Minutes Digest for Jan 05 2021

Russell reversal

- Published:

2021-01-05 13:30:30 - Author: Jason Goepfert

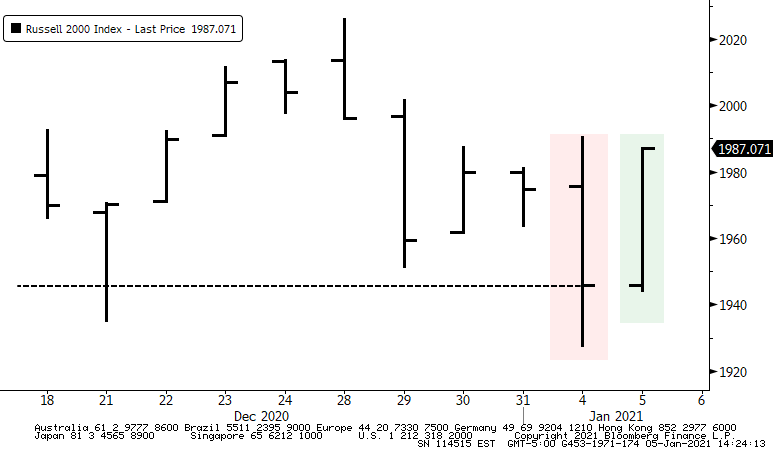

After a tough day yesterday, small-caps are among the leaders on Tuesday. The Russell 2000 is on track to completely reverse Monday's losses, which pushed the index to nearly a 1.5% loss and to a 10-day low.

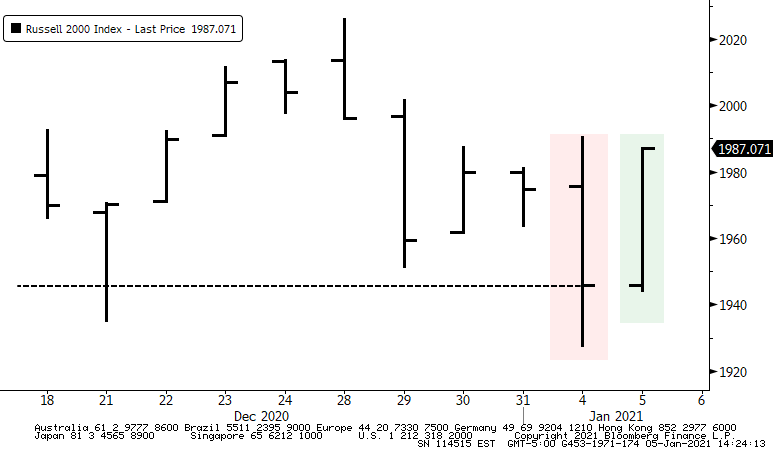

There have been surprisingly few instances of the index reversing such a big loss the next day, and so close to a 52-week high. Only one of them ended up leading to sustained, if minor, gains.

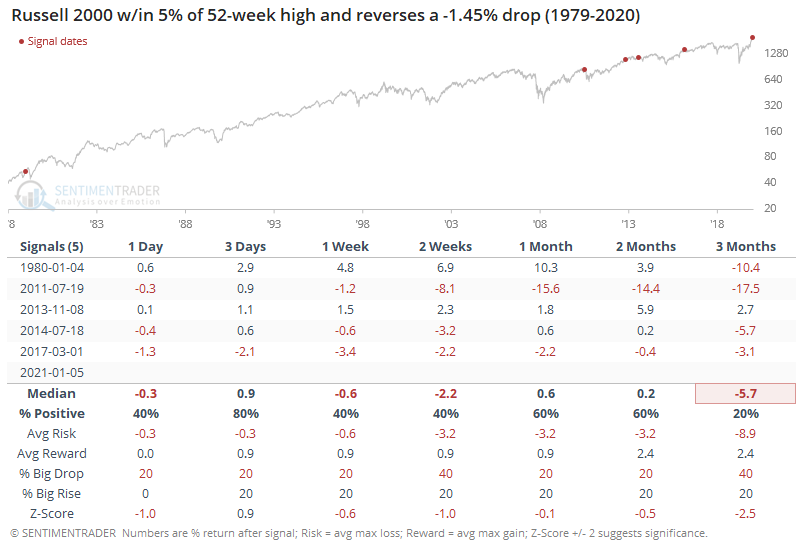

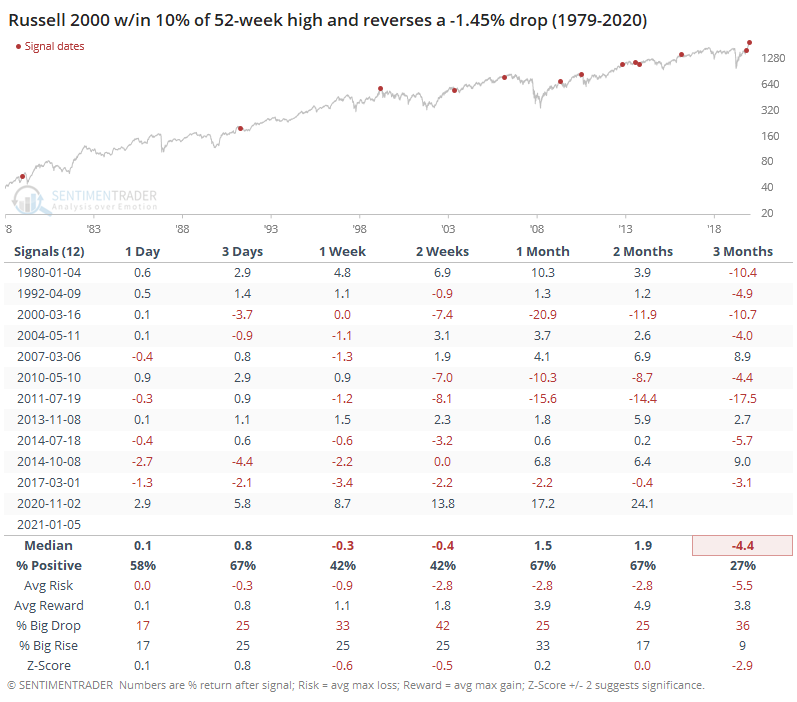

If we look at signals within 10% of a high, then we more than double the still-small sample size. Returns were still curiously weak, though, especially over the next 3 months, with only 3 winners out of the 12 precedents but the latest one from November will surely show a gain as well. As we see so often, what looks obvious on a chart doesn't necessarily hold up under scrutiny.

Energy has energy

- Published:

2021-01-05 12:01:25 - Author: Jason Goepfert

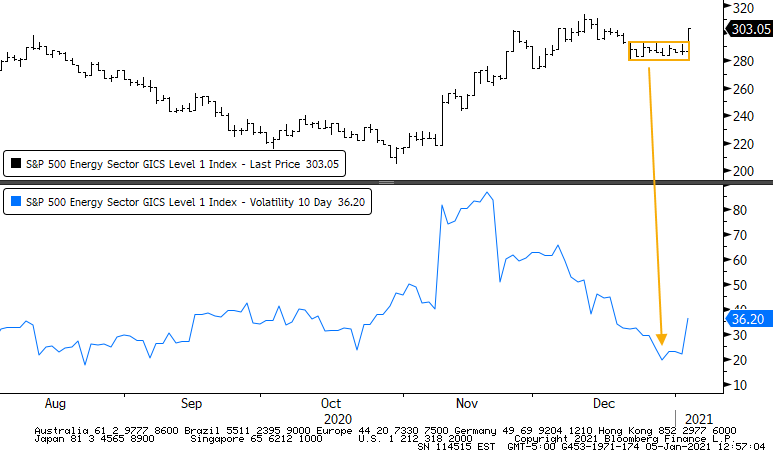

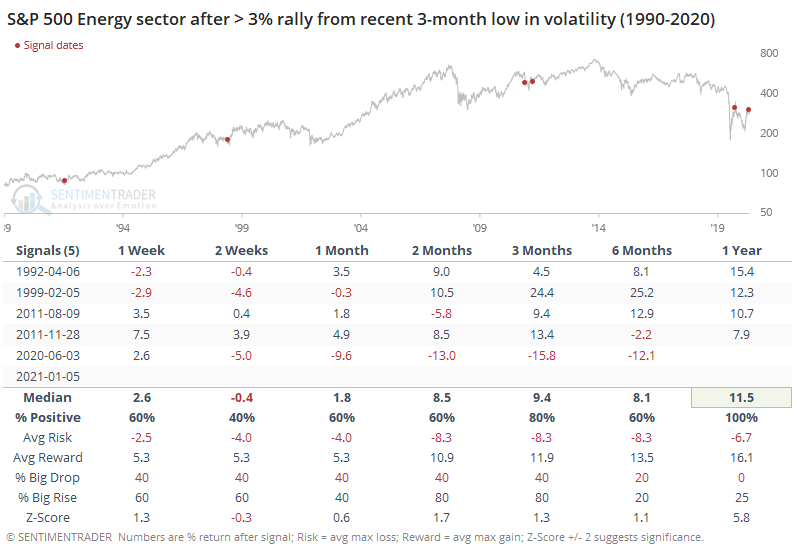

Energy stocks went into hibernation over the past two weeks, pushing its 10-day historical volatility down to multi-month lows. Today, many of the indexes and individual stocks are breaking above their highs from that consolidation period.

The sector has had a tough go of it for long stretches, so we've seen a few periods of false hope for the group. The last time we saw a break from short-term consolidation, last June, the stocks ran for another week or so, then had a very rough few months. The others mostly led to gains, but with the caveat of a tiny sample size.

Gold rush

- Published:

2021-01-05 07:46:43 - Author: Jason Goepfert

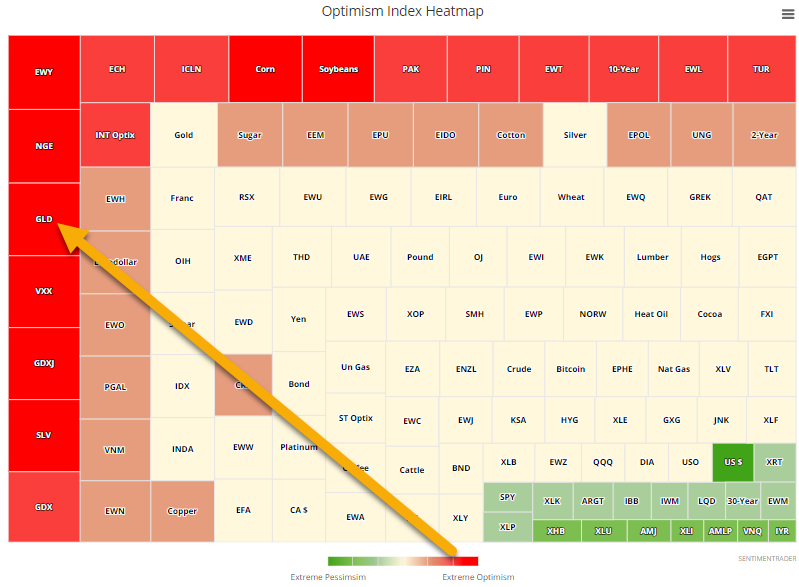

The Heatmap shows that the jump in gold on Monday was enough to push the Optimism Index for GLD toward the upper-left quadrant, reserved for the markets showing the most extreme optimism.

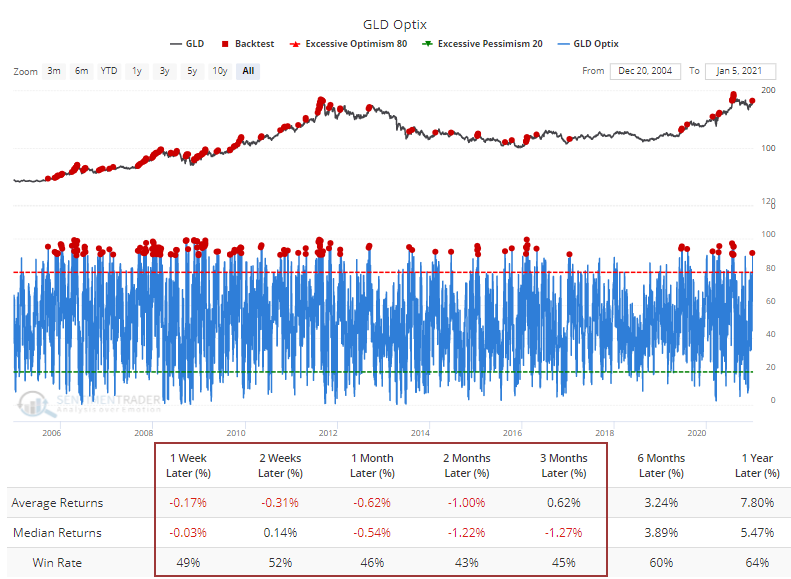

According to the Backtest Engine, it's been tough for GLD to consistently add to its gains after recording such a high reading, with negative average returns across most time frames up to 3 months later.

There was a +0.30 correlation between the 1-week and 3-month returns, giving a modest suggestion that if buyers continue to be interested in gold even after a surge like this, then it bodes well for medium-term returns.