Minutes Digest for Feb 02 2021

Price pops as volatility drops

- Published:

2021-02-02 13:52:18 - Author: Jason Goepfert

Stocks have behaved even better today than yesterday in some respects. Buyers started out strong and have only built on it as the day progressed.

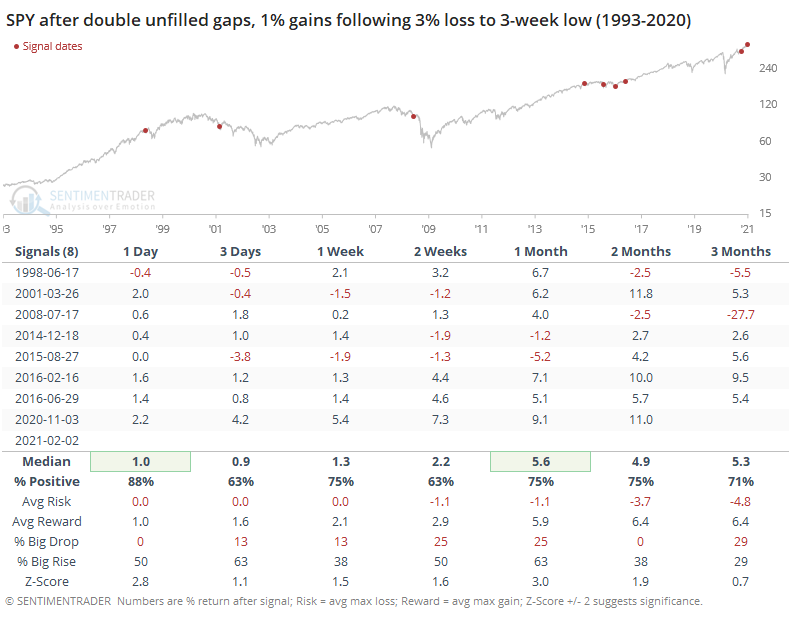

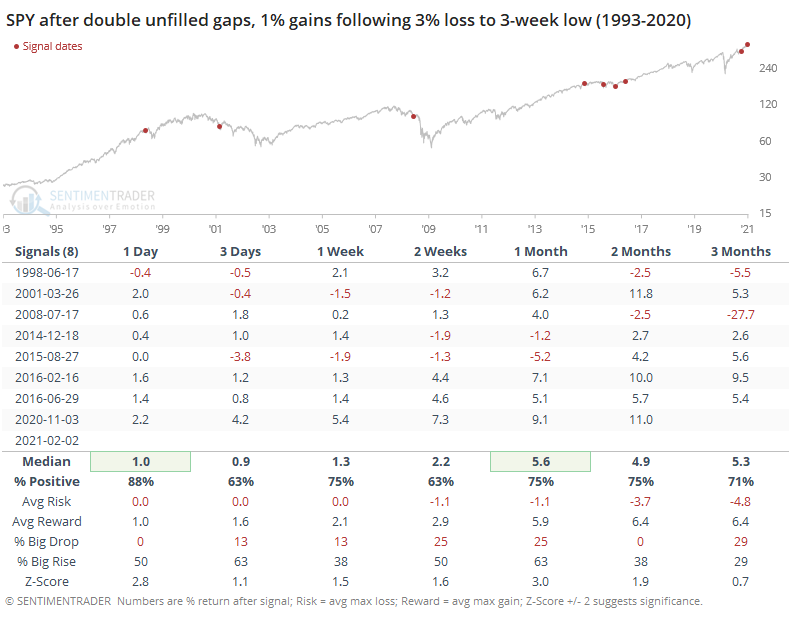

After falling more than 3% over the prior week and to a 3-week low, SPY has enjoyed back-to-back days with an unfilled gap up (it never traded in negative territory either day) and with gains of at least 1%. That's been a decent sign.

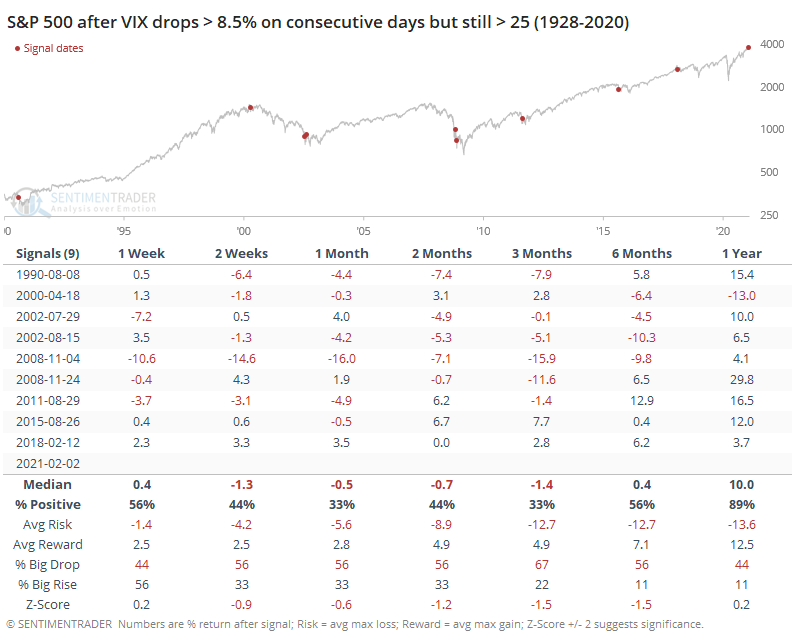

It should also be a sign that implied volatility is plunging after the surge last week. The VIX has dropped more than 8.5% now on back-to-back days, even though it's still hanging above 25. Theoretically, this is supposed to be a positive.

In practice, not so much. We saw these kinds of swings in a high-volatility environment mostly during violent markets, and it took a while before calm took over.

These are saying different things, and we'd probably put more weight on the VIX idea. Not just because it fits with a lot of other work we've looked at lately, but price patterns like on SPY have just become less reliable in recent years. That's why we rarely discuss them anymore.