Minutes Digest for Jan 22 2021

Investment grade bonds haven't been a great investment

- Published:

2021-01-22 09:24:59 - Author: Jason Goepfert

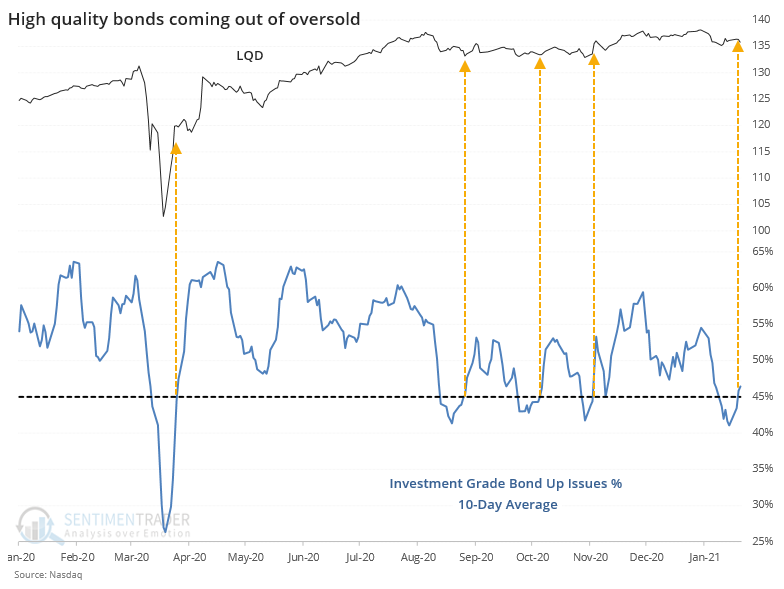

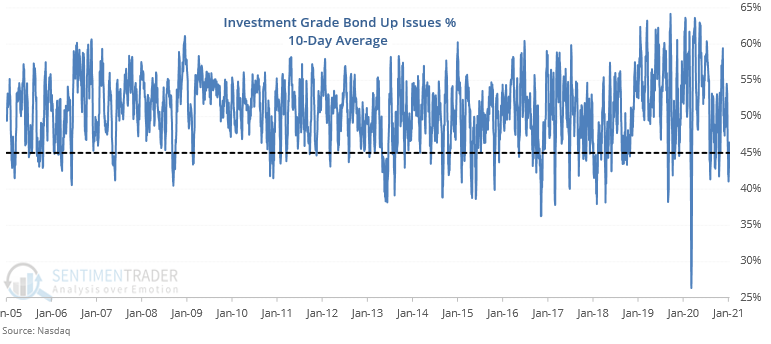

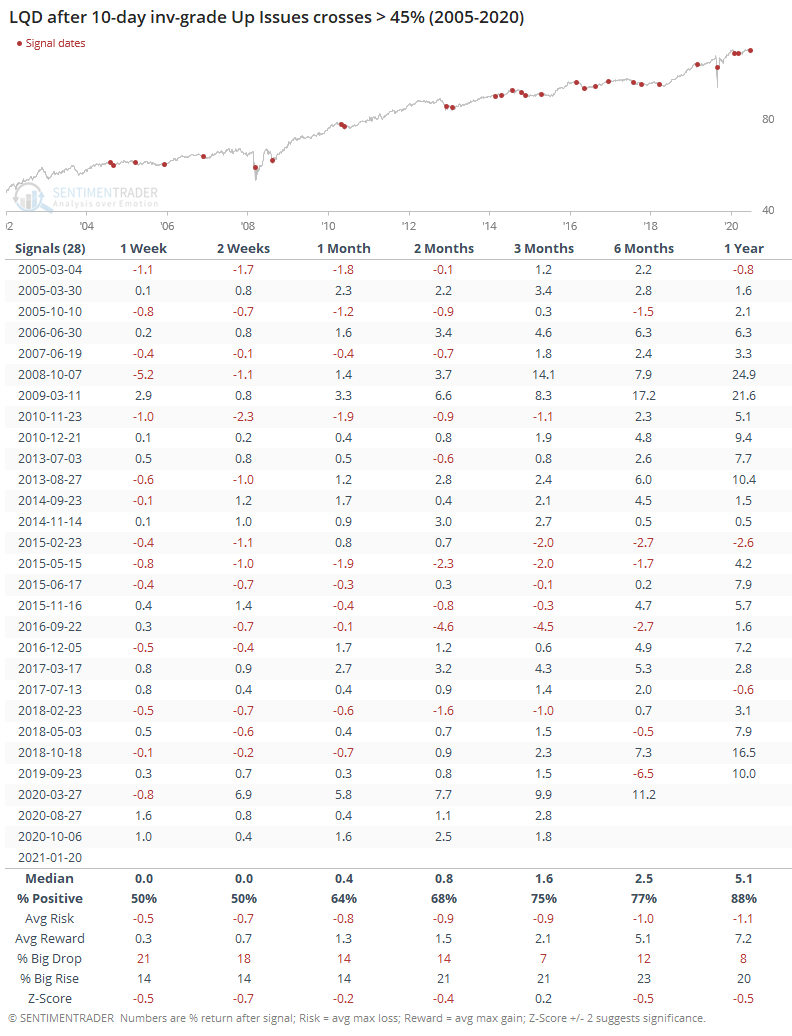

The WSJ pointed out that one of the few markets that has been struggling is investment-grade bonds. That certainly has been the case, as the 10-day average of the percentage of advancing bonds is just now trying to curl up from a very oversold condition.

A recent reading near 40% is one of the lower ones in 15 years.

As far as a signal, though, it's been only so-so. The LQD fund did tend to rise going forward but its average return was a bit below average. The biggest positive was that these signals triggered when coming out of oversold conditions, so forward losses tended to be limited.

A rare short-term breadth signal

- Published:

2021-01-22 08:10:57 - Author: Dean Christians

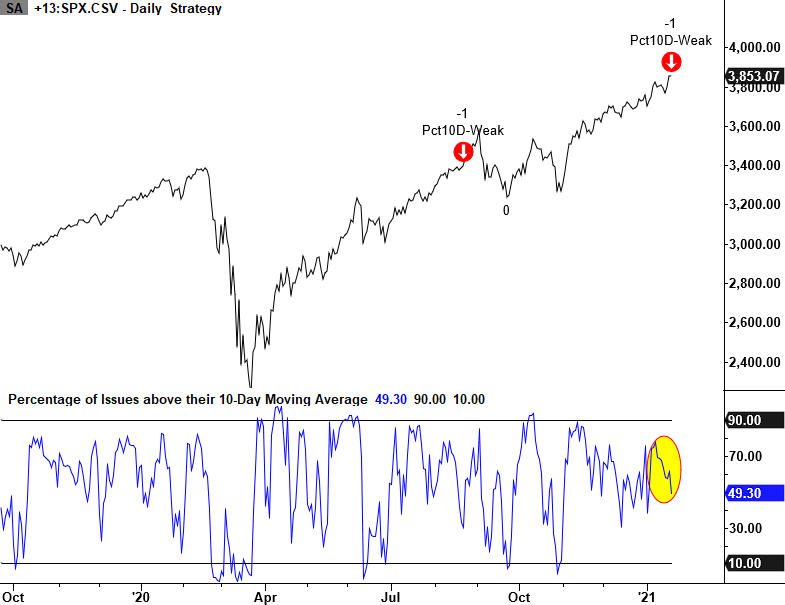

As Jason and I have noted in several studies of late, the big picture backdrop for the market remains constructive as several intermediate to long-term market breadth measures continue to track a bullish recovery phase. However, in the last few days, one short-term breadth measure for the S&P 500 softened as the market advanced to new highs. The number of S&P 500 members above their respective 10-day moving average registered a less than 50% reading as the S&P 500 closed at a new high.

Let's take a look at all other instances since 1928.

Current Chart and Signal

Historical Signal Performance

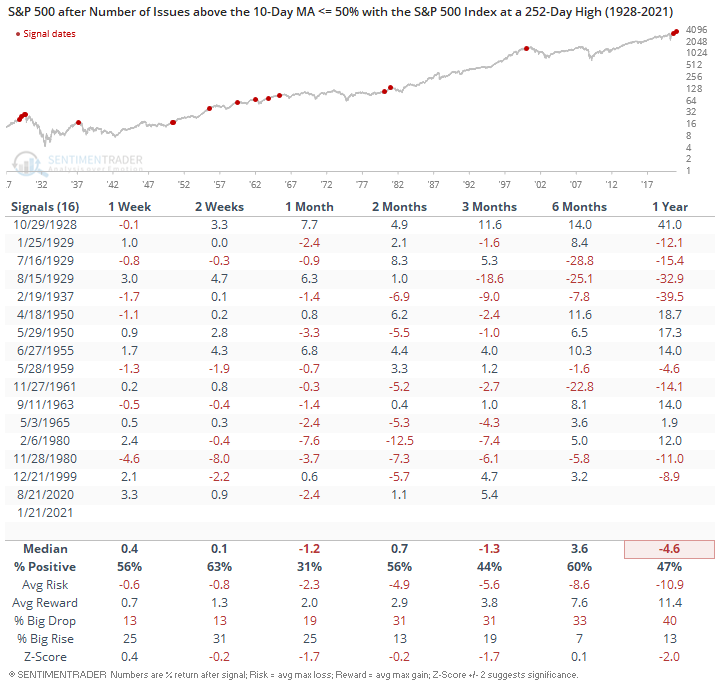

While the sample size is small, the forward returns out 1-month are weak.

Conclusion: The intermediate to long-term backdrop remains constructive, and one short-term signal does not make a trend. As a risk manager, I'm always monitoring the market for new developments that run counter to my outlook.

Few puts and fewer calls

- Published:

2021-01-22 08:03:09 - Author: Jason Goepfert

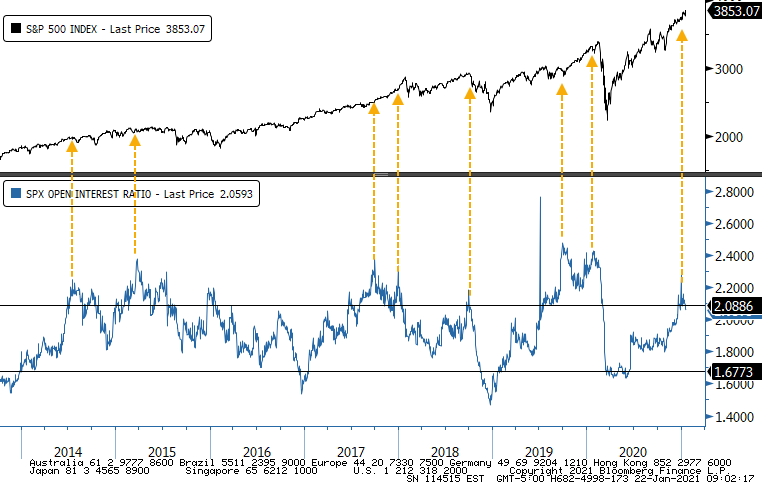

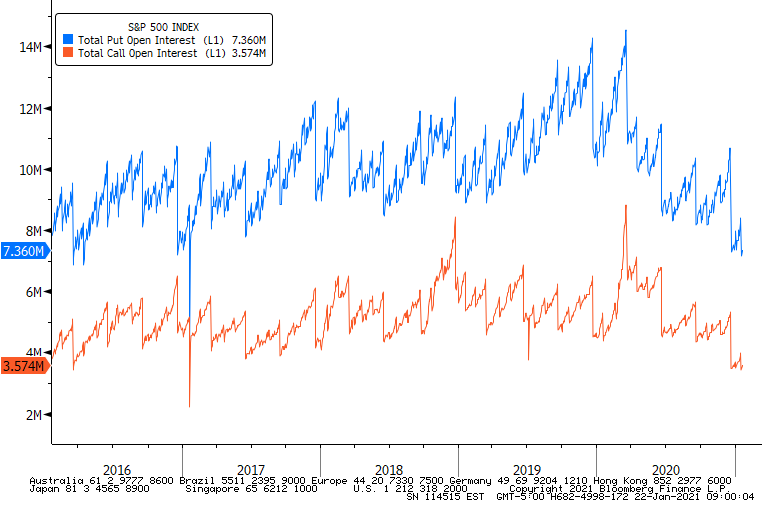

Bloomberg notes that put open interest on the S&P 500 is very low. Very true. But call open interest is low, too.

The ratio is such that put open interest is more than twice call open interest. As we've shown many times before, though, this is not a good thing. In SPX options, it's more of a smart money play, and high levels of put open interest relative to call open interest have consistently led to lower prices for the index itself, and vice-versa.