Minutes Digest for Feb 19 2021

Gold stocks' make or break

- Published:

2021-02-19 13:25:59 - Author: Jason Goepfert

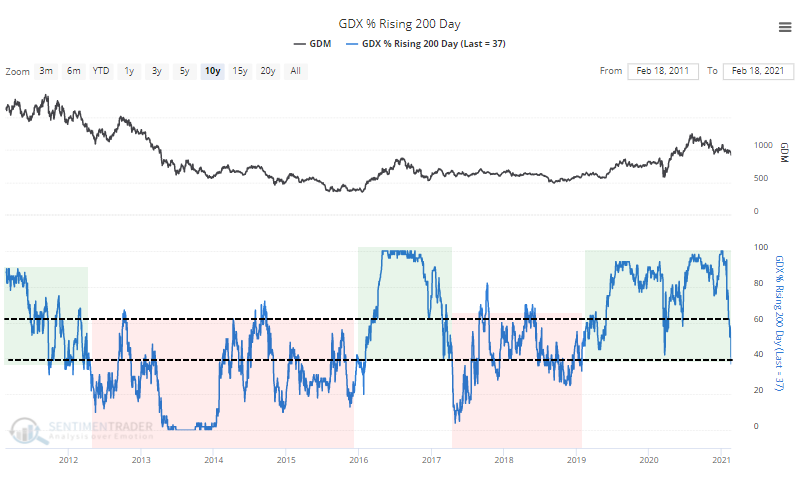

Gold miners are struggling again today, and there has been a lot of internal deterioration there in recent weeks. It's gotten bad enough that now fewer than 40% of them have rising 200-day moving averages.

We saw before that when this figure has dropped after a plonged stretch of very positive readings, that kind of momentum has consistently - almost without error, actually - led to rebounds over the medium-term. So far, it's not taking.

The 40% threshold is a pretty good determinant of the market environment for gold stocks. If it hangs consistently below 40% and selling pressure comes in above 60%, it's unhealthy. If it hangs consistently above 60% and buying comes in below 40%, it's healthy. We're hovering on that precipice now.

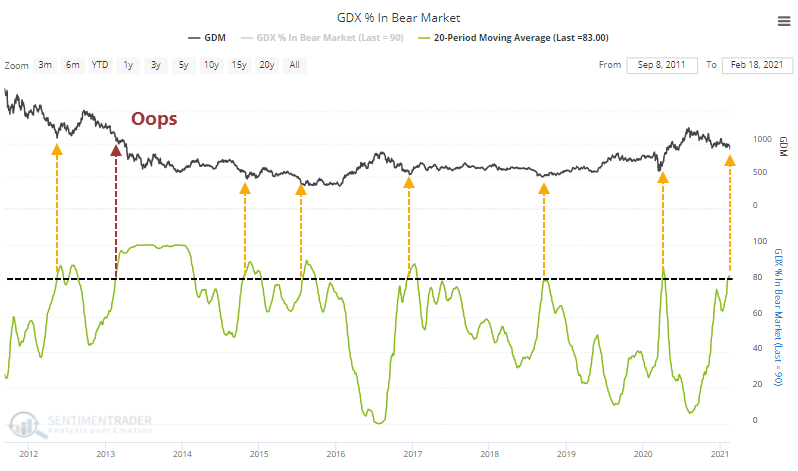

Over the past month, an average of 80% of gold miners have been in bear markets. During anything but protracted downtrends, this kind of selling pressure has consistently preceded rebounds as well.

These stocks have not been acting well, and with some longer-term trend measures in gold now turning negative, it seems like an important juncture. Either they respond soon by stemming the declines, or the risk rises substantially that it will be better to sell the rallies than buy the dips in this group.

Leap in leverage

- Published:

2021-02-19 09:35:12 - Author: Jason Goepfert

The latest margin debt figures are out and showed another month with investors ramping up their leverage - borrowing money and using the value of their stocks as collateral - despite a month when stocks dropped.

The difference between credits (cash) in their accounts and the amount they owe is now -$333 billion, a record low.

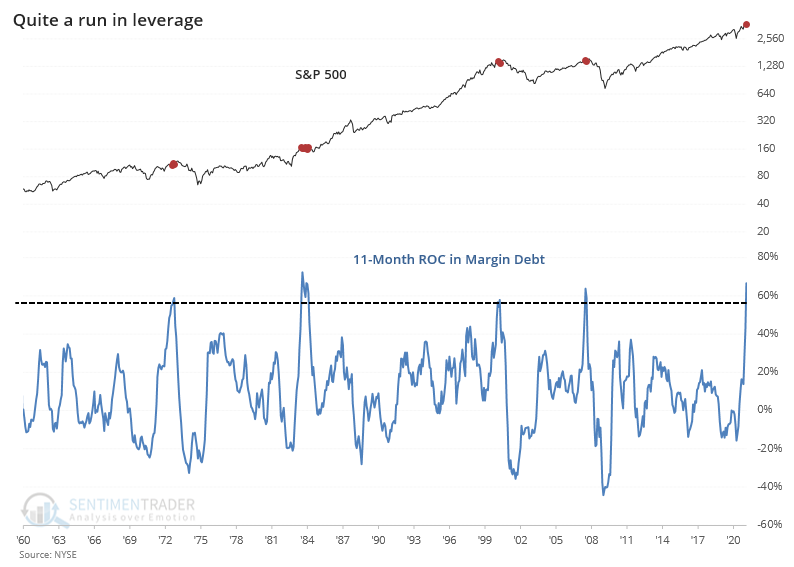

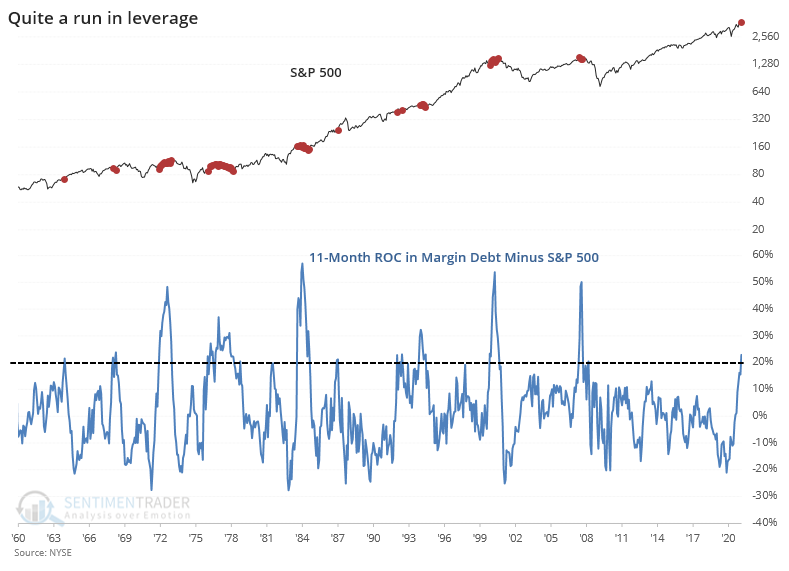

Since markets bottomed last March, margin debt has jumped more than 60%, putting it in rarefied air.

Of course, stocks have skyrocketed, too. Growth in debt is still more than 20% above and beyond that of the S&P 500, enough to be considered extreme, but well off the speculative peaks in 2000 and 2007.

Opex games

- Published:

2021-02-19 08:15:18 - Author: Jason Goepfert

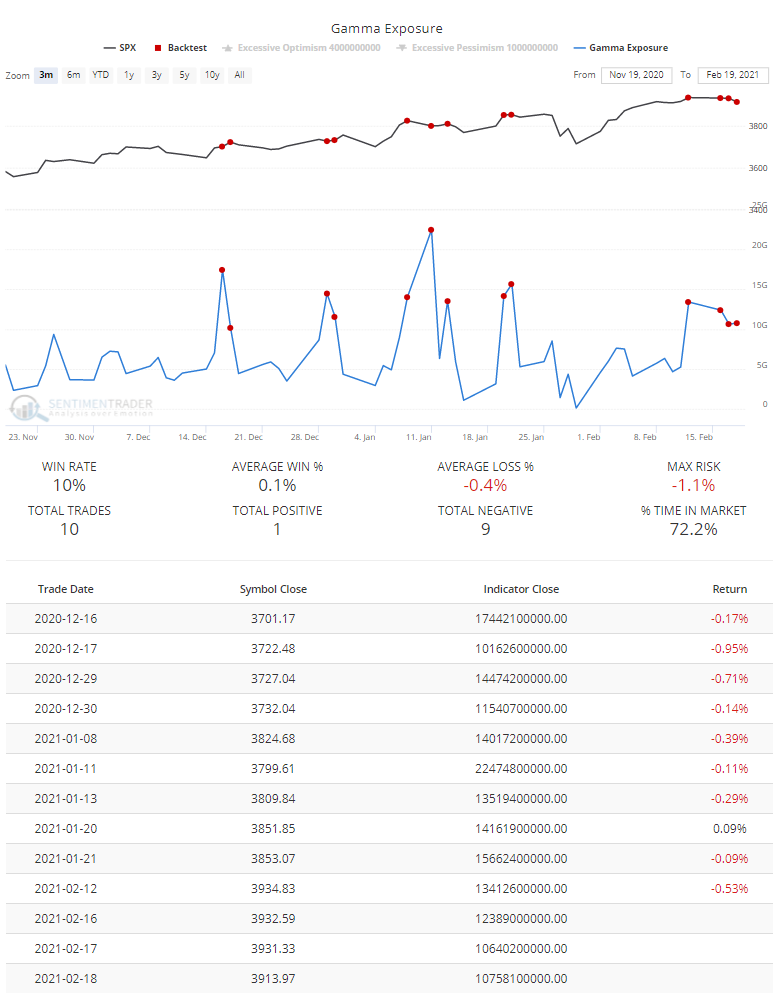

As futures pop higher on option expiration day, it's worth keeping in mind that due to all the raging call buying from retail investors, dealers' exposure has been sky high. Gamma Exposure has averaged (median) more than $10 billion this week, the 2nd-highest in history, second only to January 13 of this year.

A daily Gamma Exposure above $10 bln has had a consistent tendency to precede short-term weakness, with the S&P 500 showing only 1 positive return over the next 3 days out of the past 10 attempts, according to the Backtest Engine.

Another interesting wrinkle is that the Stock/Bond Ratio is once again bumping up against its ceiling, for all practical purposes.

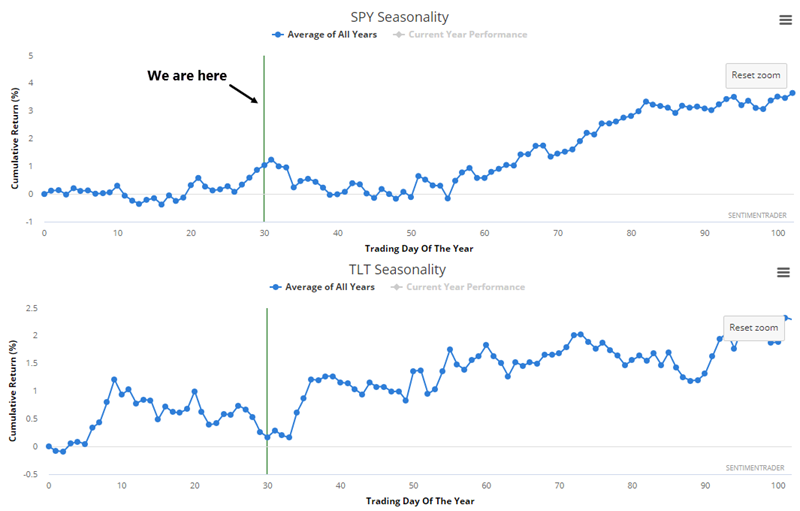

This is happening right when SPY is forming its typical seasonal peak and bonds their seasonal low.