks, especially those involved in the physical infrastructure supporting AI data centers. While these beneficiaries of AI-driven capital spending are experiencing strong momentum, not all areas of the market are participating in this trend. Home improvement stocks, which tend to correlate closely with the housing sector, continue to deteriorate, a trend consistent with my previous guidance to avoid housing-related exposure amid persistent headwinds.