Mom-and-pop are not interested

There is a chorus of opinion that stocks couldn't possibly have formed an important bottom in March because we never saw peak pessimism, whatever that means. Usually, as evidence, the proclamations include a chart of some random, isolated sentiment indicator.

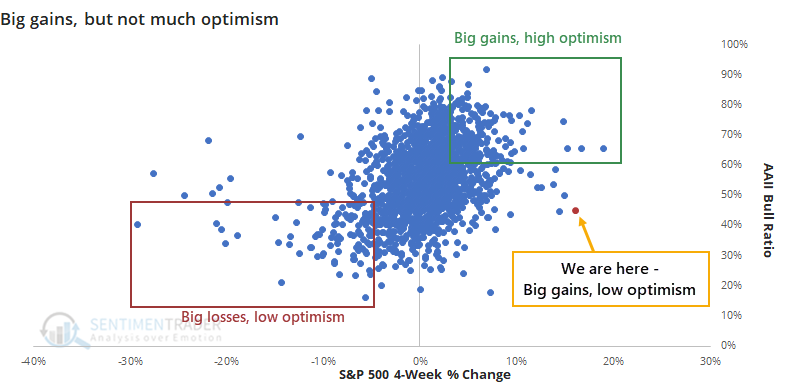

No single indicator is perfect, and there is usually something that doesn't fit with the others. One of the measures that didn't really show much pessimism near the low in March was the survey of individual investors from AAII.

Here's the curious thing, though - despite a massive rally in stocks, folks are still pessimistic. Over the past four weeks, stocks have jumped more than 10%, but the Bull Ratio has barely edged higher. Never before has the S&P 500 rallied so much, with so little movement in optimism. And never before has it rallied so much while bears still outnumbered bulls.

There were only two weeks when conditions were even remotely similar. Both led to large gains going forward. When we relax the parameters to get a larger sample size, it's evident that such an apathetic investor attitude tends to be a better long-term sign than when optimism surges.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more in-depth look at what it means when investors don't jump in

- Despite a big rally, the equal-weight S&P 500 index is dropping to new lows relative to the cap-weight index

- Sentiment has hit high optimism across sectors

- Tech has massively outperformed banks and the wider S&P index

- What happens when we see a big gap up during a tough market