Minutes Digest for Dec 16 2020

Fed reaction

- Published:

2020-12-16 14:04:50 - Author: Jason Goepfert

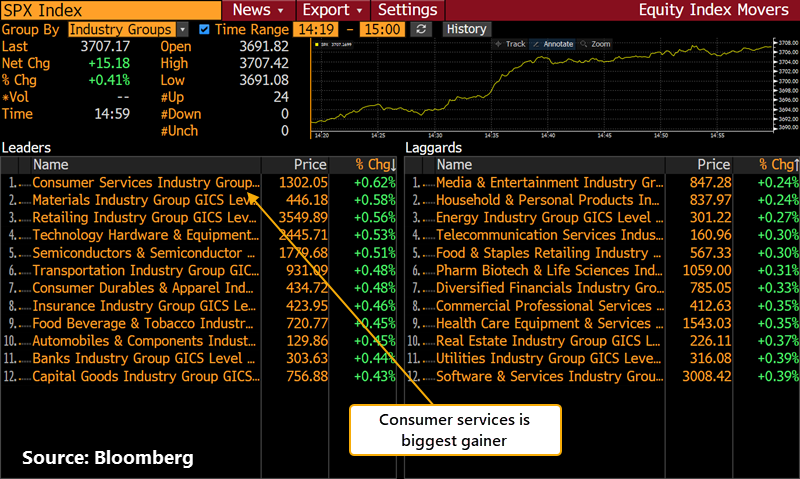

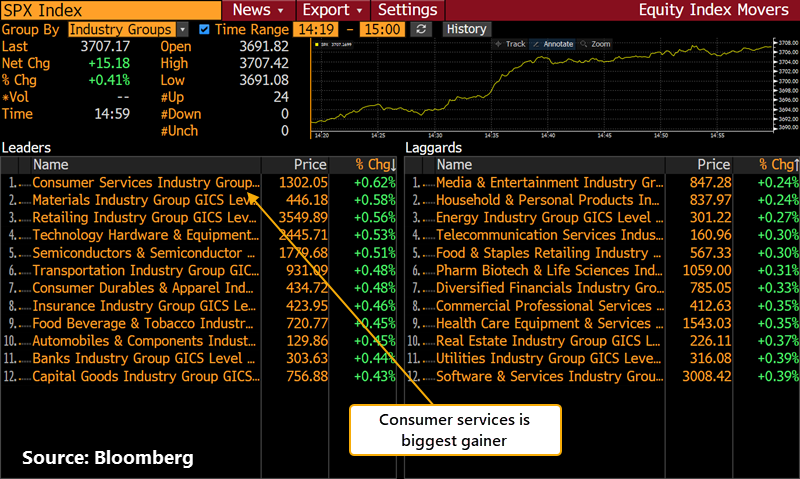

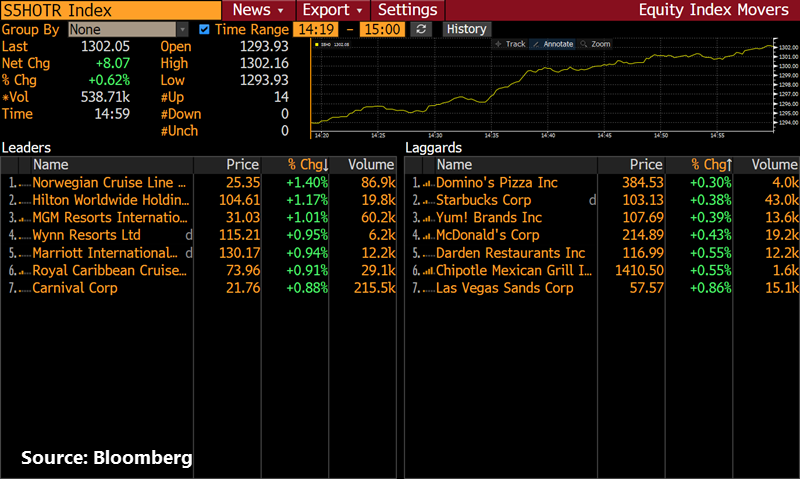

It's always interesting to see how traders interpret the smoke signals being flared by the Fed in the aftermath of their latest rate announcement. The S&P 500 jerked lower for a bit, then bottomed about 19 minutes after the release. In the ~45 minutes since, it's been an interesting mix of stocks leading the charge.

Consumer services is leading, with retailing not too far behind. Apparently, traders are taking some comfort in the recovery idea, with hotels and cruise lines being among the biggest beneficiaries.

They might have a tough challenge ahead as the previous highs loom and with the industry already doubling off its March low.

FOMC drift

- Published:

2020-12-16 10:41:04 - Author: Jason Goepfert

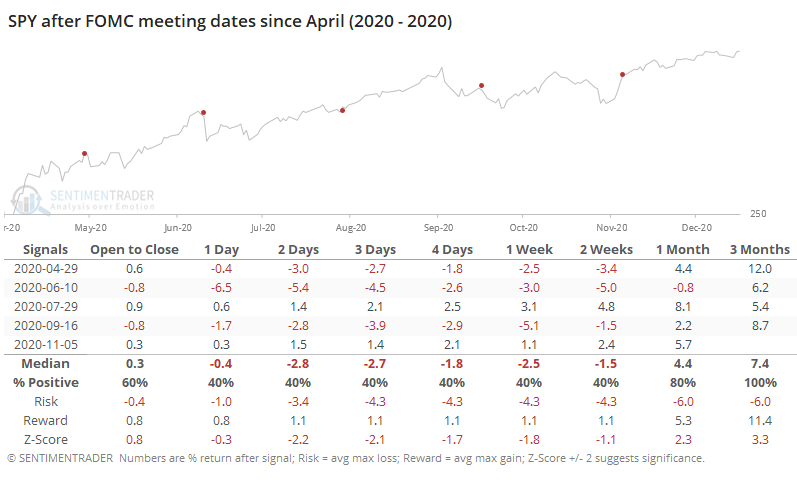

The positive drift into FOMC rate announcements is well-known and has persisted for a long time. It typically doesn't last all that long, though. Below, we can see returns in SPY from the open on the day of a FOMC announcement since April. The only one that showed meaningful sustained gains over the next week or so was in July, coming on the heels of what had been a minor decline. The others occurred after stocks had already rallied.

Retail disappointment

- Published:

2020-12-16 08:46:15 - Author: Jason Goepfert

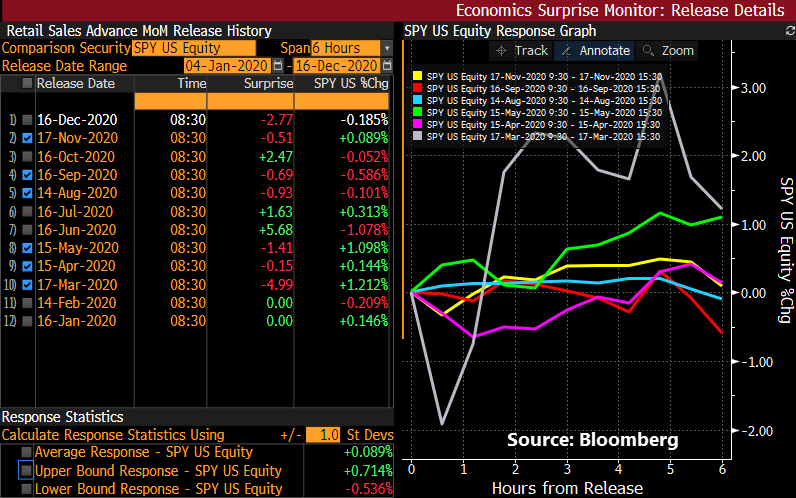

A lot of traders were hoping to see decent, or at least not horrible, retail sales numbers this morning. They were disappointed, as the numbers came in well below survey expectations.

Looking at intraday returns following other disappointing retail sales numbers since the pandemic began, it hasn't had much of a discernable impact on SPY, with 4 gains and 2 losses over the 6 hours after the release of the data.

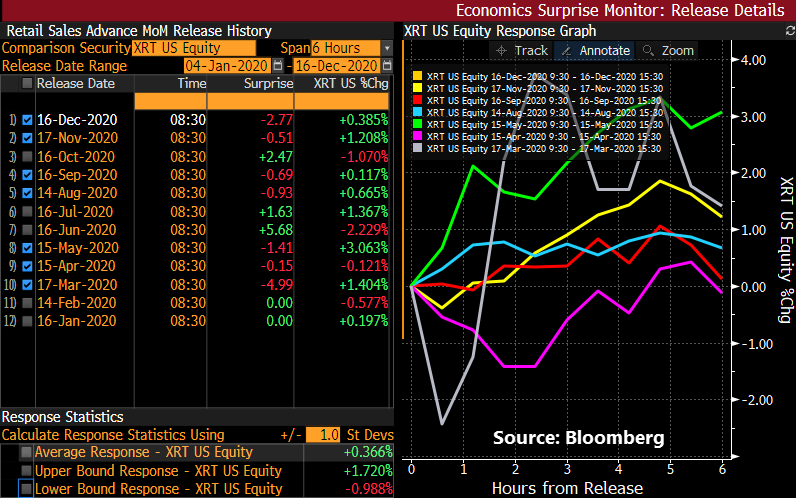

Oddly, the XRT retail ETF has done even better, rallying over the next 6 hours every time but once.

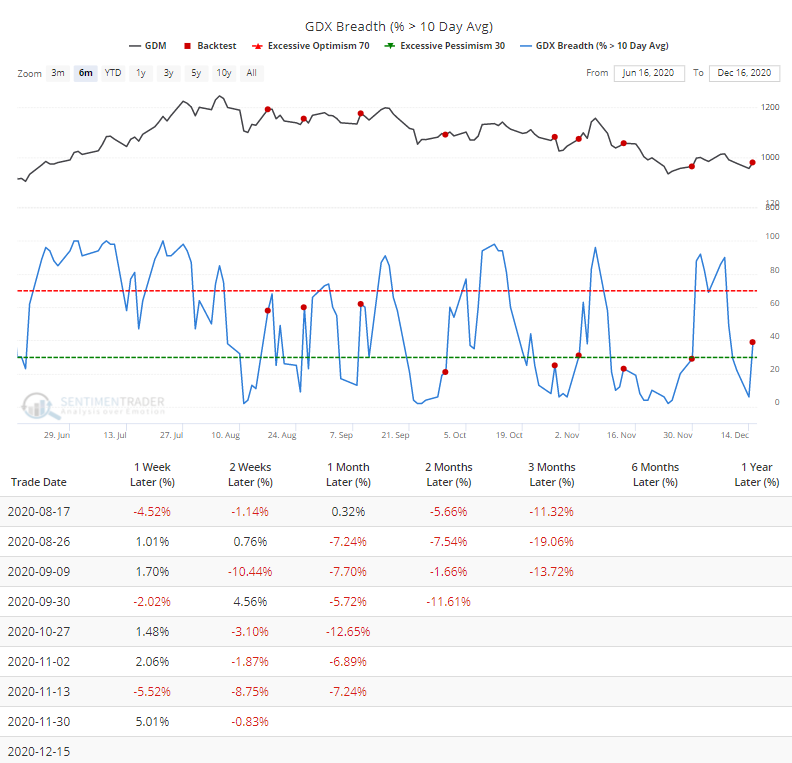

Minor miner rebound

- Published:

2020-12-16 07:44:08 - Author: Jason Goepfert

Gold miners rebounded from another drop on Tuesday. Fewer than 7% of them had held above their short-term 10-day moving averages, and that popped well above 20% by Tuesday. Bulls need to see the pattern over the past 6 months make a change for this to stick. While the group often managed to add a few more days' of gains, those quickly evaporated.