Mexico - MEXBOL Index Percentage of Members at a 4-Week High

In my absolute and relative trend update on Monday, I noted a slight uptick in the performance of emerging market countries relative to the S&P 500. I also shared some of the recent trading signals from EM countries like Brazil, Taiwan, and India.

Mexico, an emerging market, maintains a solid absolute and relative trend profile. On Monday, we got additional trend confirmation as internal participation increased with a surge in new highs.

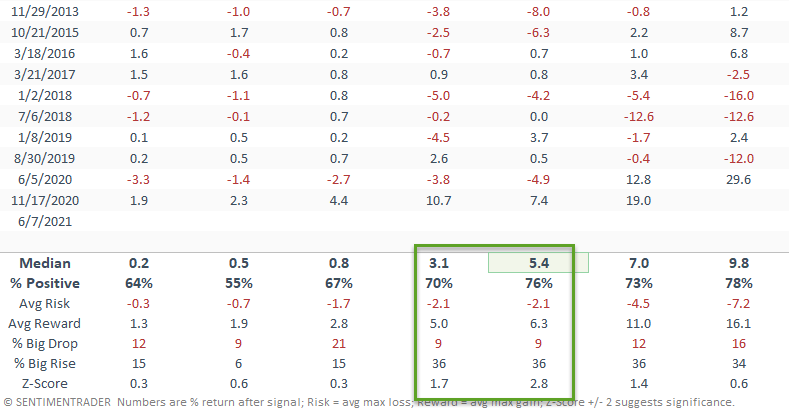

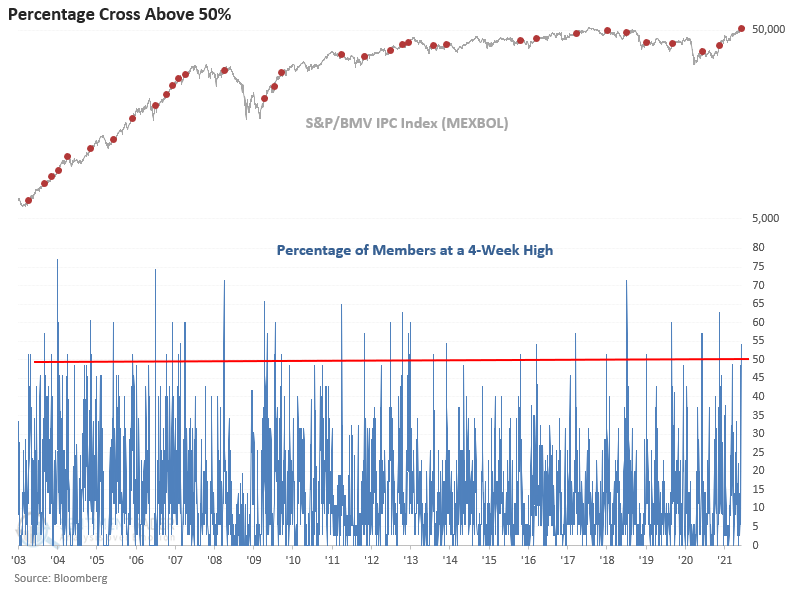

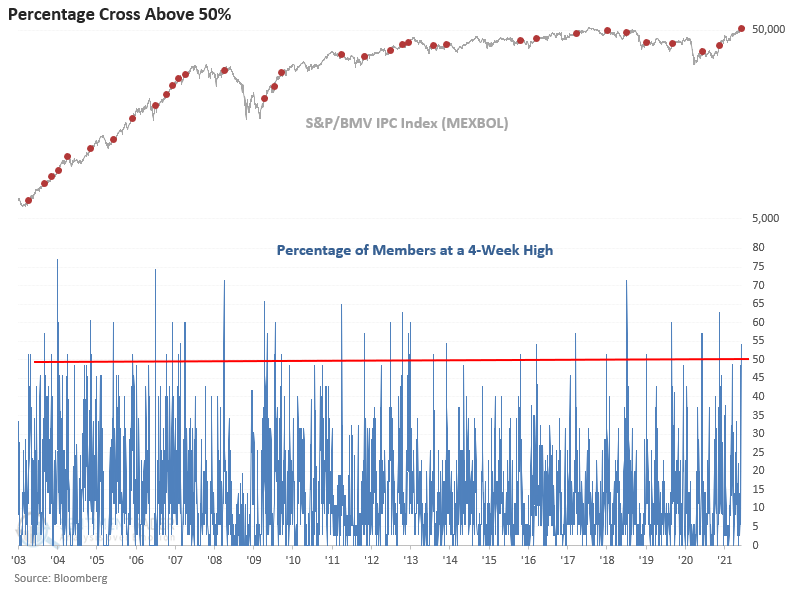

The percentage of members registering a 4-week high spiked to 54.29%.

Let's lower the threshold and assess the forward return outlook when the percentage of 4-week highs cross above 50%.

Please select the following link for the backtest engine scan of this study. Click here.

HISTORICAL CHART

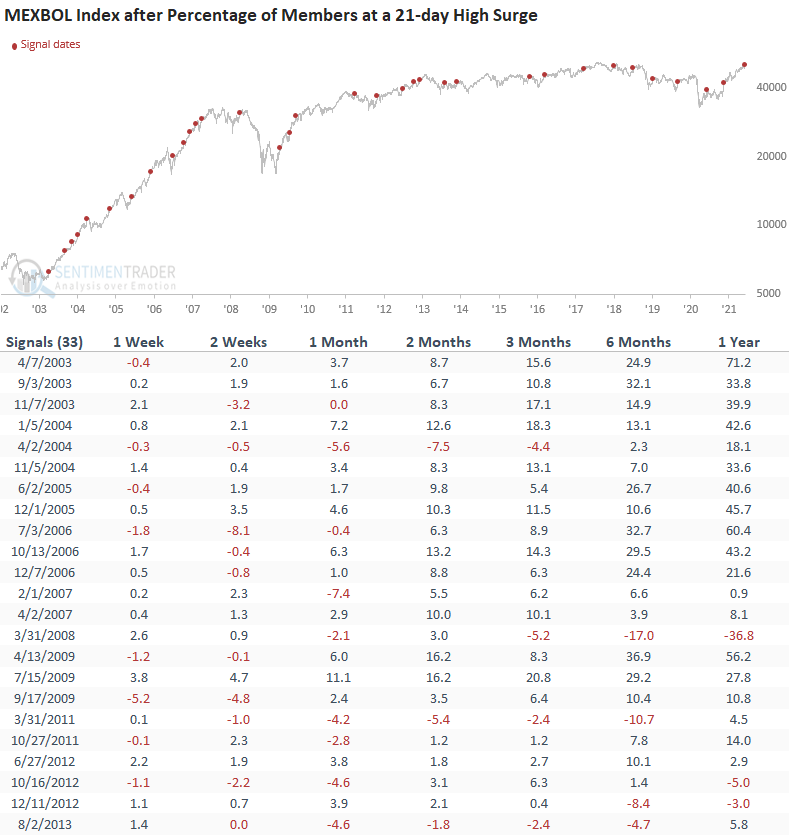

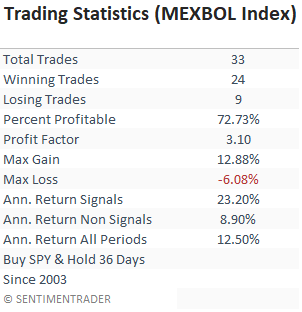

The trading statistics in the table below reflect the optimal days-in-trade holding period of 36 and 38 days. When I run optimizations for trading signals, I cap the max number of days at 42.

It's not surprising to see trading statistics that look similar with a high correlation between the MEXBOL Index and the EWW ETF.

HOW THE SIGNALS PERFORMED

The 2-3 month timeframe looks solid, especially during the last major emerging market cycle between 2003-2007. As always, one must keep an eye on the dollar when allocating capital to emerging markets.