Minutes Digest for Dec 10 2020

Energy's relative uptrend

- Published:

2020-12-10 13:39:41 - Author: Jason Goepfert

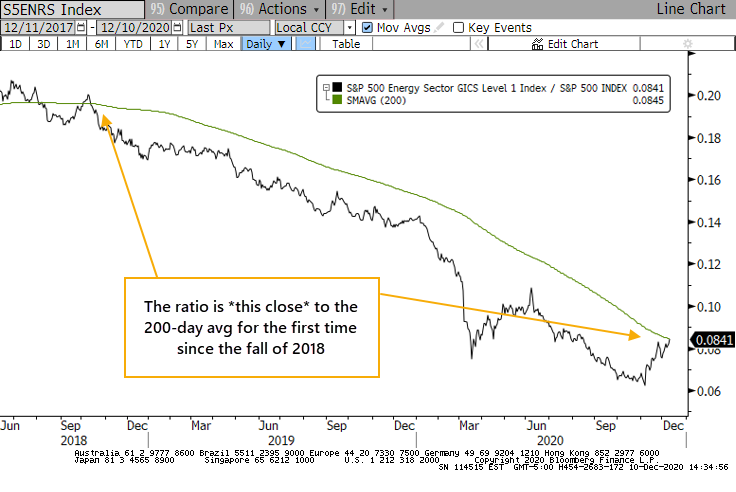

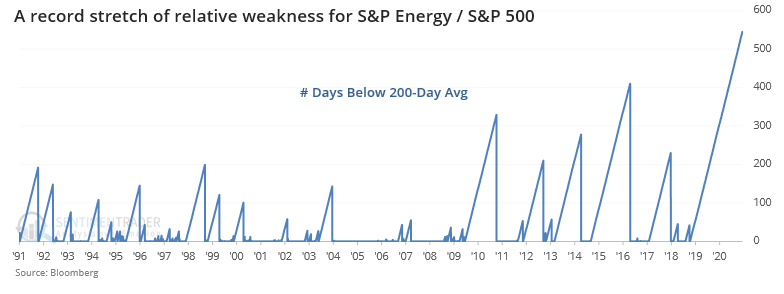

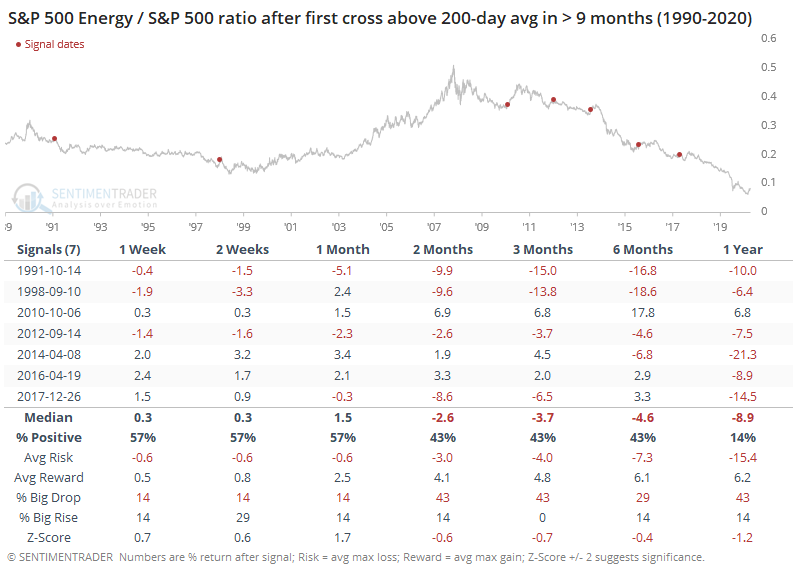

For the first time in almost 2 years, energy is about to move into an uptrend relative to the broader market. The ratio of the S&P 500 Energy sector to the S&P 500 itself is oh-so-close to its 200-day average.

This would end the longest streak in a relative downtrend since 1990, by far.

Other times the ratio moved above its average for the 1st time in at least 9 months, it struggled to hold its momentum. When it failed almost immediately, watch out - long-term returns were very poor. While short-term upside follow-through wasn't a panacea, it at least seemed to be a better sign than those times when buyers shied away again right as the relative uptrend was getting started.

Small caps near record rebound

- Published:

2020-12-10 09:06:49 - Author: Jason Goepfert

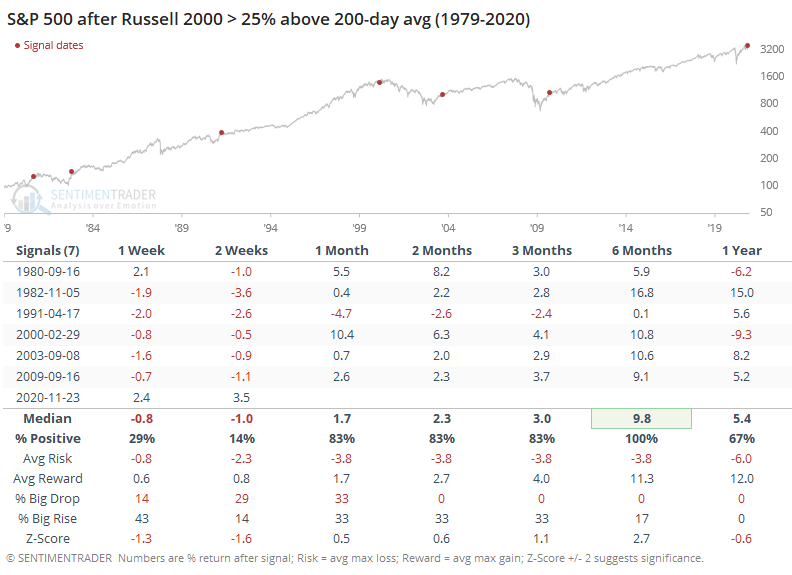

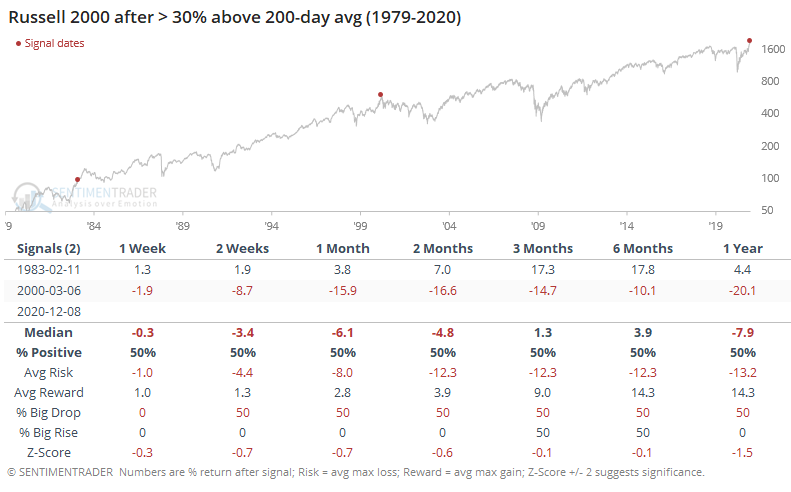

There's quite a bit of chatter out there right now about the Russell 2000 being 30% above its 200-day average. That's nearly a record dating back to its inception in 1978. There were only 2 other times it exceeded a 30% spread from its long-term average.

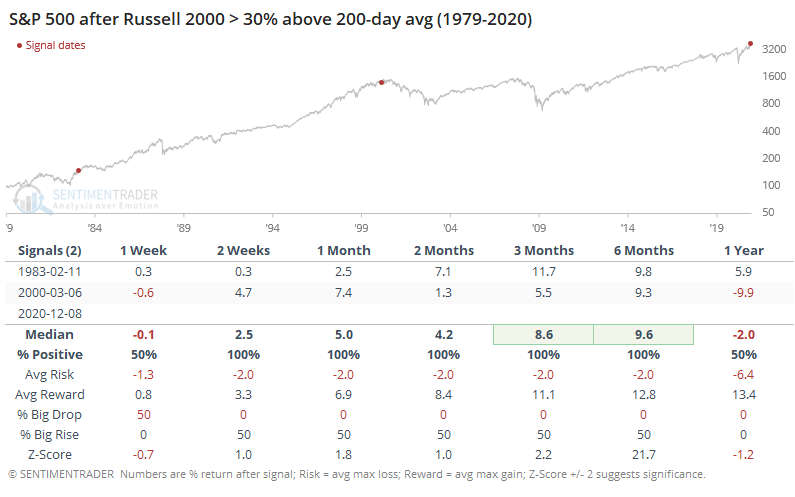

Both ended up leading to declines, but in 1983 it rallied strongly for months first. For the S&P 500, it was a better sign.

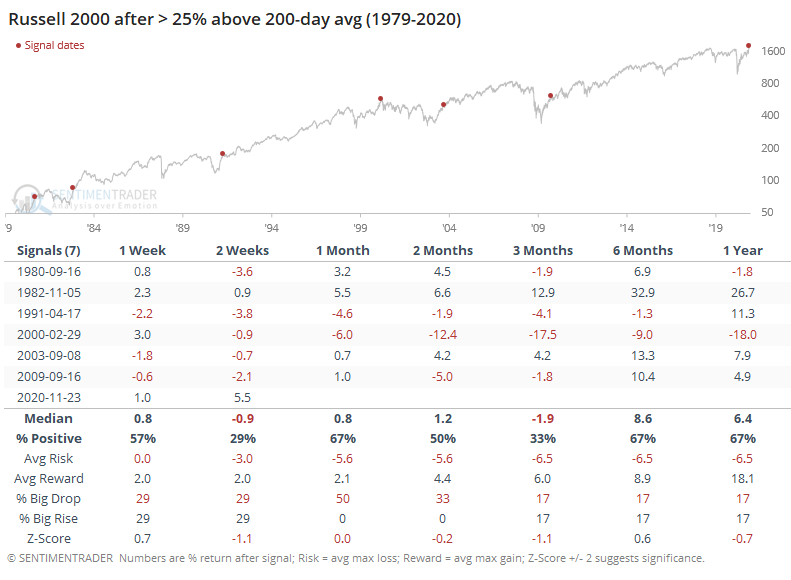

Looking at 25% spreads, it wasn't quite so negative for the Russell except in the short-term.

The S&P 500 dropped over the next 2 weeks every time - except for the current one. Maybe that means it will buck the rest of the trend, which would be too bad for bulls since the index rose over the next 6 months every time.