Momentum in the commodity with a Ph.D. in economics continues to lose its luster

Key points:

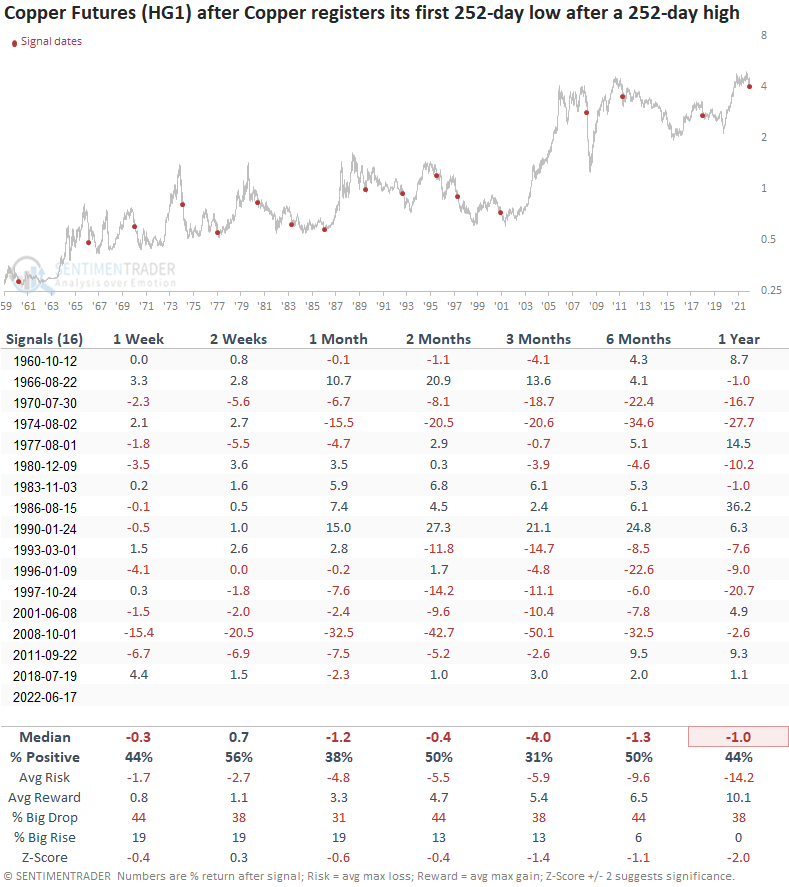

- Copper futures registered a new 252-day low on 6/17/22

- The new low is the first occurrence after a 252-day high

- After similar signals, copper, commodities, and stocks show negative returns

The commodity with a Ph.D. in economics continues to lose momentum

In a note on April 26th, I shared a momentum study for copper that suggested the commodity with a Ph.D. in economics had lost its luster. Since the publish date, copper has declined by more than 9%, and it's down significantly this morning. Copper registered a new 252-day low last Friday, representing the first occurrence since its previous 252-day high in March.

Let's conduct a study to assess the outlook for copper, commodities, and stocks after copper futures register their first 252-day low after a 252-day high.

After the 2nd highest number of 252-day highs in history, copper has lost momentum and is now registering a 252-day low.

Similar signals preceded negative returns for copper futures

Similar signals preceded negative returns for copper futures

This study generated a signal 16 other times over the past 62 years. After the others, copper returns and win rates look unfavorable across almost all time frames, especially on a medium-term basis. The 1-6 month window shows a loss at some point in 12 out of 16 cases.

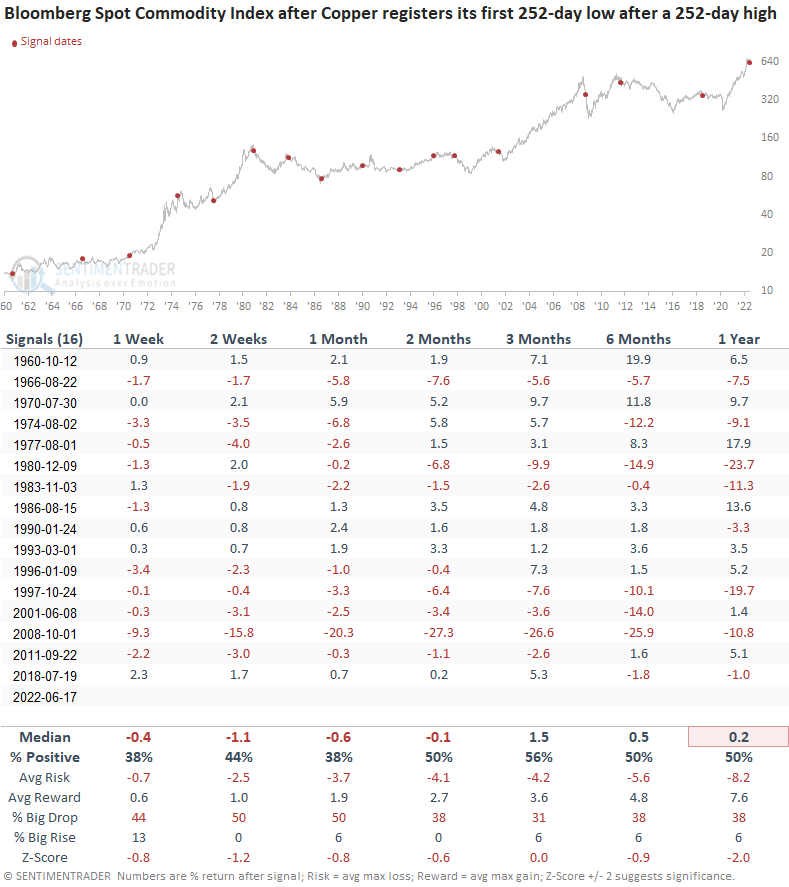

What happens to commodities after copper signals

Commodities tend to struggle in the next few months and show little upside progress over the next year.

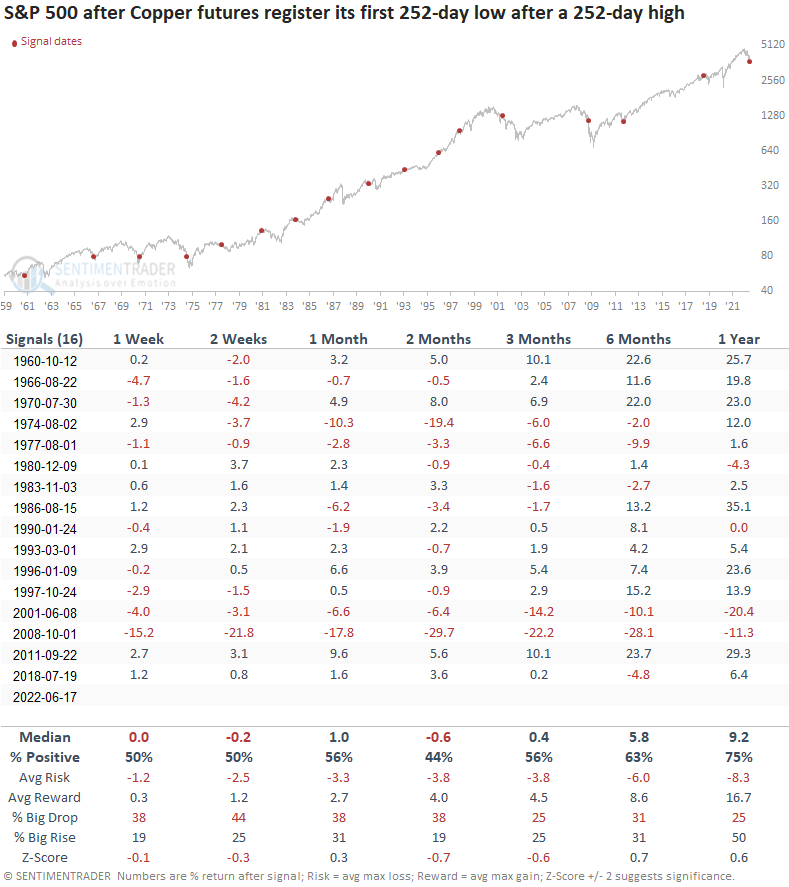

What happens to stocks after copper signals

Stocks tend to struggle in the next few months. However, the 1-year return and win rate suggest better days ahead, especially if we can avoid a recessionary bear market like 2000-02 and 2007-08.

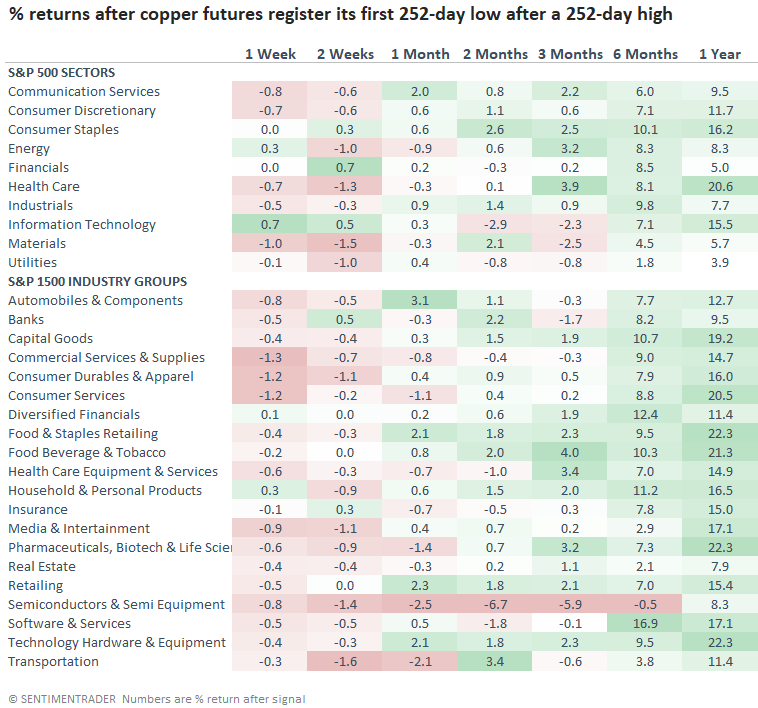

The sector and industry group table confirms the broad market outlook. Very few groups avoid the cautionary stance in the first few months. Resource-based sectors like energy and materials suffer the most in the first few weeks, which shouldn't be surprising given the commodity outlook table. As was the case with the S&P 500, the 1-year time frame looks constructive.

What the research tells us...

When copper futures register their first 252-day low after a 252-day high, the shift in momentum typically leads to more adverse price action for copper. Similar setups to what we're seeing now have preceded unfavorable copper performance and win rates across almost all time frames. If I apply the signals to commodities or the S&P 500, forward returns look unfavorable in the next few months. Resource-based sectors tend to struggle the most. However, the 1-year outlook for stocks looks constructive.