Minutes Digest for Dec 08 2020

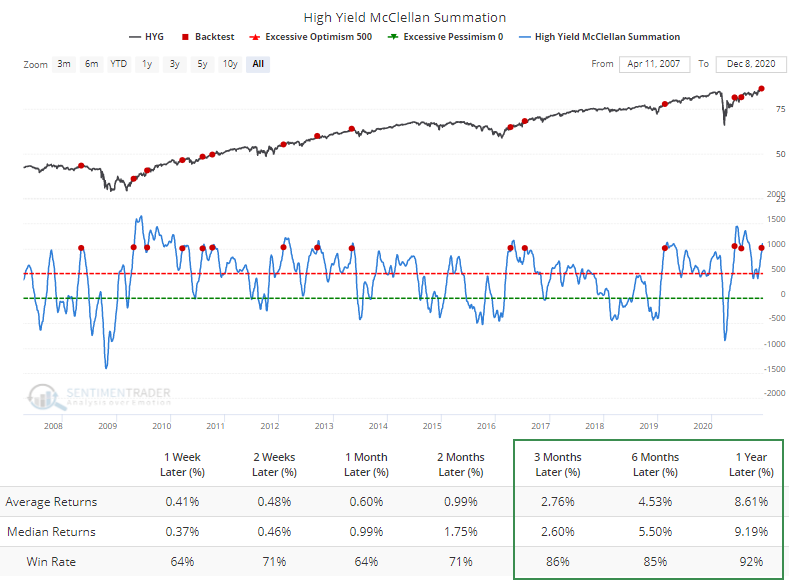

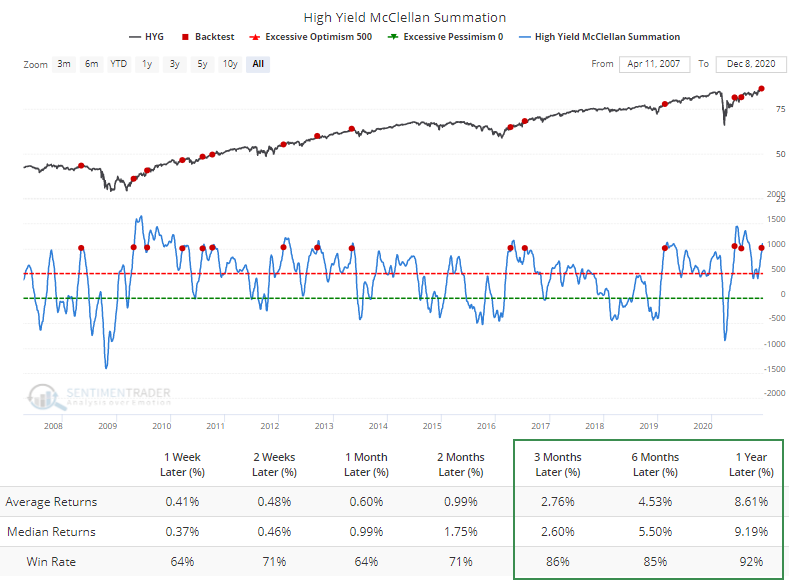

Not so junky

- Published:

2020-12-08 14:07:58 - Author: Jason Goepfert

High-yield bonds are treading water today, but many of them have been holding up extremely well. Enough so that High-Yield McCellan Summation Index has managed to cross above +1000.

Funds like HYG have shown very good longer-term returns when the McSumm has crossed this threshold. Granted, most of the study period has been dominated by a bull market.

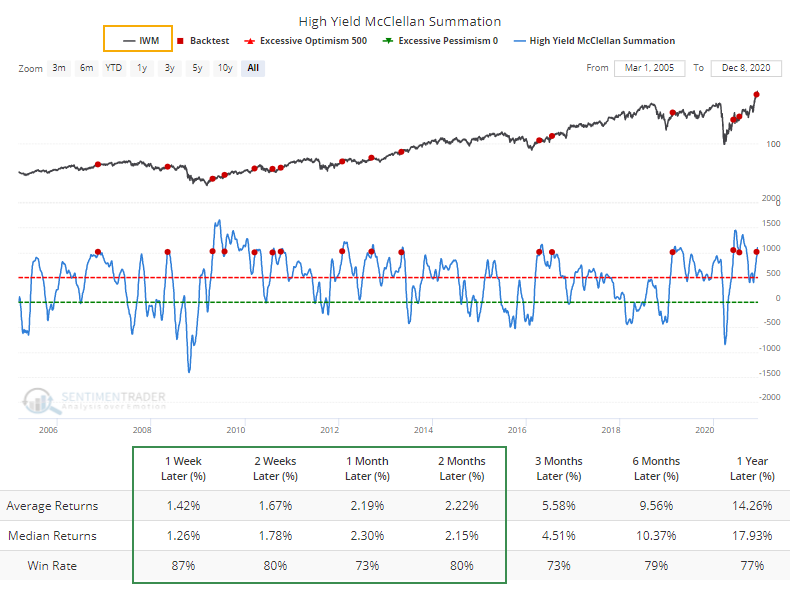

Smaller-cap stocks are ostensibly impacted the most by good (or poor) economic conditions, and excellent momentum among high-yield bonds should mean that conditions are favorable. And indeed, returns in the Russell 2000 have been good after these signals.

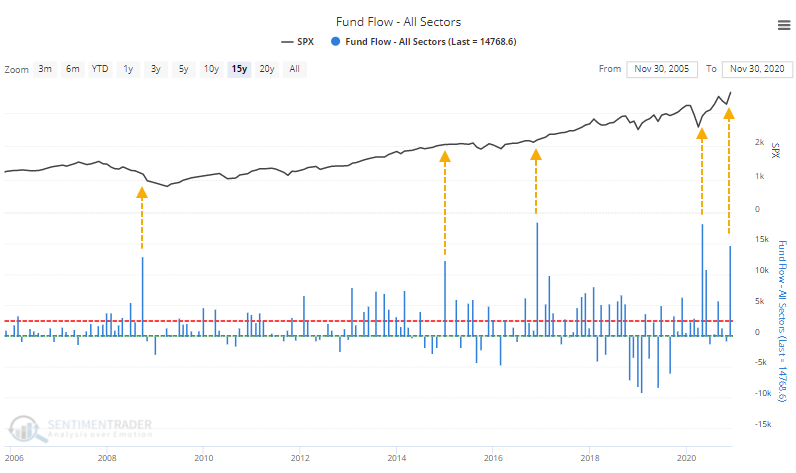

Sector windfall

- Published:

2020-12-08 11:43:06 - Author: Jason Goepfert

U.S. equity sector ETFs took in a whopping $14.8 billion in flows in November according to Bloomberg aggregate data, led by financial and industrial funds. That was the 3rd highest monthly inflow in 20 years, on an absolute basis, anyway. Fund flows are a tricky thing, though, and not the greatest contrary indicator. We can see below that other big inflows didn't necessary precede a pullback.

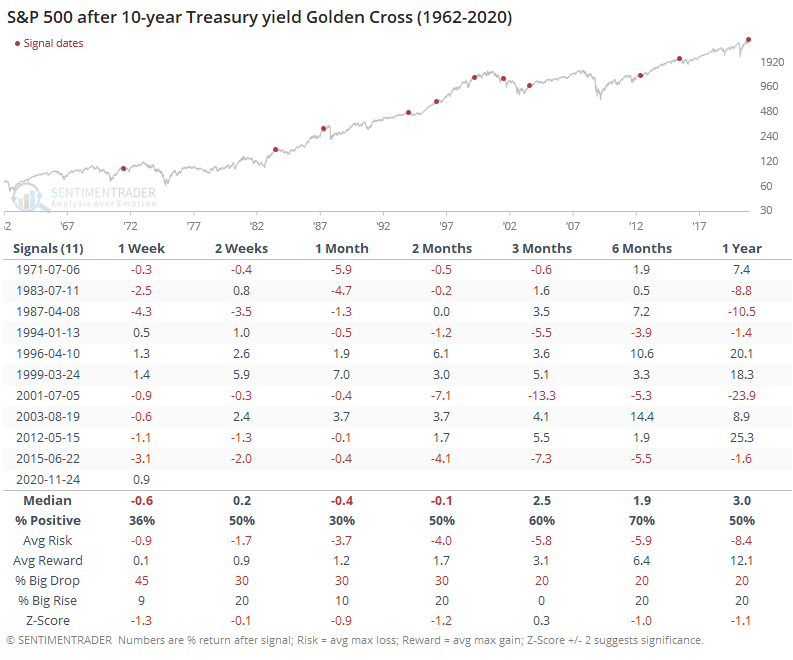

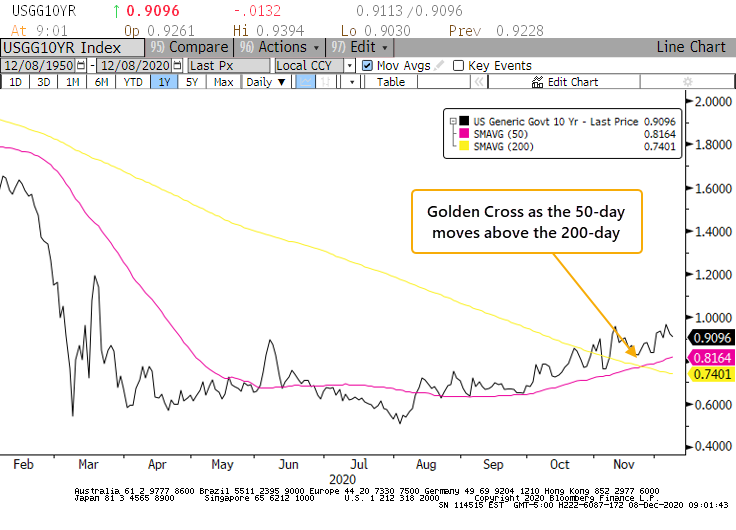

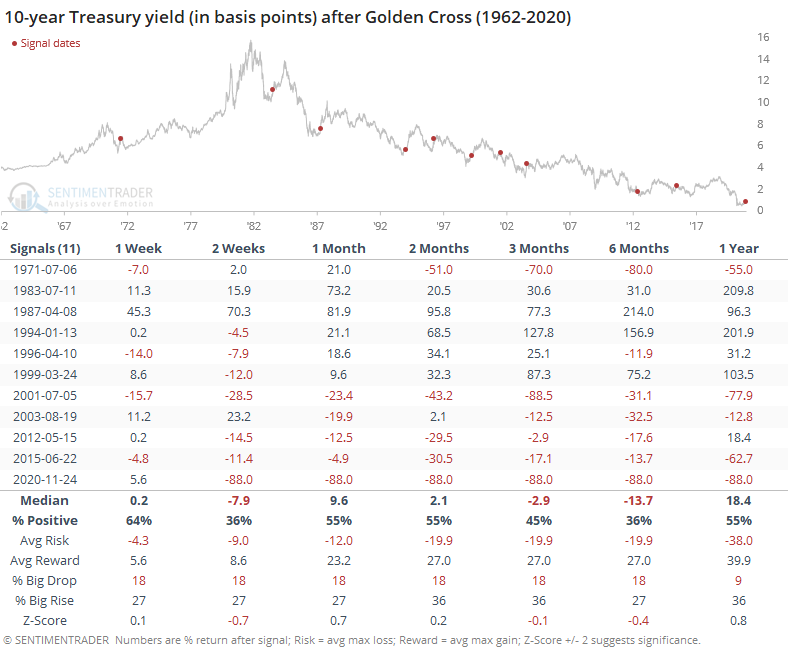

Golden Cross on rates

- Published:

2020-12-08 08:05:35 - Author: Jason Goepfert

For those looking for higher rates in the coming months, a "golden cross" in the 10-year T-note yield might come as some confirmation. For the first time in nearly 2 years, the 50-day average has crossed above the 200-day average.

Prior to the past 2 decades, this was a pretty good indication that higher interest rates were in the offing. Since then, not so much.

For stocks, it proved to be a shorter-term headwind.