Minutes Digest for Jan 21 2021

Active manager record confidence

- Published:

2021-01-21 14:07:40 - Author: Jason Goepfert

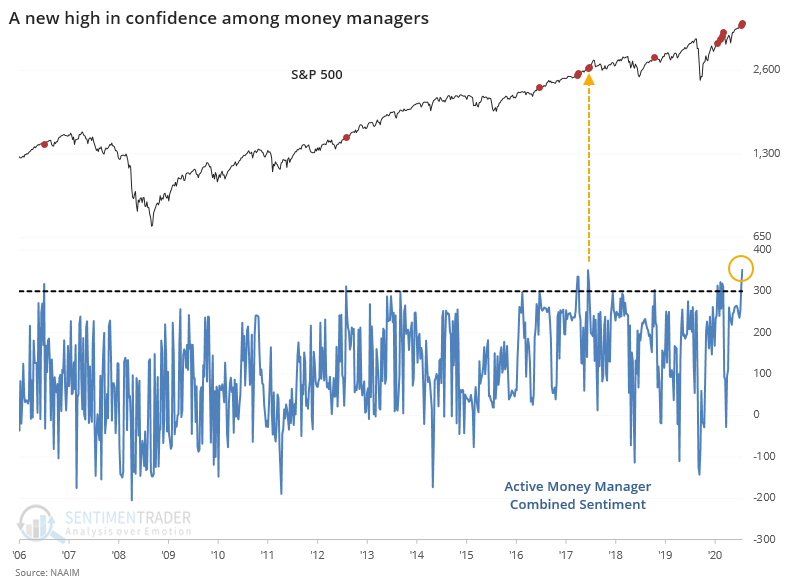

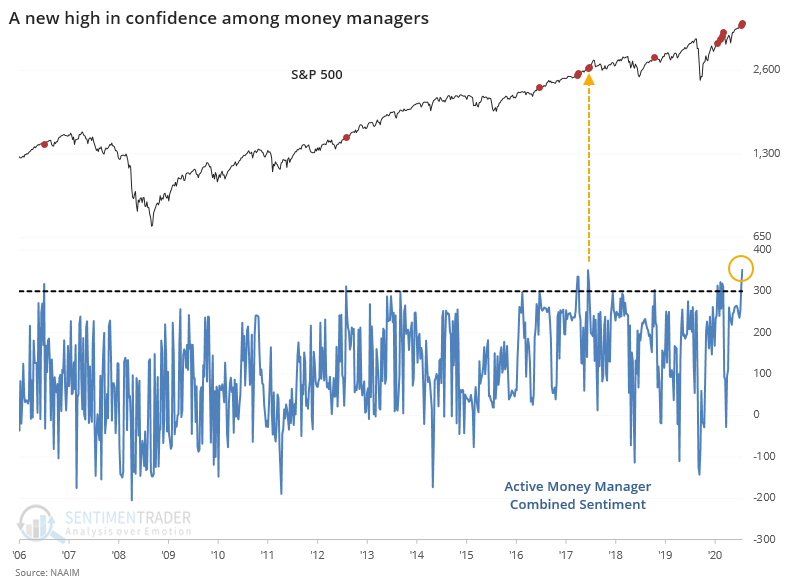

The NAAIM survey of active managers is getting some buzz today because it shows that the average manager is leveraged long. That doesn't happen too many times. Not only that, even the most bearish manager is 75% net long, and there is a small standard deviation among responses (suggesting group-think).

We've discussed this survey countless times since 2006, as I had a (very) small part in helping its inception. The overall conclusion is that it's just not a very good contrary indicator. Most of the time when these managers are heavily long, they're proven right in doing so.

Below, we show a version we've looked at before, which takes into account average exposure, min and max exposure, and adjusts for the standard deviation among responses. The current reading was matched only once before, the week of December 13, 2017. Other times it was almost as high mostly led to further gains.

Financial flow

- Published:

2021-01-21 13:27:41 - Author: Jason Goepfert

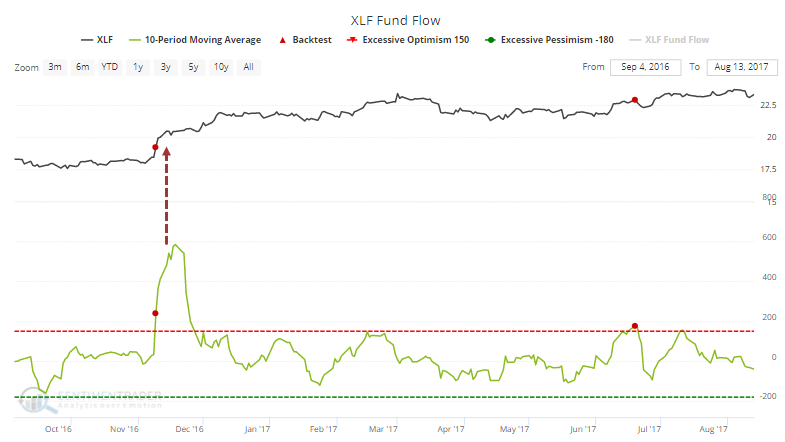

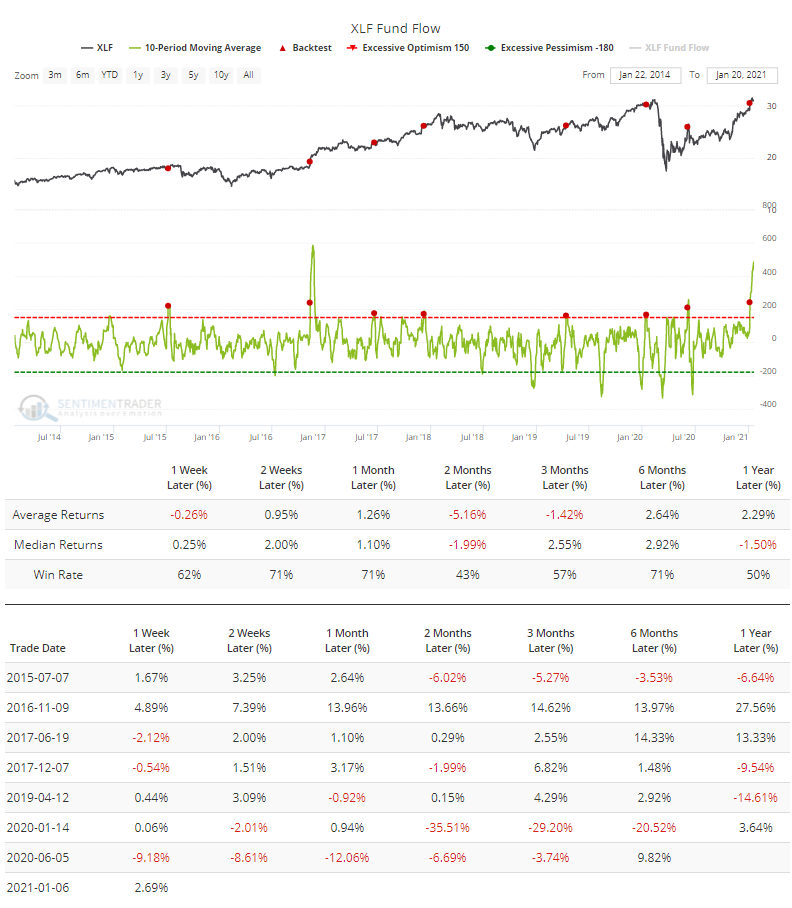

Financials are struggling a bit today, after absorbing a bunch of new money from ETF traders. The most popular fund, XLF, has seen an average inflow of nearly $450 million per day over the past 2 weeks. According to the Backtest Engine, XLF showed some weak returns over the next couple of months when inflows exceeded $150 million per day.

That other big spike was right after the 2016 election, and while XLF consolidated for a bit after that big inflow, it managed to chop higher in the months ahead.

That other big spike was right after the 2016 election, and while XLF consolidated for a bit after that big inflow, it managed to chop higher in the months ahead.