Minutes Digest for Dec 23 2020

Smalls won't stop

- Published:

2020-12-23 11:21:25 - Author: Jason Goepfert

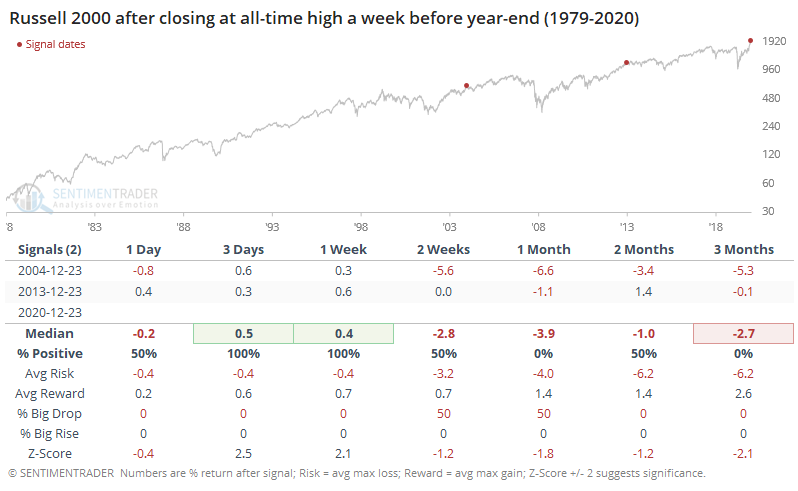

Yesterday, we saw that when the S&P was near a new high heading into the last week of the year, it tended to keep going, at least for a little while. We've been asked if it's the same with small-caps, which barring some kind of reversal, should close at an all-time high today.

There were only 2 other times when the Russell 2000 closed at an all-time high a week before the end of the year, and it continued to gain both times over the next week, but settling back after that.

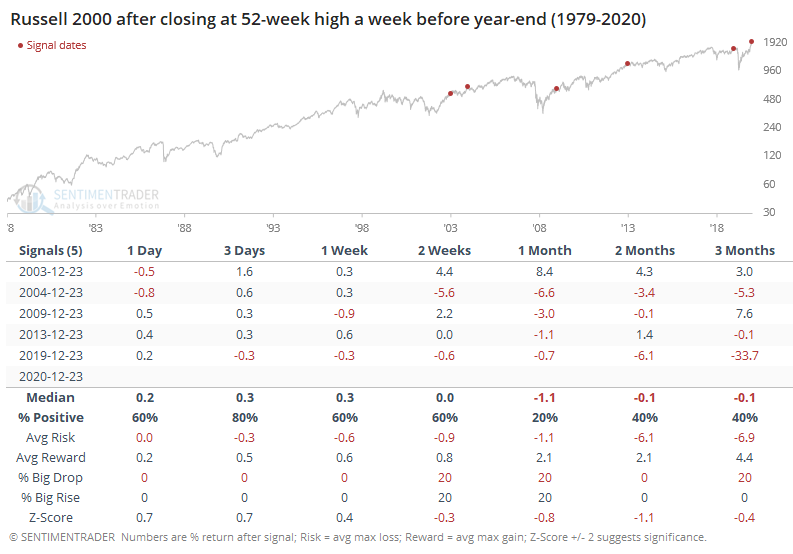

It was mostly the same story with lesser extremes, if we look at 52-week highs (instead of all-time highs).

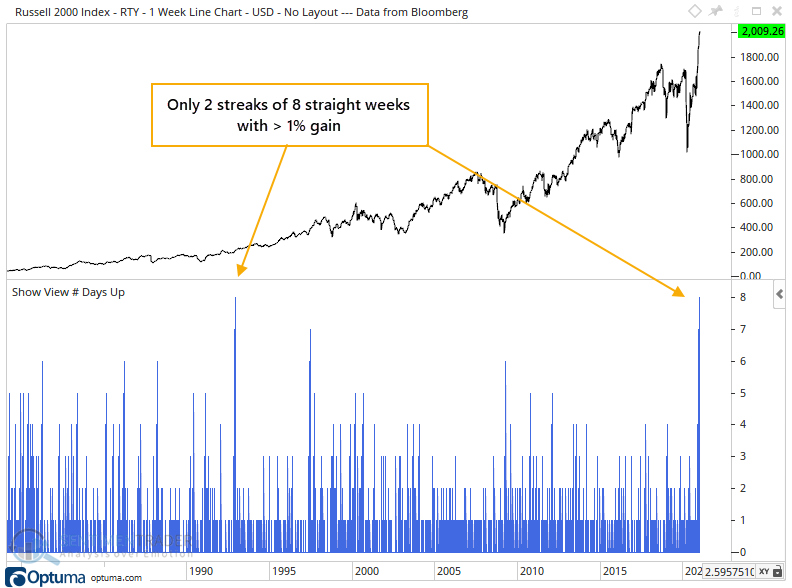

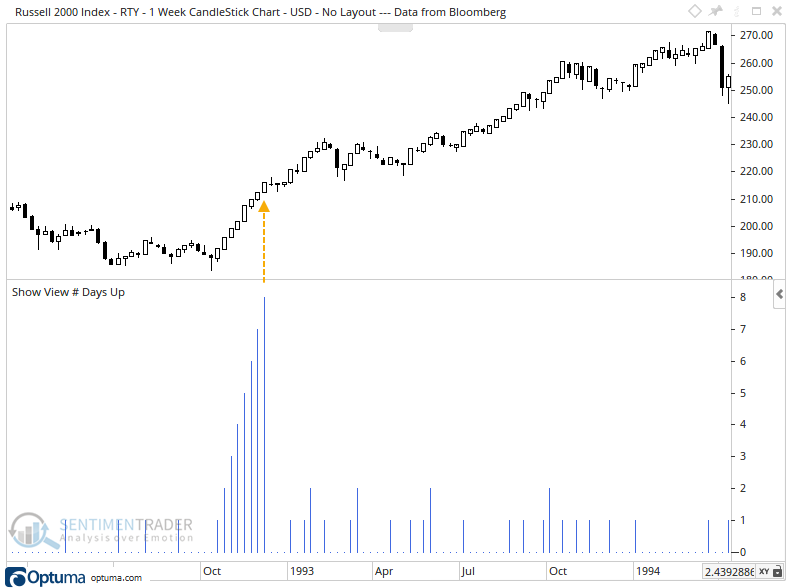

Just as remarkably, the index is on track for its 8th consecutive weekly gain of more than 1%. That's tied for the longest-ever.

FWIW, the other one saw some slight chop over the next few weeks, then jumped higher again.

Big bets

- Published:

2020-12-23 08:06:02 - Author: Jason Goepfert

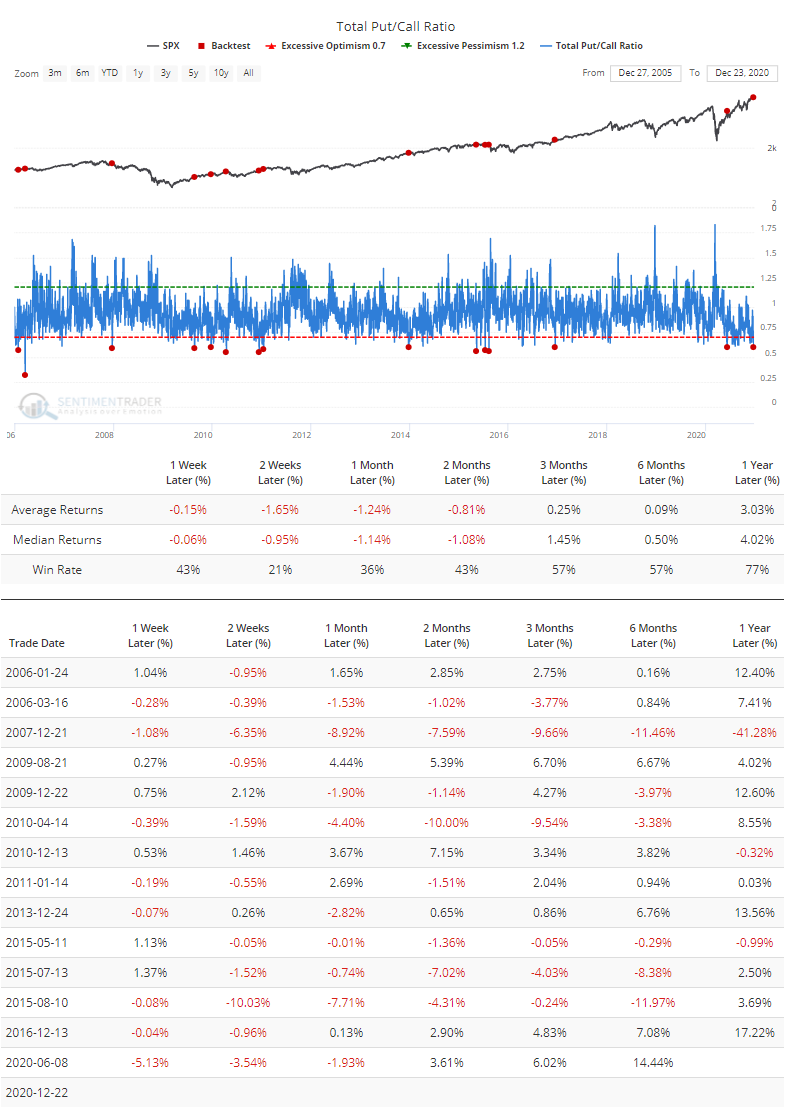

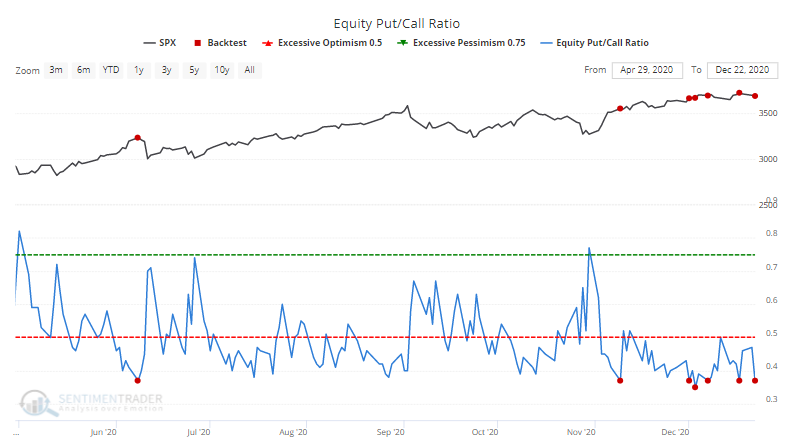

The options market has been seeing speculative extremes for weeks on end, and it's not showing any signs of ebbing yet. Tuesday's Total Put/Call Ratio ranked among the lowest in 15 years, which the Backtest Engine shows has led to a negative return on some time frame every time, usually within the first month.

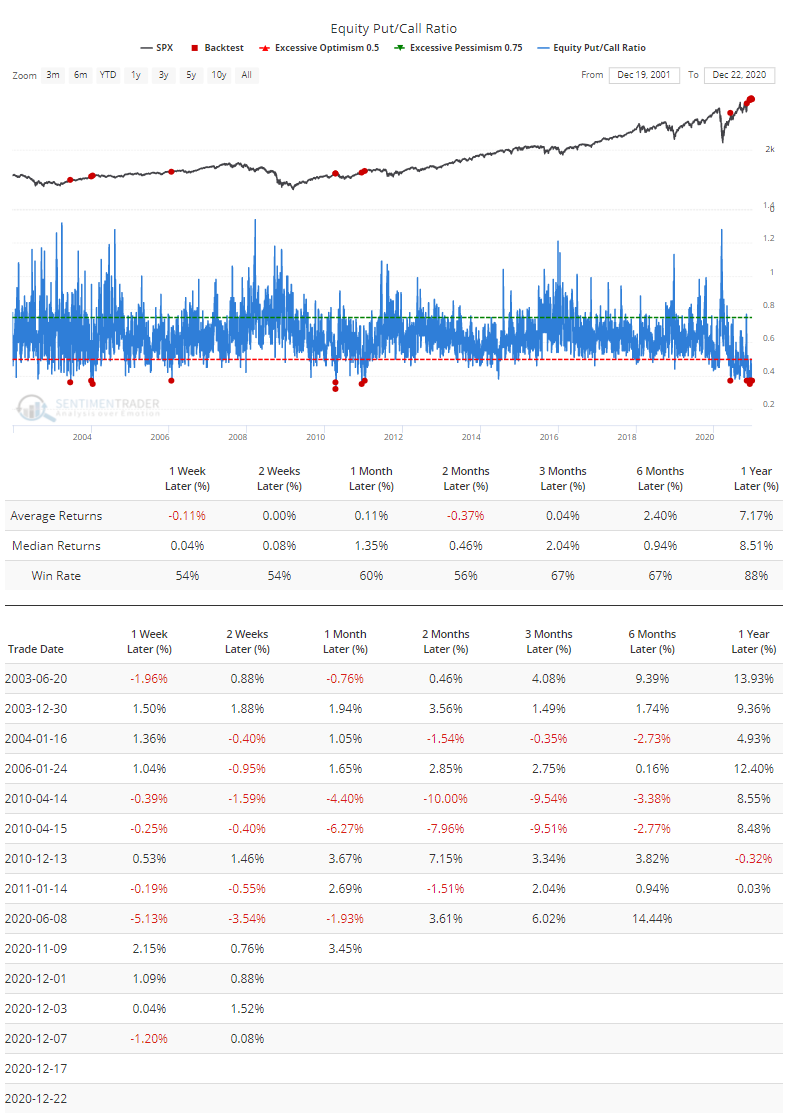

It was less consistent with the Equity-only ratio, but it was still tough for stocks to show large, sustained gains after readings like Tuesday's.

In recent months, we can see how rallies petered out once the ratio got this low.

Corn daze

- Published:

2020-12-23 07:46:07 - Author: Jason Goepfert

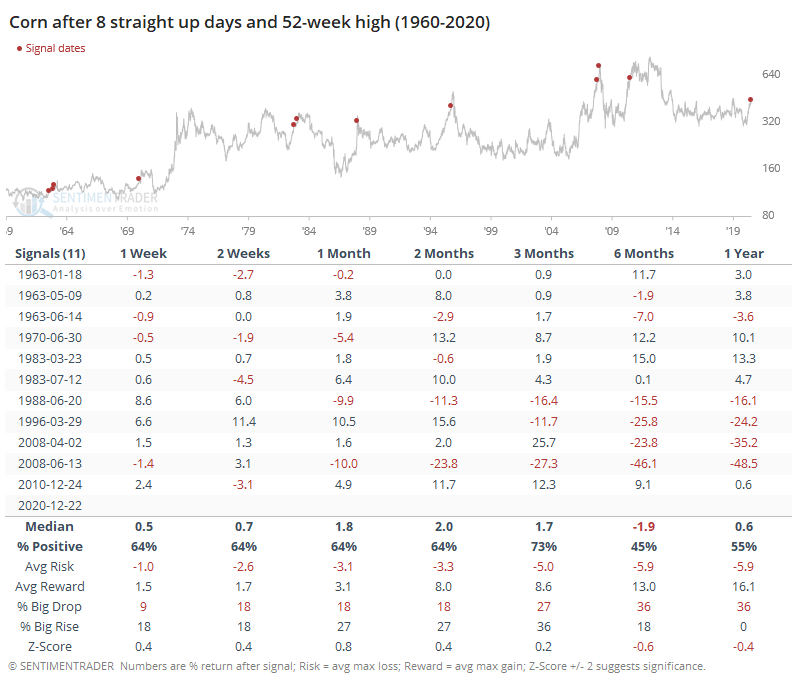

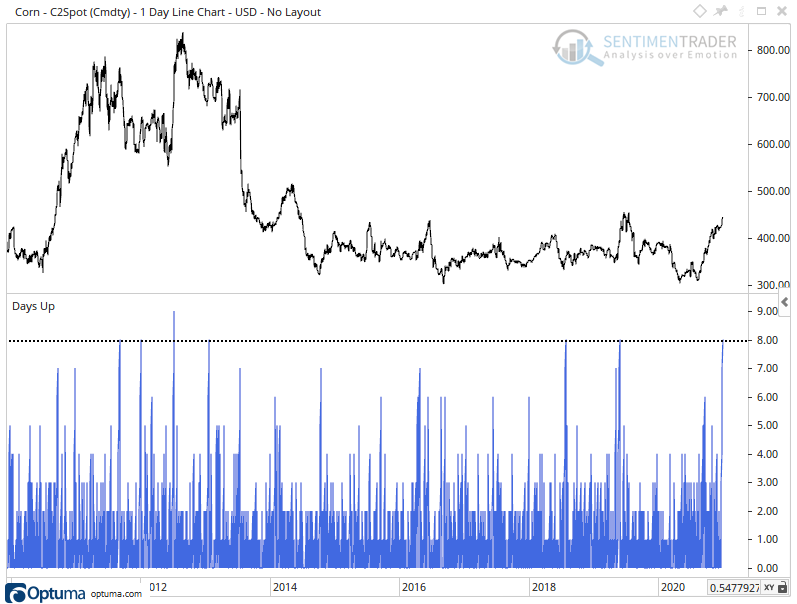

It's been a heckuva run for many commodities, including corn which just recorded its 8th straight positive day. That's nearing its longest streak of up days in the past decade.

It's had a decent record of continuing its runs over the ensuing weeks - months when the long streaks coincided with a 52-week high. The failures were painful, however.