Minutes Digest for Feb 10 2021

Commodity Participation

- Published:

2021-02-10 10:36:04 - Author: Dean Christians

The breadth of participation for a basket of 21 commodities remains strong. The advance from the pandemic lows looks similar to other post-recession periods.

Let's take a look at a few charts I'm watching.

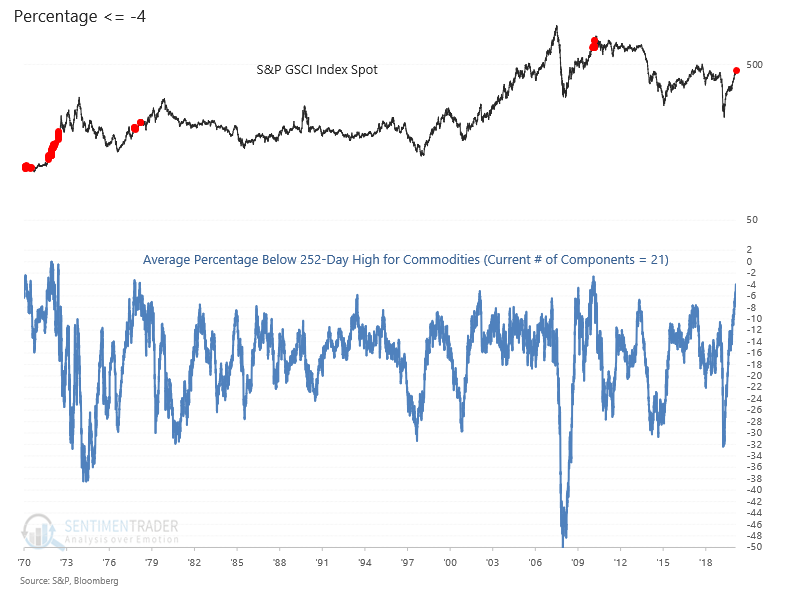

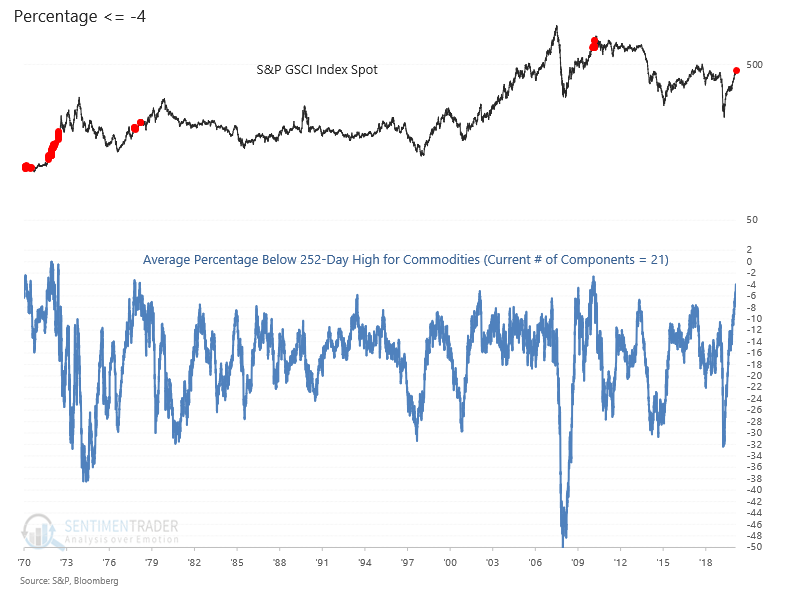

Average Percentage Below 252-Day High

The chart below shows the average percentage below a 252-day high for a basket of 21 commodities. The indicator just registered a new cycle high on 2/9/21 by crossing above the -4.0% level. One has to go back to March 2011 to find the last time this indicator showed a -4.0% or lower level.

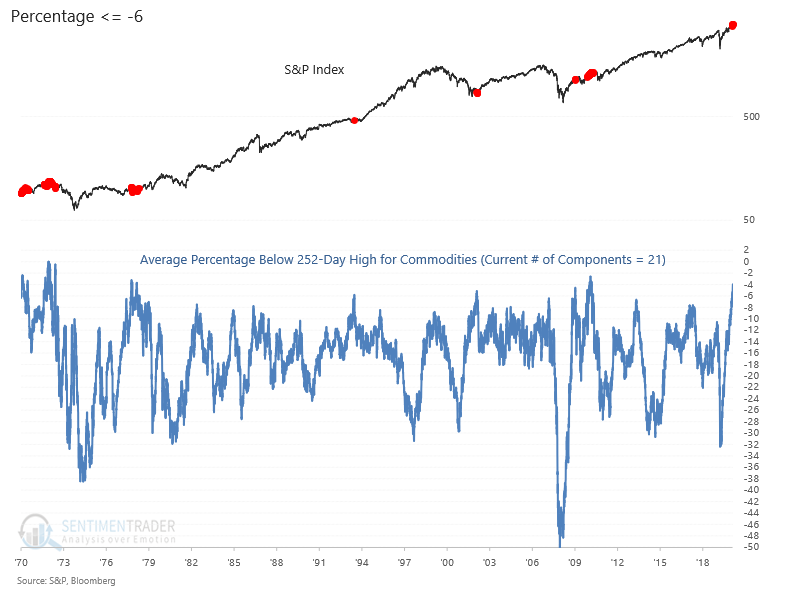

Let's take a look at the same indicator and plot it with the S&P 500 Index. I modified the threshold level to -6% to show a few more instances.

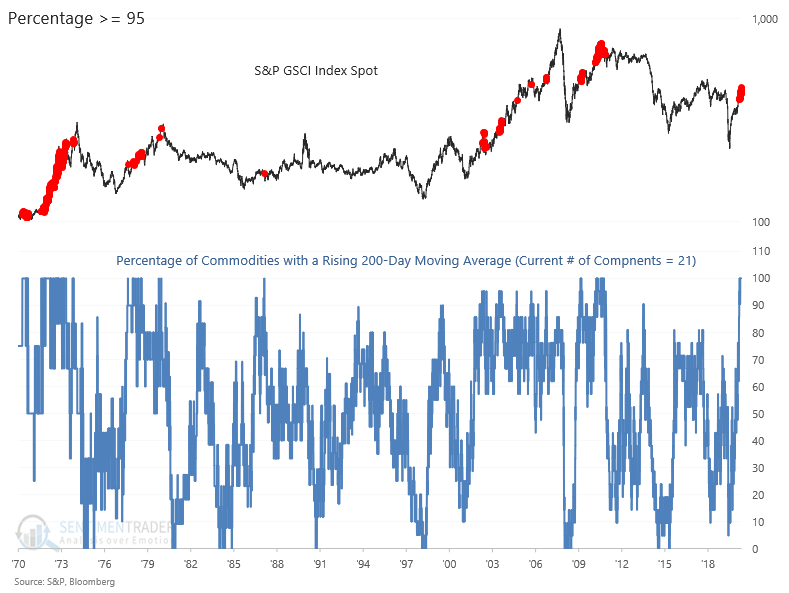

Commodity Participation Rising 200-Day MA

Before the most recent instance on 12/18/20, one has to go back to November 2009 to find the last time this indicator reached 100% after a reset below 15%.

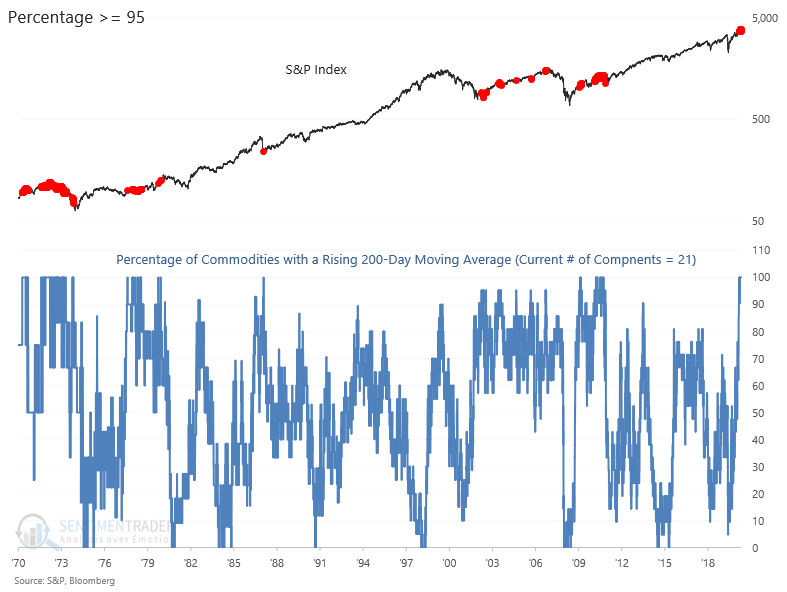

Commodity Participation Rising 200-Day MA SPX Chart

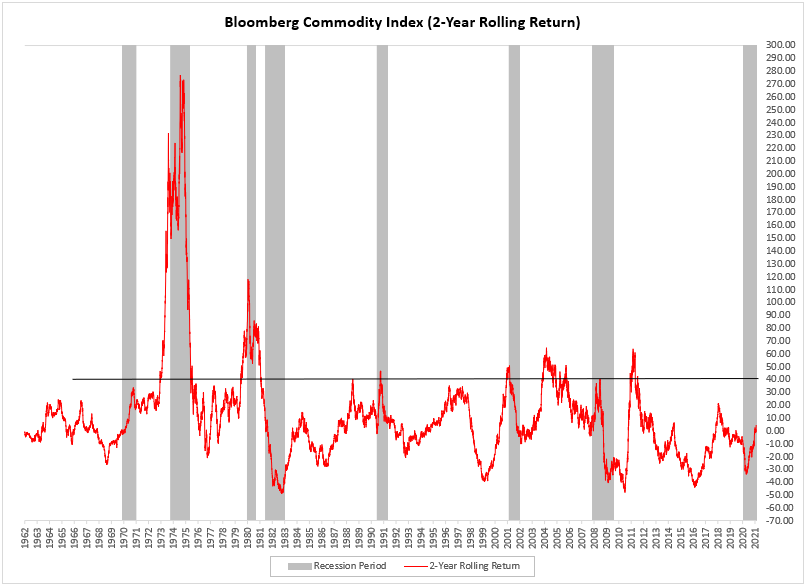

Rolling Return Post Recession Level

If we look at the 2-year rolling return for the Bloomberg Commodity Index, it's not uncommon for the measure to reach the +30-40% range on the rolling return post a recession period. The level currently resides at 4.63%.

Source: Bloomberg

The Russell keeps running

- Published:

2021-02-10 07:58:43 - Author: Jason Goepfert

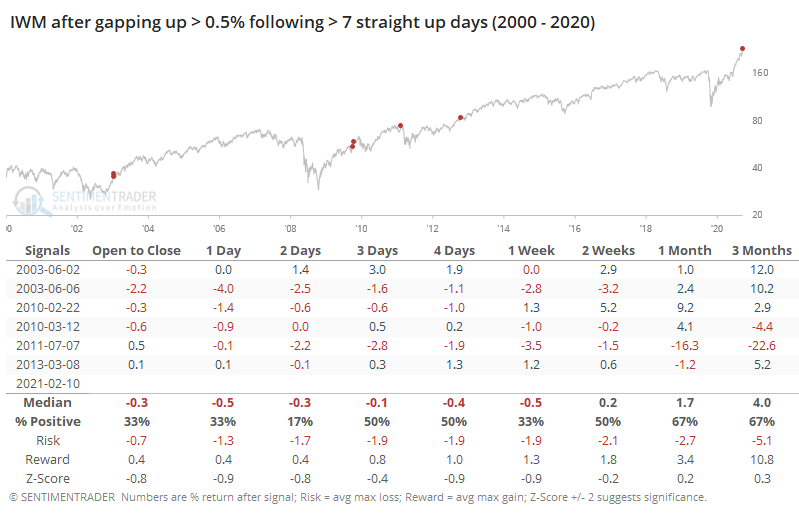

Even after 7 straight days of gains, traders can't get enough of small-caps with the IWM Russell 2000 fund set to gap up more than 0.5%.

This would mark only the 7th time in the fund's history that it managed to gap up with such a large gain after having already rallied at least 7 straight sessions. All of them marked temporary exhaustion, for what it's worth.