Minutes Digest for Feb 05 2021

Miner recovery

- Published:

2021-02-05 08:47:04 - Author: Jason Goepfert

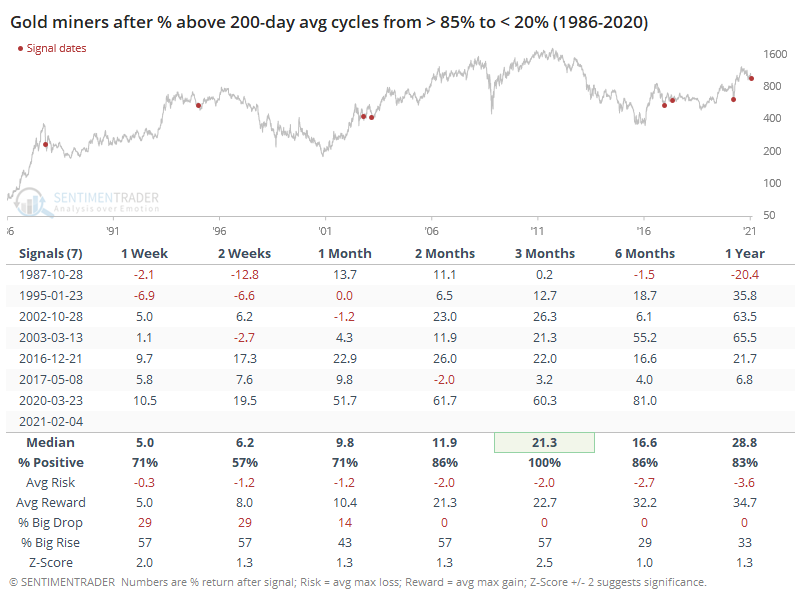

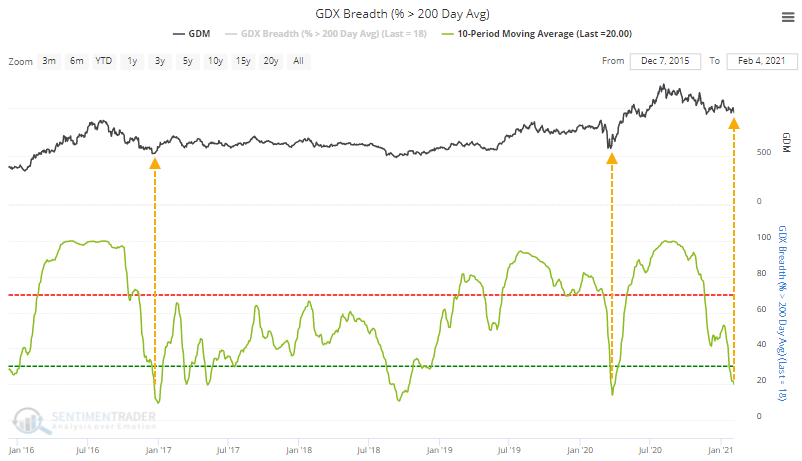

The long-term uptrend in gold may be teetering on the edge, which has a debatable tendency to lead to more weakness should the 50-day finally cross below the 200-day. When it comes to miners, they've gotten hit hard enough that on an average day over the past 2 weeks, only 20% of them were holding above their 200-day moving averages.

Putting this into context, it comes on the heels of a period when more than 85% of them were above their long-term average. They have cycled like this 2 other times in recent years.

Going back as far as we can, this kind of behavior has resulted in rebounds over the next 3 months, with a very good risk/reward ratio. The group isn't just oversold (or getting there, anyway), they've consolidated after a major upward momentum burst. That's the kind of thing that hasn't rolled over easily in the past.