Momentum continues to accelerate in the energy sector

Key points:

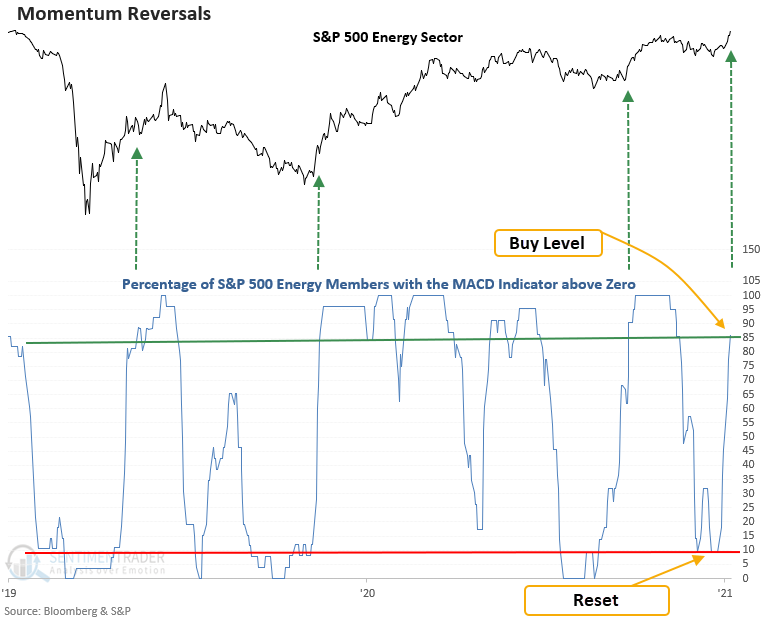

- The percentage of energy sector stocks with the MACD indicator above zero surged higher

- The sector has rallied 77% of the time over the next 3 months after other signals

Measuring the breadth of participation with the MACD indicator

Data vendors like Bloomberg sometimes provide multiple time series that measure the breadth of participation for a technical indicator like the moving average convergence divergence (MACD). For instance, one method might measure the percentage of issues with a MACD indicator cross above the exponential moving average over a lookback period. In contrast, a second technique might calculate the percentage of issues with the MACD indicator above zero. After coding a trading model and running an optimization process, I determined that the percentage of issues with the MACD indicator above zero is a better time series. It returned fewer signals with better results.

If you're interested in learning more about the MACD indicator, click here.

A trading model for the percentage of issues with the MACD indicator above zero

The system triggers a buy signal when the percentage of issues with the MACD indicator above zero reverses from less than 10% to greater than 85%.

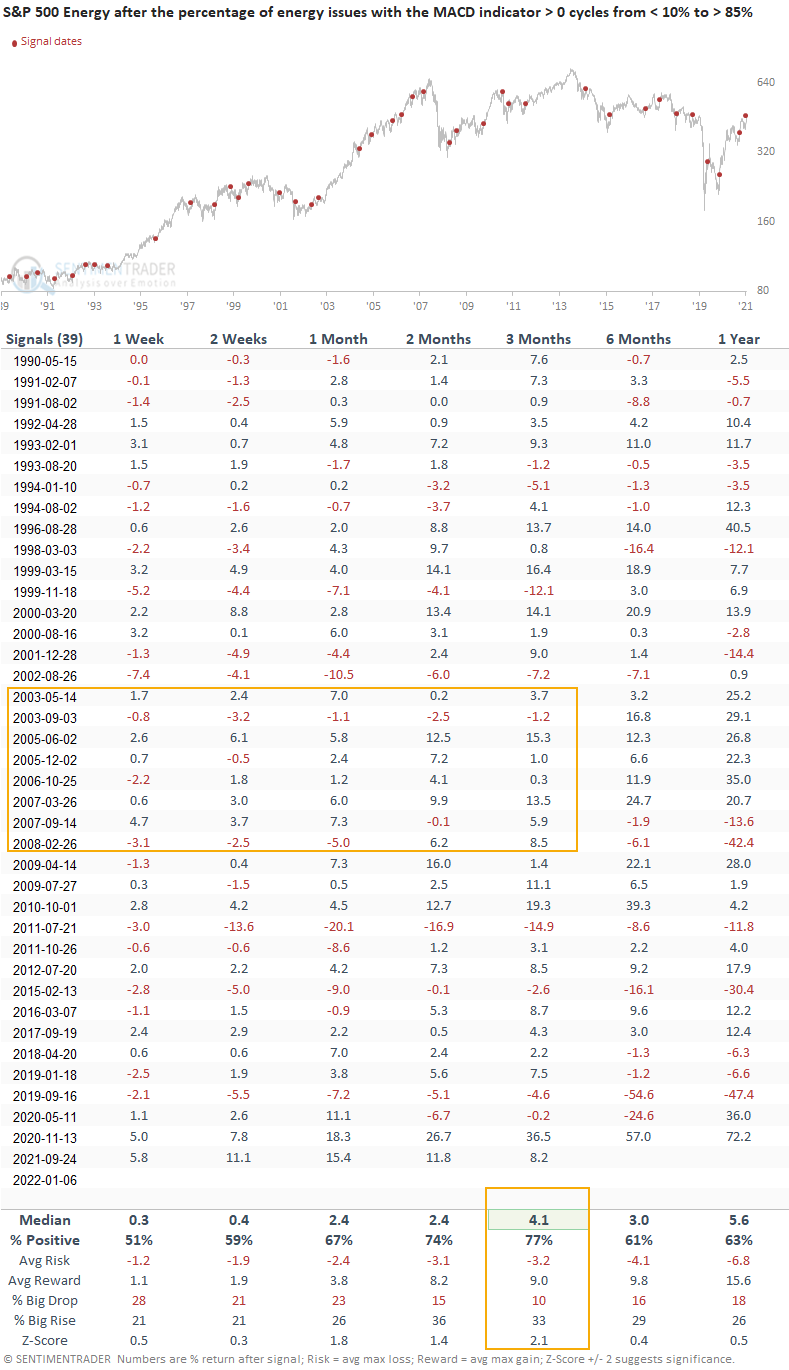

Energy stocks rallied 77% of the time after other signals

This signal has triggered 39 other times over the past 32 years. After the others, future returns and win rates were better than historical averages across most time frames. The 3-month window provides the best outlook with a solid return, win rate, and z-score. If you're in the camp that energy is in a bull market similar to the 2003-08 environment, this trading model identified several solid swing trades in that period.

What the research tells us...

The percentage of energy issues with the MACD indicator above zero reversed from oversold to overbought. Similar setups to what we're seeing now have preceded rising energy stock prices, especially in the 3-month time frame.