Minutes Digest for Dec 28 2020

Breakaway gap on SPY

- Published:

2020-12-28 14:02:51 - Author: Jason Goepfert

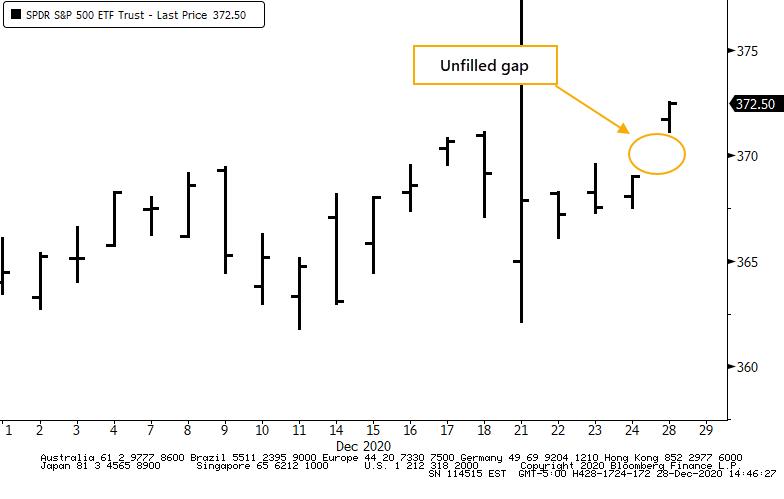

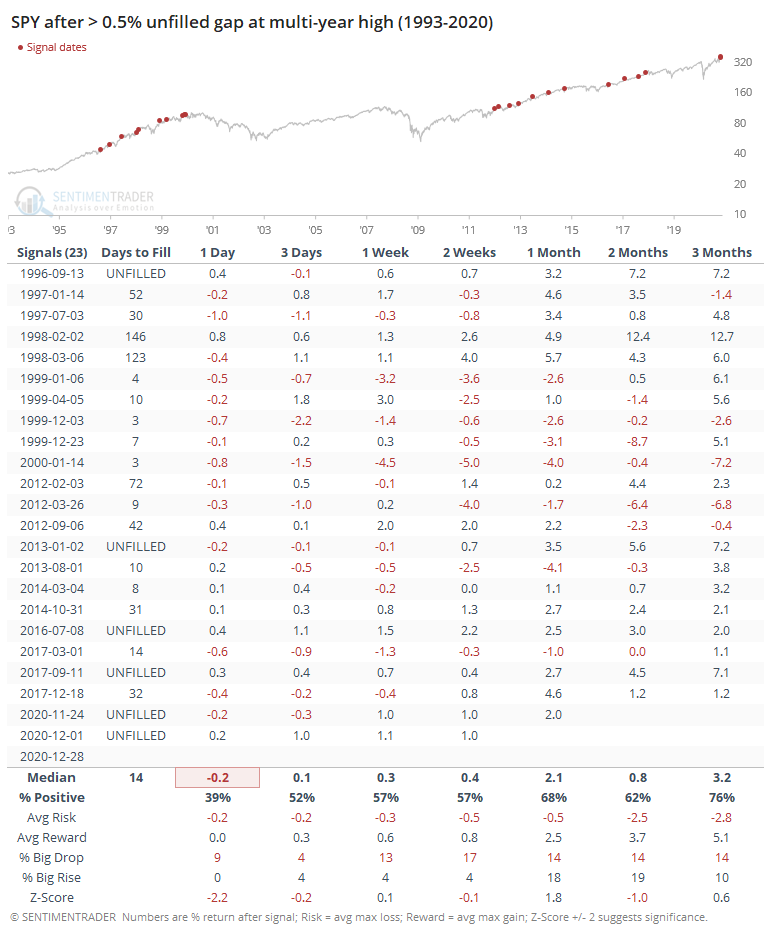

Buyers keep pressing into the major equity ETFs, with SPY and QQQ recently hitting their highs of the day. For both, there is a potential that this is a "breakaway gap", where buyers are so eager to get in that there is a gap between today's low and yesterday's close.

When SPY has seen this kind of behavior before, it tended to fall back the next day, and had mediocre returns in the short-term in general, but showed decent performance over the next month.

It took a median of 14 days for SPY to fill the gap, meaning it closed below the price prior to the gap open. But there was wide variability among them, with several of them taking more than 3 months. There were 4 that went unfilled for at least 6 months, not including the most recent couple of gaps.

It's tenuous, but we could gingerly conclude that behavior like this is unlikely to be a true breakaway that never sees a price that trades below Friday's close.

Another small reversal

- Published:

2020-12-28 12:01:42 - Author: Jason Goepfert

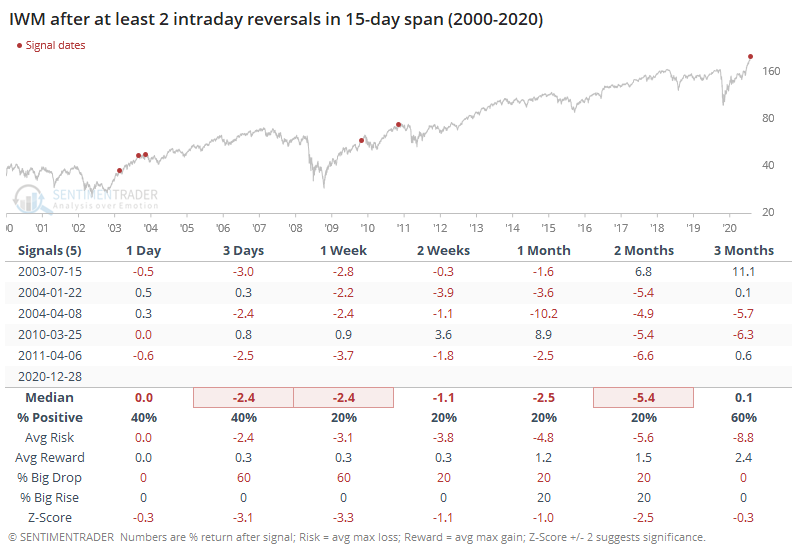

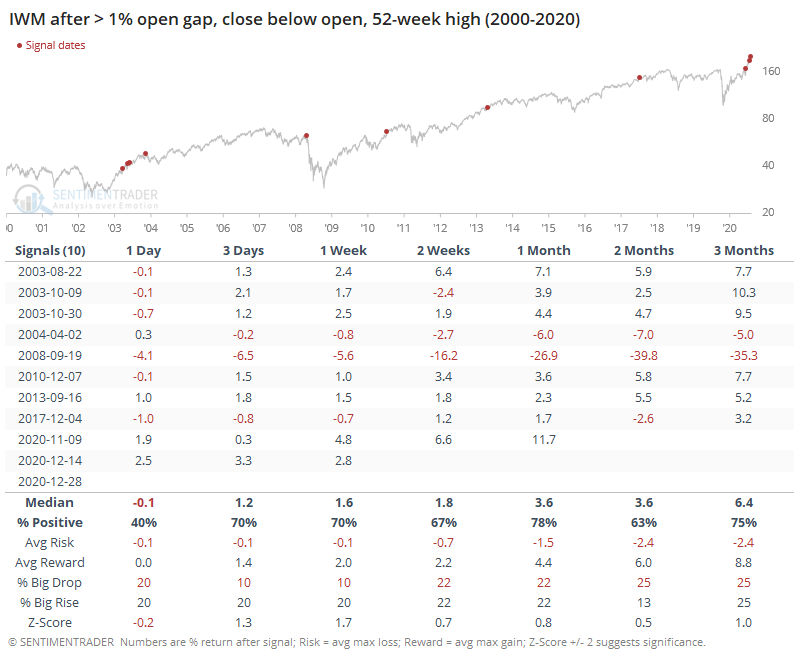

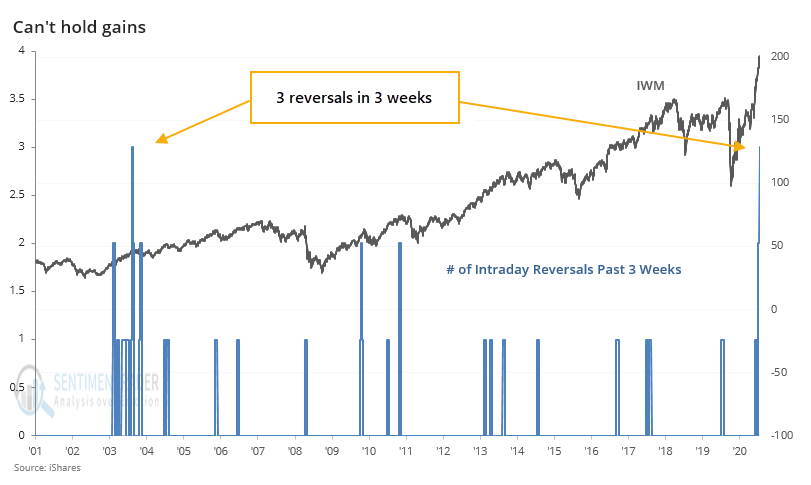

There have been some notable reversals from the opening print, especially in the dollar, gold, and small-cap stocks. For the Russell 2000 fund, IWM, it gapped up more than 1% at the open and is on track to close below the opening price as buyers haven't been interested in chasing. As we saw before, though, these haven't been all that reliable as reversal signals.

The last two times this triggered, IWM turned around immediately and hit new highs. Probably the most worrying aspect of this is simply that it keeps happening. This is the 3rd time in 3 weeks that IWM has gapped up at least 0.5%, hit a new high, then couldn't hold its opening price. The only other time it had a cluster like this was in January 2004.

Each time it had even 2 reversals in a 3-week period, it couldn't hold its gains going forward. Tiny sample size, though.