Mom & pop sell while newsletters tell them to buy

Much has been made of the idea that despite much real-money evidence to the contrary, individual investors are not optimistic. Pretty much the sole source of this opinion is a weekly survey from the American Association of Individual Investors.

We've discussed this multiple times in recent months and don't need to rehash it. A good way to see what research we've published on any given indicator is to pull up its chart, then scroll to the bottom of the page and click the tab for Research & Blog Posts. This is the one for the percentage of AAII members that are bullish on stocks. Clicking the title will pull up that piece of research.

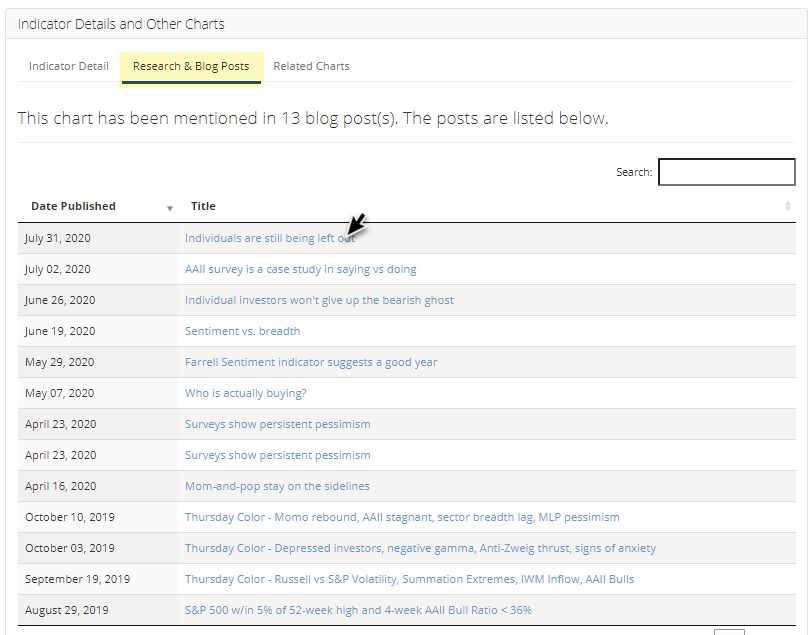

Even though stocks hit records again this week, the percentage of bulls remains low and bears remains high, so the Bull Ratio is still extremely low. That's not only unusual given stocks' returns in recent months, it's unusual compared to other surveys.

The poll of newsletter writers by Investor's Intelligence, for example, is showing extremely high optimism. That makes our current juncture the most unusual in the more than 30 years that both surveys have been released. Never before have we seen such pessimism from individuals at the same time as there has been such optimism from newsletters.

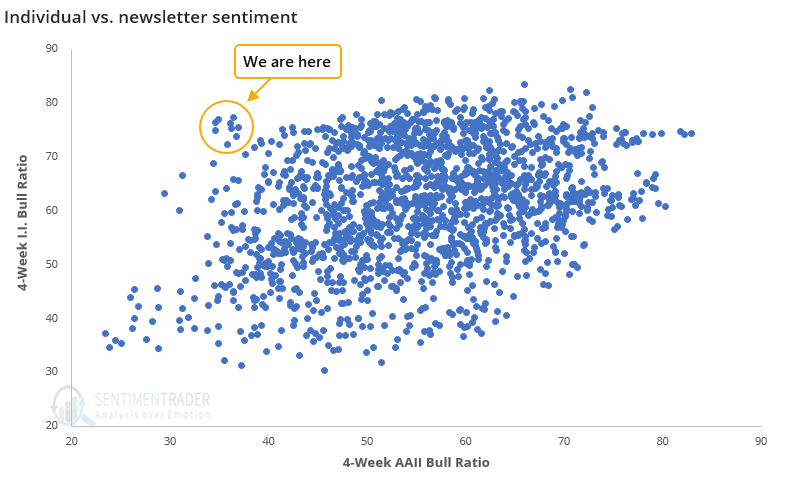

The spread between the 4-week average of the Bull Ratios from both surveys just hit a record low.

We can see from the chart that the S&P 500's annualized return when the spread is positive (AAII > Investor's Intelligence) is +15.9%. That's more than twice as high as when the spread is negative. In other words, when individuals were more optimistic than newsletter writers, then stocks performed better. So much for the idea that mom & pop are always the dumb money.

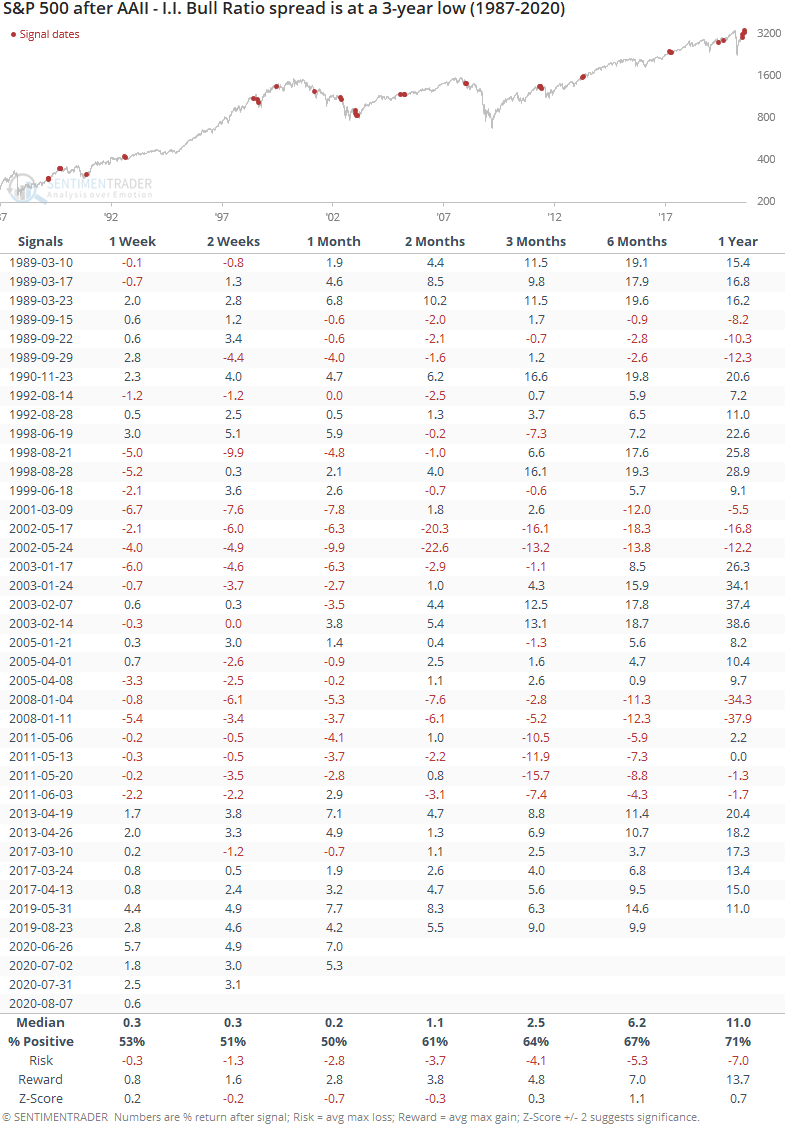

The table below shows the S&P's returns after any week when the spread between the two surveys was at its lowest level in at least 3 years.

Returns were below average, but highly variable. It preceded several large declines, but also several large rallies.

People who are bullish on stocks will point to the AAII survey and trot out the tired, incorrect cliche that stocks are climbing a wall of worry. Bears will point to the I.I. survey and suggest that optimism is too high and stocks will fall.

We prefer to incorporate all of the evidence and see what sorts out. Currently, there are exceptions but there is much more evidence that optimism is excessively high, especially when looking at where investors are actually putting their money instead of just giving their opinions.

There is no perfect sentiment indicator, and surveys rank among the lower tier of them. They can be useful, primarily when in agreement and at one extreme or another. The current divergence between AAII and others is exceptional, and likely doesn't mean much. If anything, it might be a very slight negative given historical reactions under similar conditions.