Minutes Digest for Jan 12 2021

Gold miners see few uptrends

- Published:

2021-01-12 14:26:07 - Author: Jason Goepfert

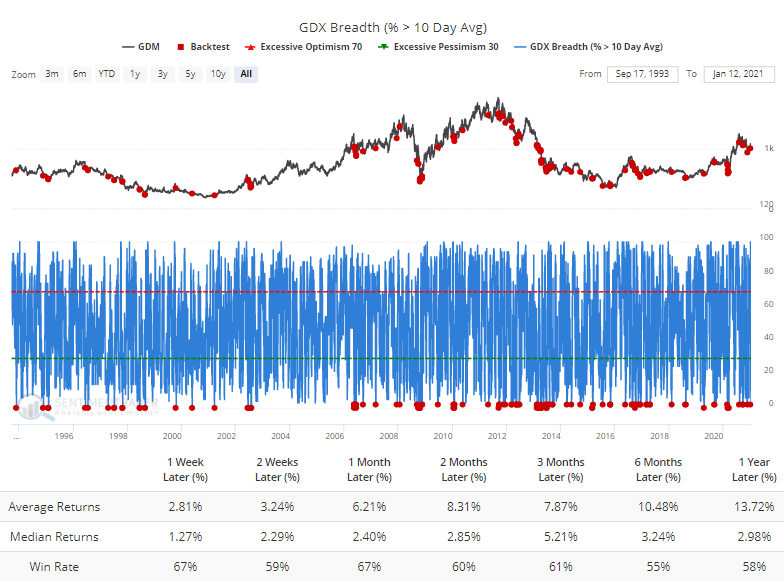

Miners haven't taken the jump in the buck very well. The selling has been enough so that only 2% of the stocks have managed to hang above their short-term 10-day moving averages. That'll probably drop even more by the way today looks.

The Backtest Engine shows okay-but-not-great returns when so few were above their averages.

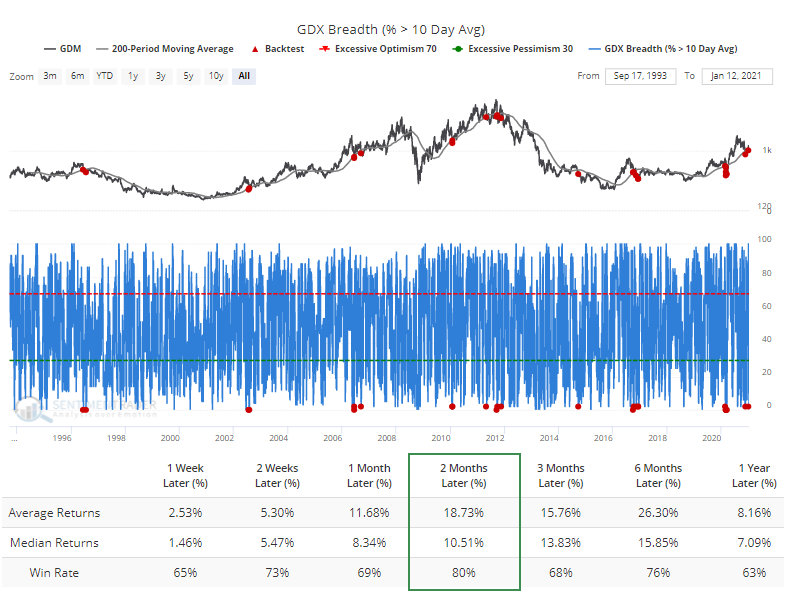

Here's a wrinkle, though - the GDX fund (and GEM index) is below a rising 200-day moving average, meaning it's selling off during what has been a generally positive trend. When we adjust the backtest for these conditions, then forward returns improved quite a bit. Out of 25 signals, 20 of them were higher over the next 2 months.

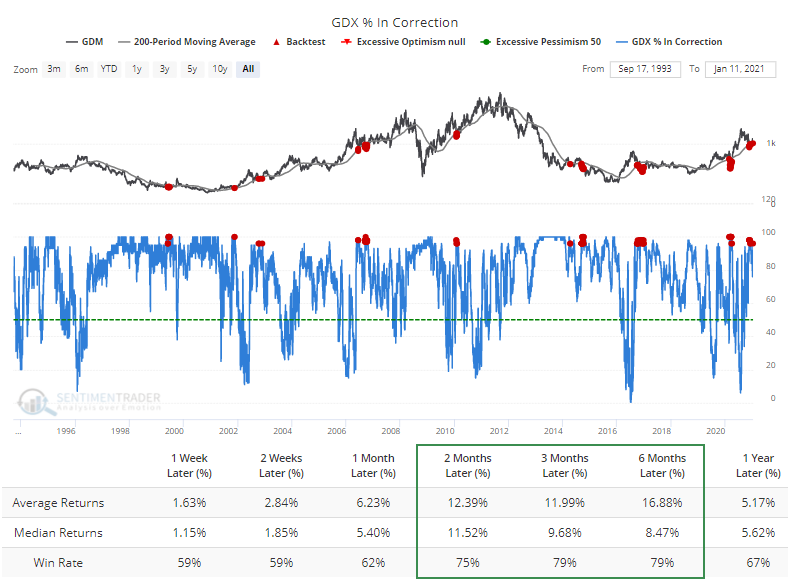

It's a similar picture for the percentage of miners in a correction. Nearly all of them are now at least 10% below their 52-week highs. When that has triggered during a dip in a longer-term uptrend, mostly positive returns going forward.

Yields up again

- Published:

2021-01-12 09:29:17 - Author: Jason Goepfert

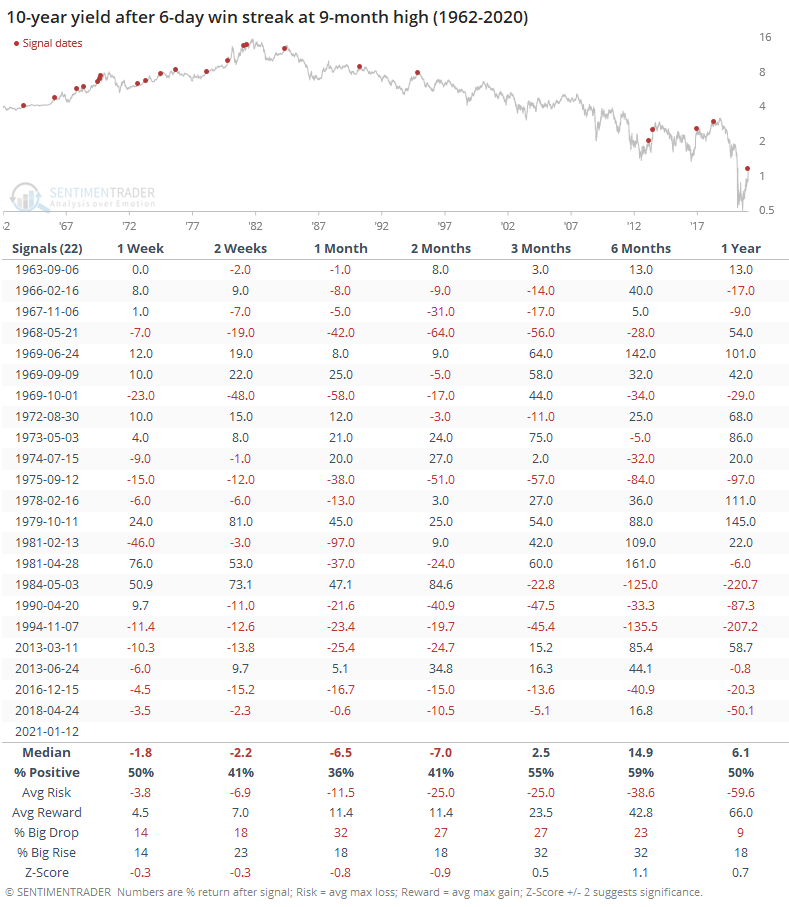

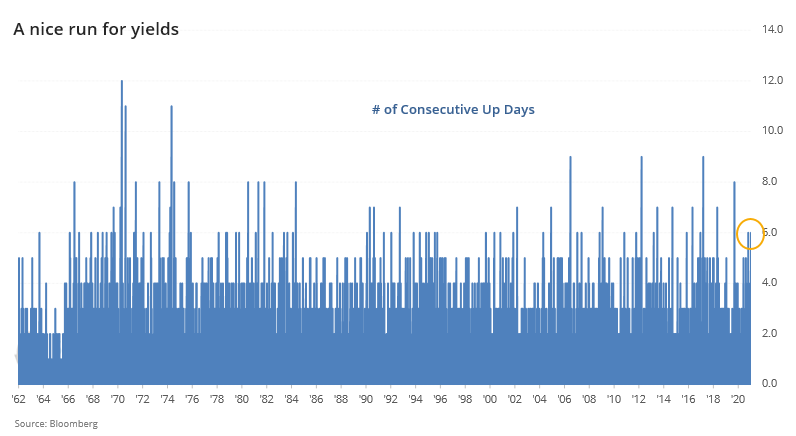

The yield on 10-year Treasuries is up again today, marking the 6th straight session with higher rates, and to a 9-month high to boot. That's one of the longer streaks since 1962.

It's not surprising that this was a more frequent occurrence prior to the peak in rates in 1982, and up until then it led to mixed results going forward. Since then, yields (of course) had a strong tendency to decrease over the next 1-8 weeks. The returns are in basis points.