Minutes Digest for Jan 06 2021

Record rally

- Published:

2021-01-06 12:37:49 - Author: Jason Goepfert

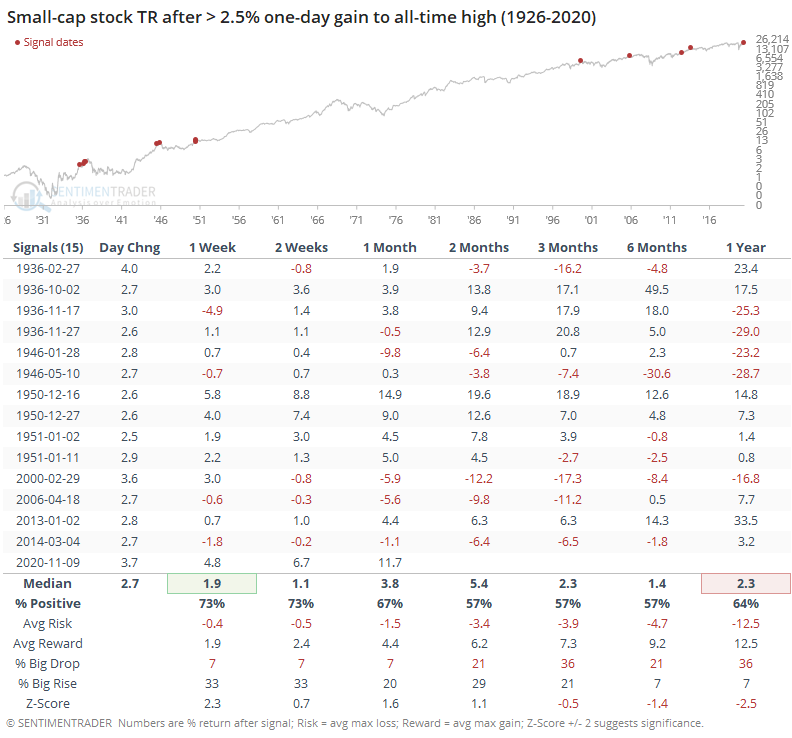

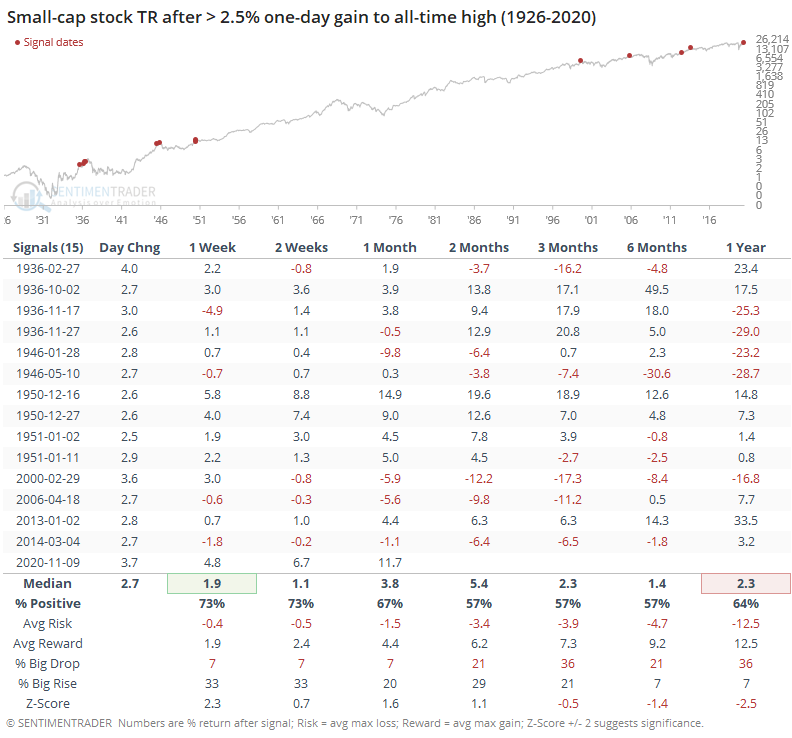

Barring a hefty pullback into the close, today will go down as the best-ever day for small-cap stocks. Never before has the Russell 2000 rallied so much on a day it scored an all-time high. The only date since 1979 when it jumped more than 3% at a record high was February 29, 2000, which obviously isn't a great precedent.

Using total return (including dividends), it gets a little easier to see big gains, but even then today would go down as the greatest of all time. Below, we can see returns in a small-cap total return index when it jumped 2.5% or more at an all-time high.

Shorter-term returns were pretty good. Longer-term returns couldn't exceed random.

Fins vs Tech

- Published:

2021-01-06 09:22:22 - Author: Jason Goepfert

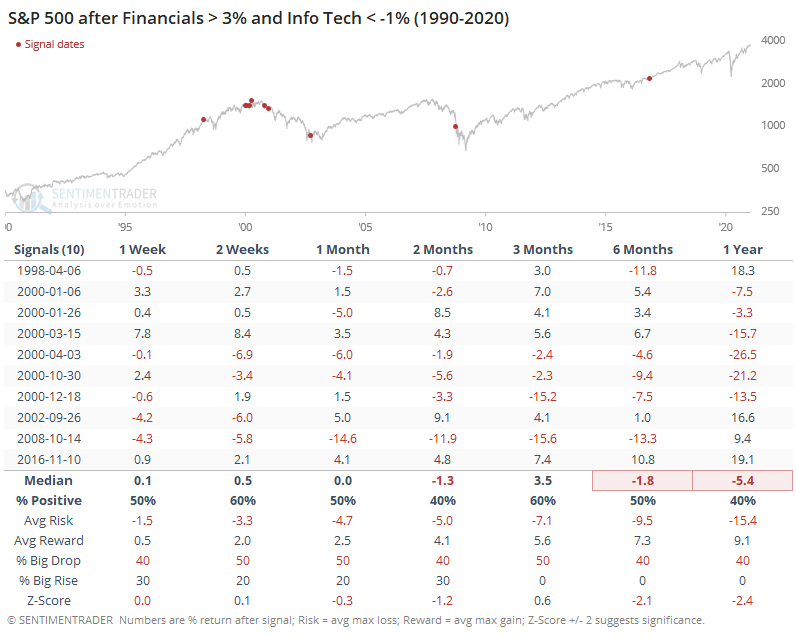

It's super early, but we were asked if there has ever been a day when Financials were up 3% and Tech down 1%. The answer is "yes," but it's rare.

For the broader S&P 500 index, forward returns were mixed-to-weak.

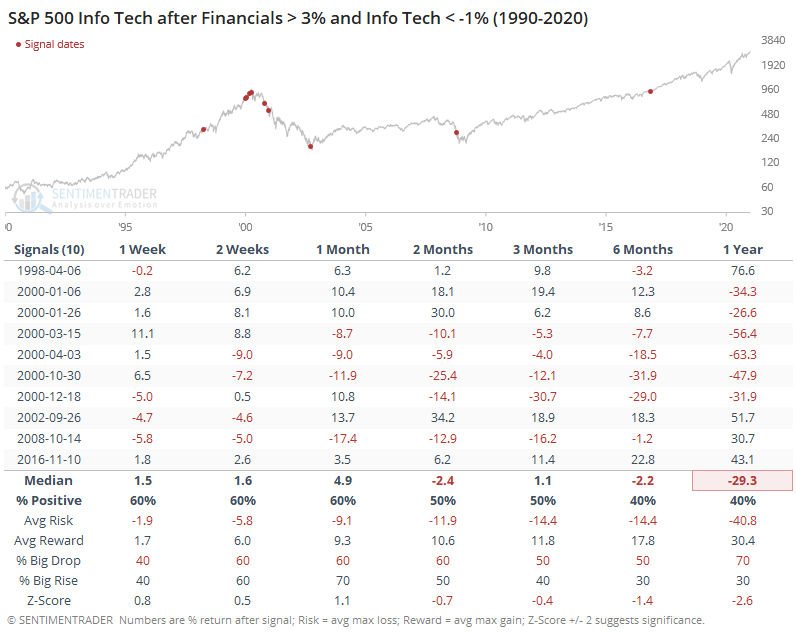

Tech did fine shorter-term, not so much longer-term.

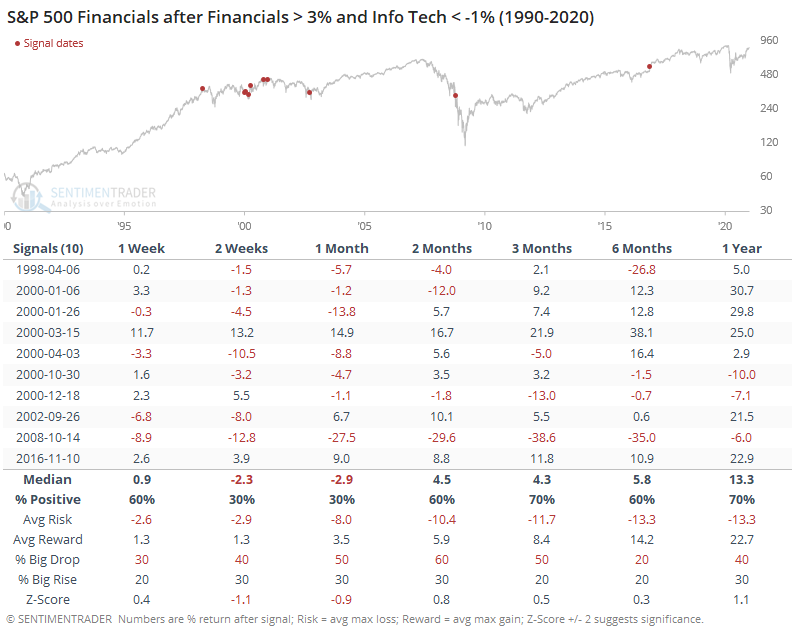

Financials were pretty much the opposite.

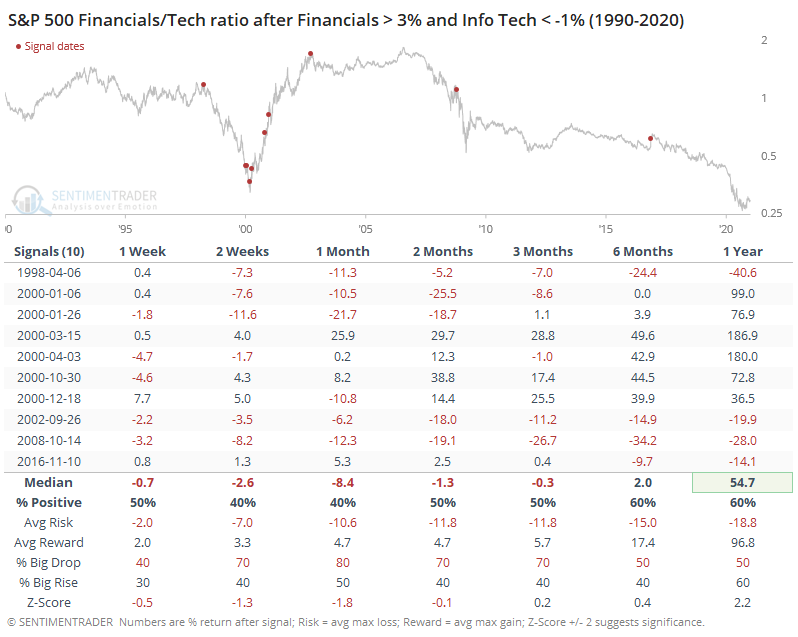

So the ratio between them favored Tech short-term, Financials longer-term.

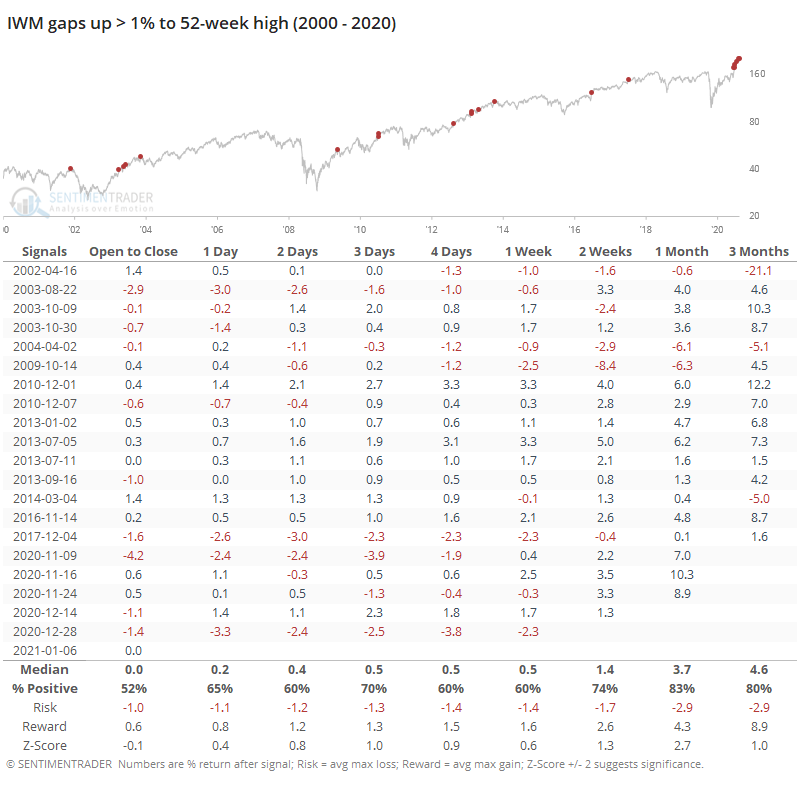

The Russell is roaring

- Published:

2021-01-06 07:49:57 - Author: Jason Goepfert

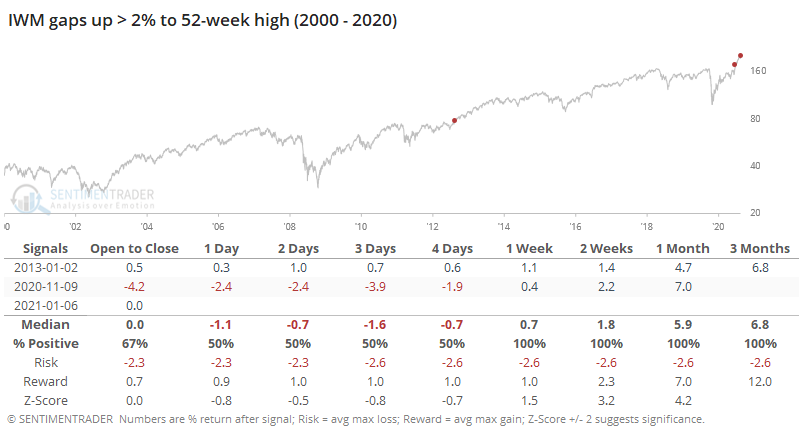

With some stocks enjoying the results of the Georgia elections, small-caps have taken off. The IWM fund is up more than 2%, exceeding all prior 52-week highs. It's done that only twice before.

If this fades before the open, it would still probably end up being one of the largest pre-opening gaps at a new high in the 20-year history of the fund. It has mostly had success in holding onto the gains, though the ones in 2020 mostly saw some selling pressure first.