Minutes Digest for Jan 08 2021

Dollar trend change

- Published:

2021-01-08 14:03:38 - Author: Jason Goepfert

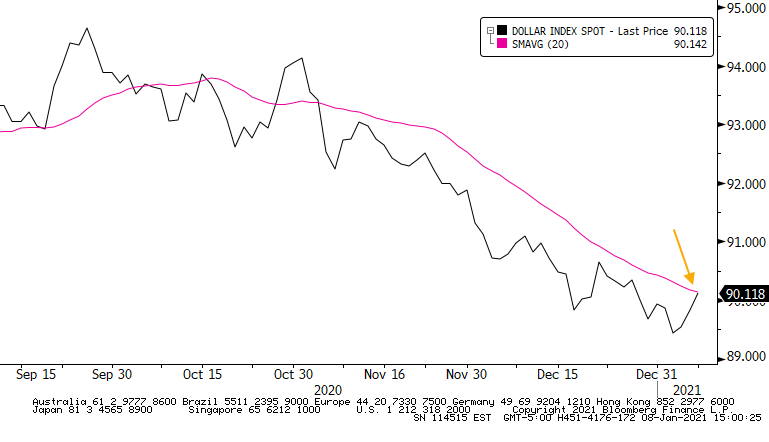

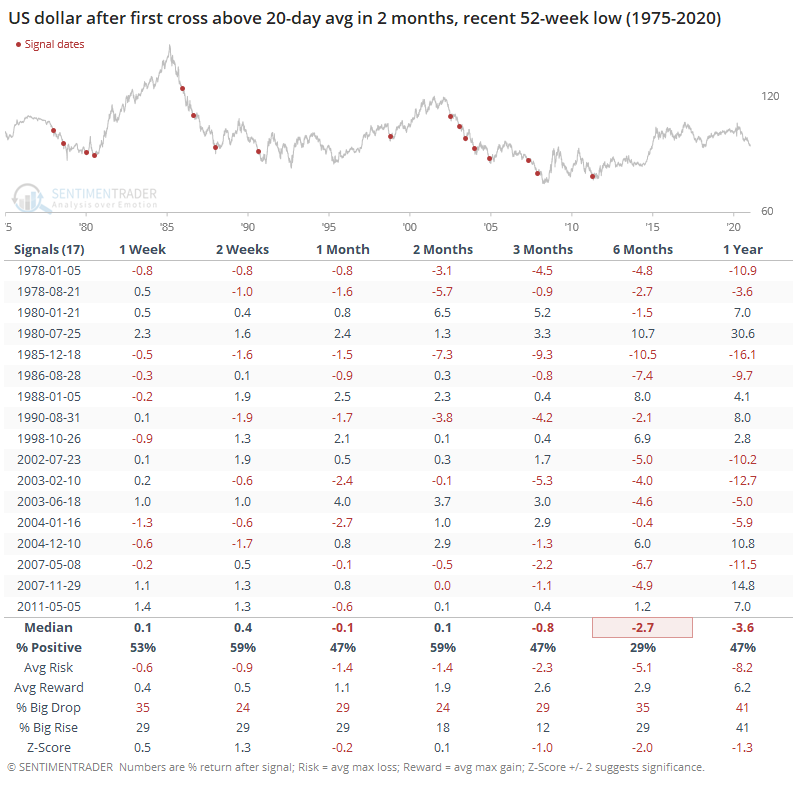

There's some brewing excitement out that that the buck is about to cross above its 20-day moving average (or close to it, anyway). This would be the first time above its average in more than 2 months, one of the longest streaks in its history.

Most of them have been false starts. When it's had such negative momentum before, it was almost universally during structural bear markets, and only 29% of these "trend changes" actually, you know, changed the trend when looking out over the next 6 months.

Gold...ouch

- Published:

2021-01-08 10:19:11 - Author: Jason Goepfert

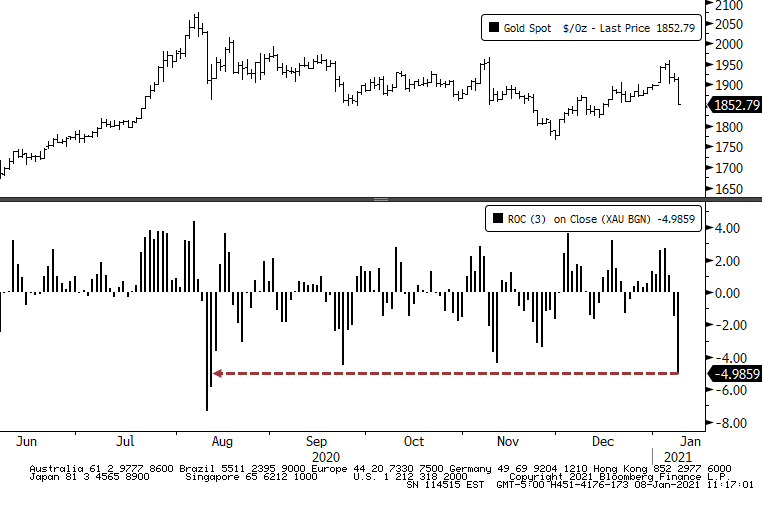

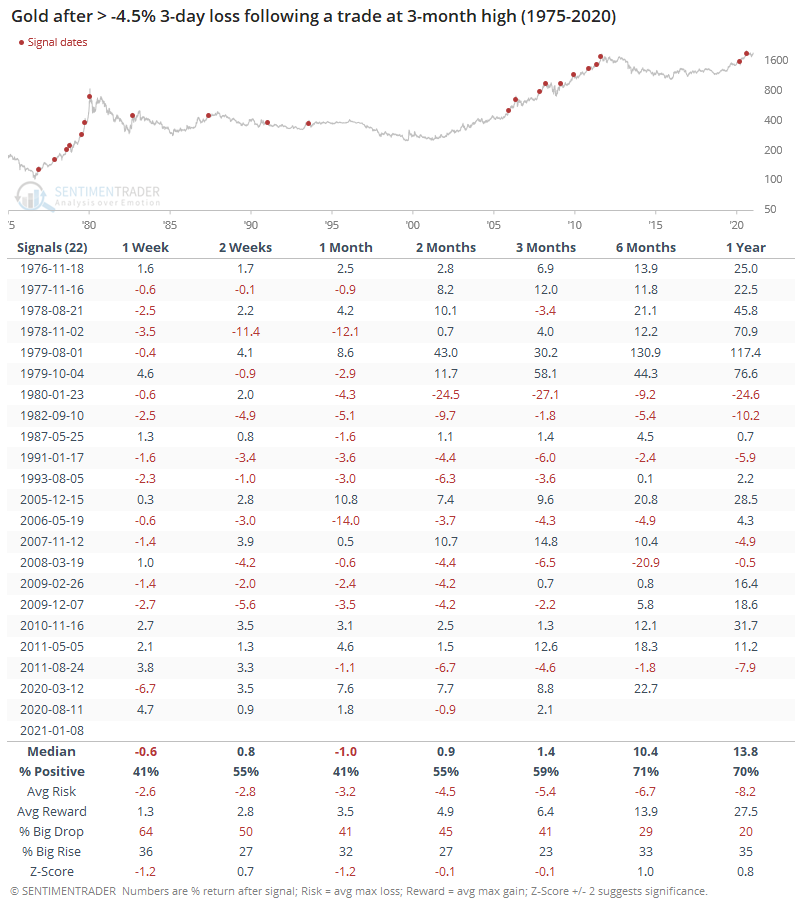

The slam in gold on Friday, if it holds, will mark the metal's worst 3-day rate of change since last August.

Other times it dropped 4.5% or more over a 3-day period, following a day when it at least intraday day eclipsed a prior 3-month high, it struggled a bit over the shorter-term. It's interesting to note that almost all the occurrences triggered during the massive run-ups in the late 1970s and 2000s, and not during bear markets.

Payroll miss

- Published:

2021-01-08 09:03:59 - Author: Jason Goepfert

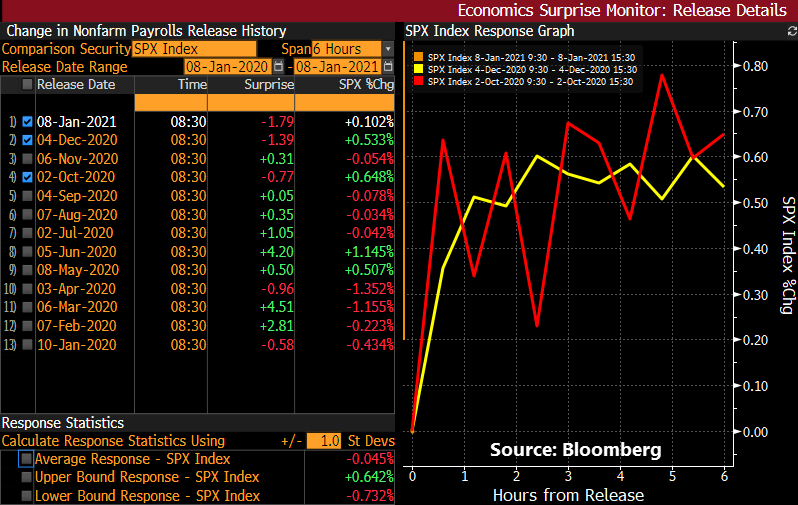

The focus this morning has been on the big miss in Nonfarm Payrolls, some expecting it to derail the relation trade. It's worth noting, though, that investors have taken the opposite side of the payroll surprise since July. Every time payrolls were better than expected, stocks sold off during the day. The two times payrolls missed, stocks rallied.