Mid Year Trade Signal Review

My colleague Jay wrote an excellent article titled, What it Takes to Succeed in the Markets. And while one could write an entire book on the subject matter, I will focus on what I think would be a good chapter in today's note. Whether you're a seasoned veteran or a novice, one should always strive to become better at what is a very challenging endeavor, the skill of investing. We can seek to accomplish this goal by reviewing our trades or investments to learn whether our process or plan is working. If we find that things aren't going so well, we may want to make some refinements.

Now that the first half of 2021 is in the books, let's review trading signals that I've shared with subscribers to assess the validity of the approach and see if we need to make any refinements.

The following trade signals/statistics reflect a hypothetical execution on the next day open after an entry or exit occurs on the previous day's close. Please remember these are trade signals based on a model and not a forecast from a study.

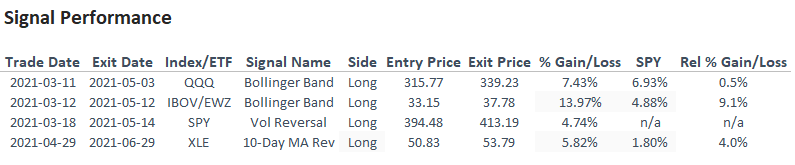

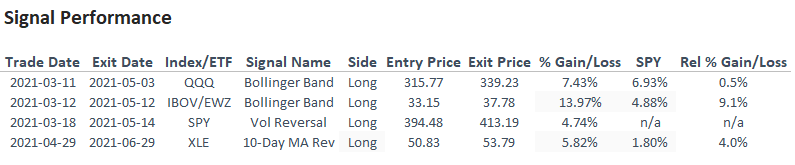

YTD CLOSED TRADE SIGNALS

Since March, a total of 4 hypothetical trades have been closed based on the optimal days-in-trade holding period. So far, the signals are performing well as each one shows a positive absolute and relative gain. The Bollinger Band signal, a mean reversion model, is triggering more often than other methods. I like the model as it provides an excellent opportunity to buy oversold conditions in groups that may be out of favor temporarily. However, it will work until it doesn't work. i.e., it could struggle in a bear market environment.

We currently have hypothetical open trades in QQQ, EWZ, and EWT.

MODEL REFINEMENT

After monitoring and reviewing signals for the Bollinger Band mean reversion model, I will make a minor adjustment to the signal criteria. When an index consolidates, the Bollinger Bands for individual stocks will contract as volatility drops. The contraction in volatility makes it easier for stocks to close outside the bands on a short but sharp move. When this occurs, the percentage of members trading below their lower BB will spike and create a signal that I'm not interested in taking. Let's look at the following chart as it will provide an excellent example of the need to make a slight adjustment.

The Bollinger Band Spread in the last sub-graph measures the difference between the upper and lower band. I use it to measure volatility in other models. The plan is to incorporate it in the BB mean-reversion model. The spread for the index or ETF will need to be above a user-defined level for a signal to be generated. The adjustment will help to identify a higher volatility oversold condition that provides a better mean reversion opportunity.

Trade review and refinement should be an essential part of one's trading or investment process. The competition is always getting better, are you?