Minutes Digest for Dec 21 2020

Whiplash

- Published:

2020-12-21 13:32:17 - Author: Jason Goepfert

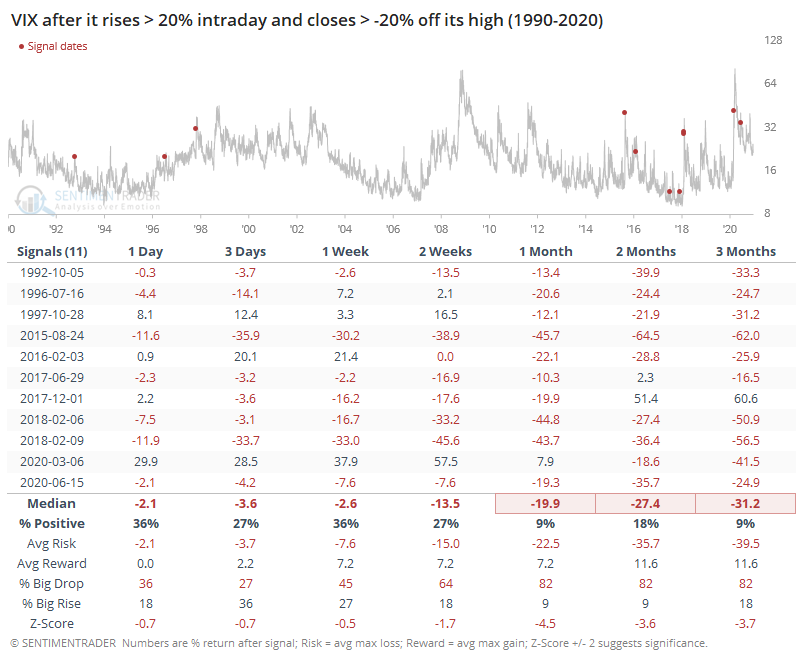

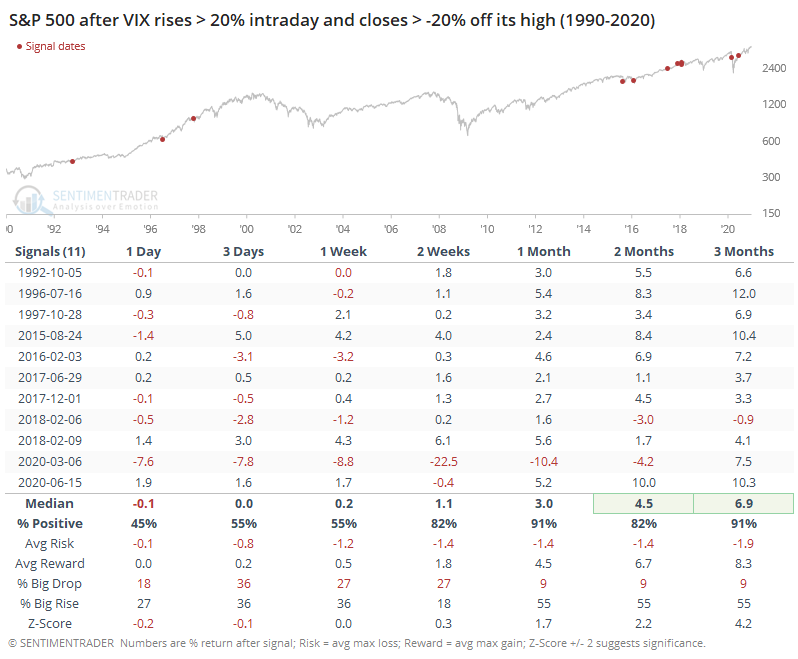

Anyone extrapolating early trading to the afternoon likely suffered a serious case of whiplash, and maybe afternoon traders extrapolating into the close will suffer the same. But if we look at where we are now, this will go down as one of the biggest intraday reversals in the history of the VIX.

Since 1990, there have only been 11 other times it jumped at least 20% intraday and then fell back at least 20% off that high into the close. Every time, the VIX saw further losses either 1 or 2 months later.

It was mostly a good sign for stocks over the next 1-3 months. These extreme moves coming on the heels of the Tesla inclusion and year-end machinations are hard to rely upon, so it's tough to put a lot of weight on this.

Volatility pop

- Published:

2020-12-21 09:21:05 - Author: Jason Goepfert

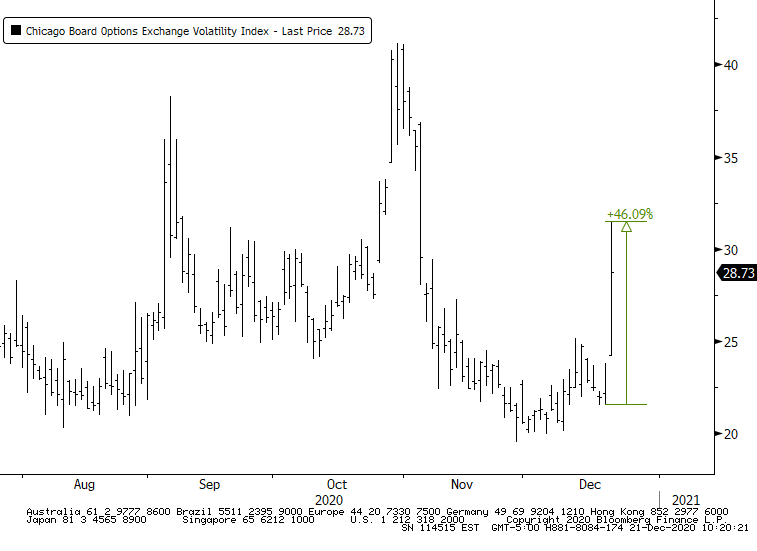

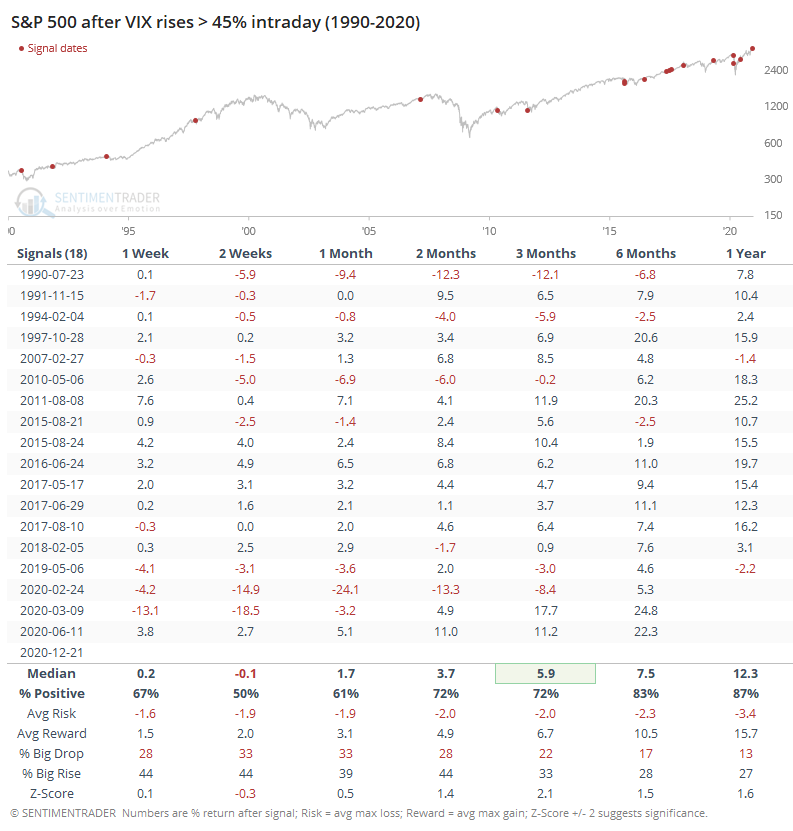

Regardless of what happens during the rest of today's session, the VIX "fear gauge" already popped more than 45% in early trading.

This marks one of the largest intraday jumps in 30 years. That hasn't necessarily meant that it's an immediate positive for stocks, but longer-term returns were above average.

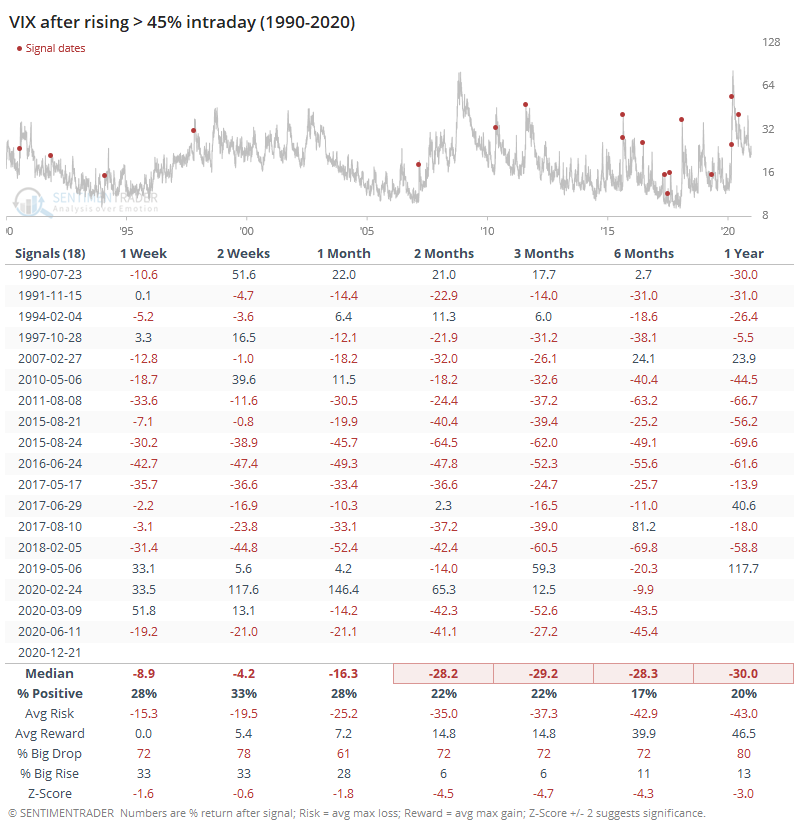

The VIX itself had a very strong tendency to decline.

Ugly open

- Published:

2020-12-21 07:50:05 - Author: Jason Goepfert

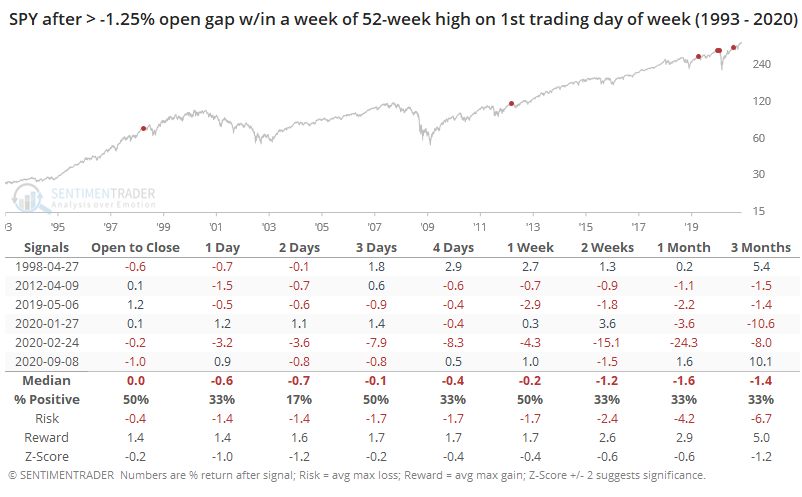

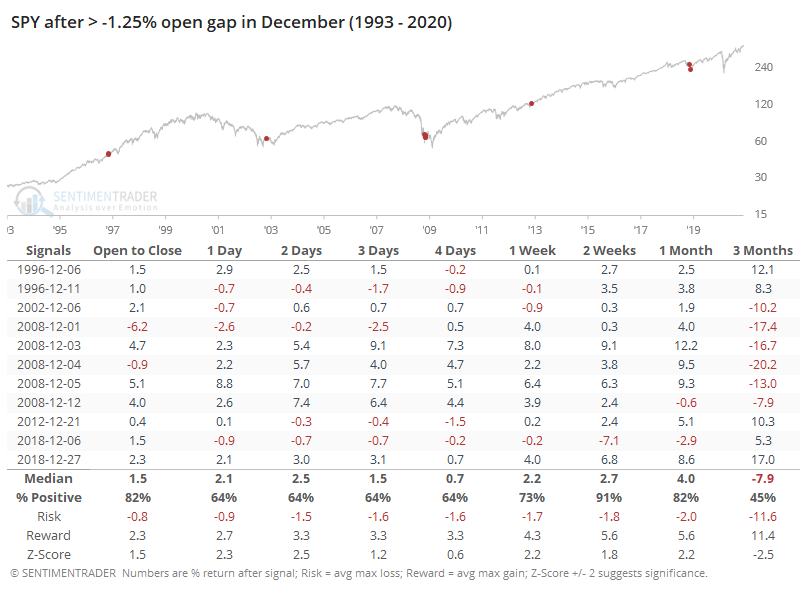

The S&P 500 is on track for the typical indigestion following the swallowing of a large new member. Indications are currently for about a 1.5% gap down.

Allowing for some wiggle room, this would mark one of the largest gap down opens in December for SPY.

The positive seasonal bias seemed to help a bit, with mostly positive returns. But most of those also occurred during very volatile conditions during downtrends, pretty much the opposite of what we're seeing today.

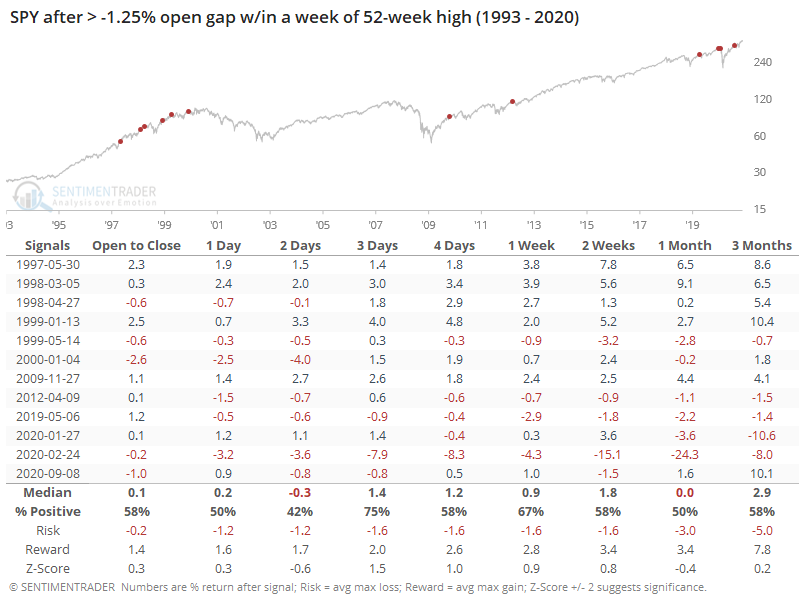

When a big gap down has triggered within a week of a 52-week high, forward returns from the open were less kind.

And when those occurred on the first trading day of a new week, all 5 signals showed a negative return at some point in the following days. Small sample size, though.