Mining Momentum And Gas Rally

This is an abridged version of our Daily Report.

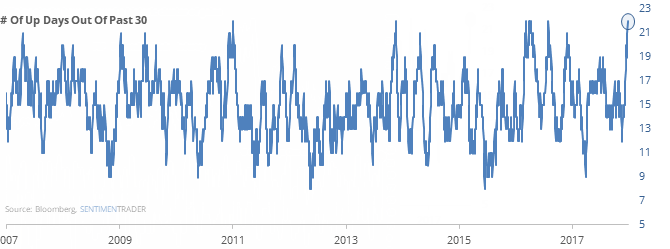

Mining momentum

The Metals & Mining industry is in the midst of a historic run. Over the past 30 days, it has enjoyed a cluster of up days seen only 4 other times since 1990.

Each of the others led to short-term weakness.

Gas powered rally

Natural gas has jumped more than 10% off its low from a few days ago. It behaved in a similar way in 2015, each of which was a “false” move. Historically, if buyers persisted over the next two weeks, it was a good long-term sign.

New high in debt

Margin debt climbed 3.5% to another new record high in November, the largest monthly gain since January. The net worth of investors fell to a record low of negative $287 billion. Still, the year-over-year increase in debt was about equal to the change in the market value of stocks.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.