Medium term trend breadth

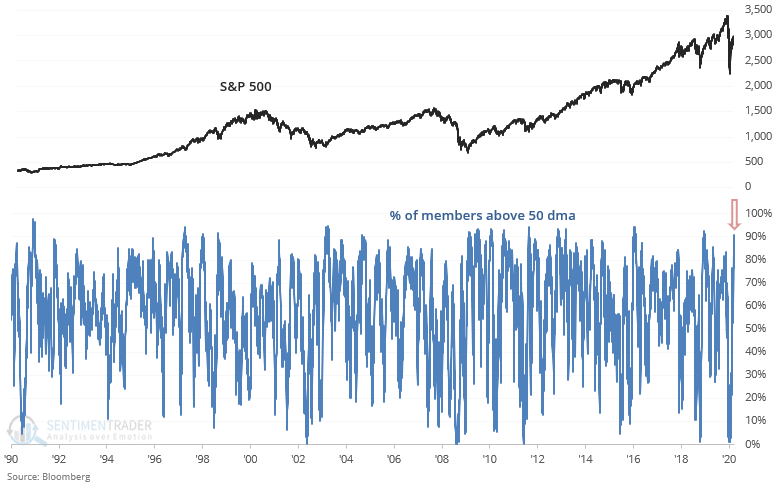

The continued rally in global equities has driven more and more stocks around the world above their 50 dma. In the U.S., more than 90% of S&P 500 members are above their 50 dma.

While it's easy to assume that this is a short term bearish factor for stocks, historically that has not been the case. The % of S&P members above their 50 dma does eventually fall, but it can fall by:

- The S&P pulling back, or

- The S&P swing sideways, allowing the 50 dma to catchup, or

- The S&P rally even more at a slower pace, allowing the 50 dma to catchup, and then make a pullback at a higher price

That's why when this happened historically, it wasn't consistently bearish for the S&P 500 on any time frame:

More than 83% of the NASDAQ Composite members are above their 50 dma:

This was a bullish sign as it occurred at the start of the 2003-2007 and 2009-2020 bull markets. However, it was also a bearish sign in January 2004:

For small caps, more than 85% of Russell 2000 members are above their 50 dma:

While the last 4 times this happened led to pullbacks for small cap stocks...

Before that it wasn't consistently bearish for small caps on any time frame:

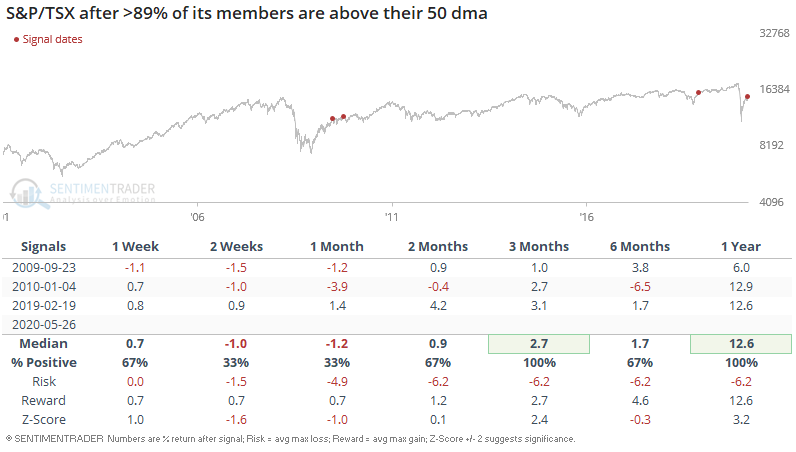

In Canada, more than 89% of S&P/TSX members are above their 50 dma:

This only happened during the 2009-2020 bull market, and led to more gains for Canadian equities over the next year:

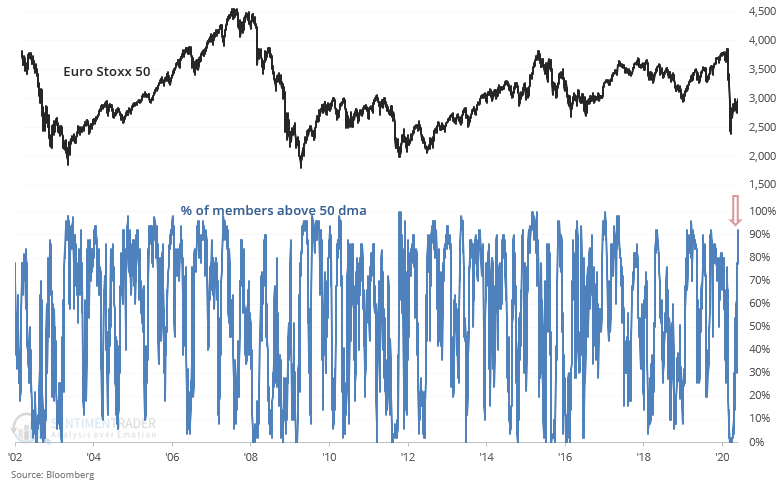

In Europe, more than 91% of Euro Stoxx members are above their 50 dma:

This led to better than average returns over the next year for European equities:

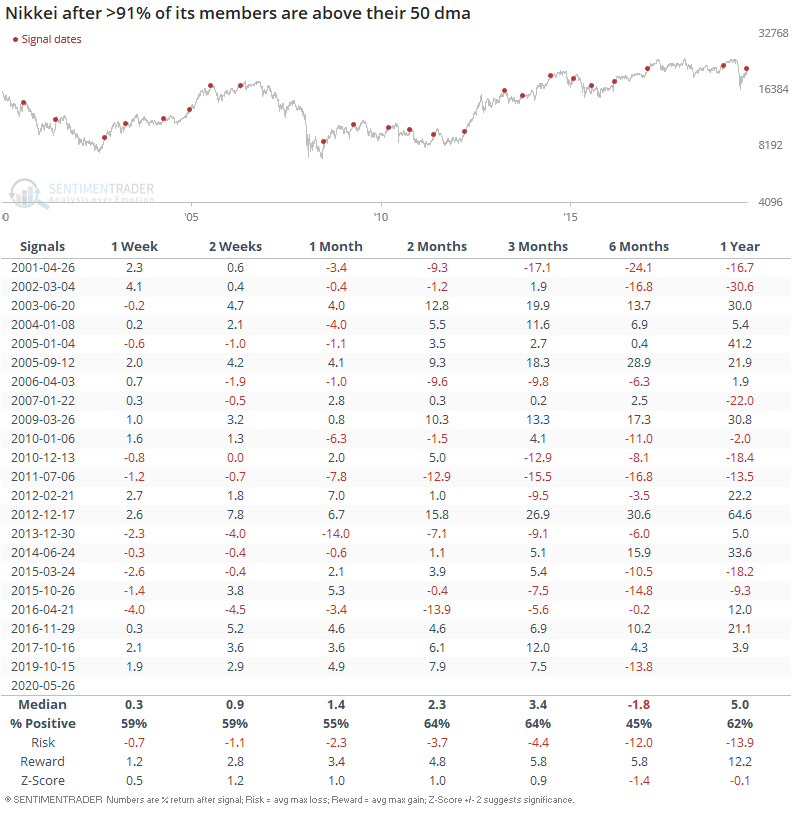

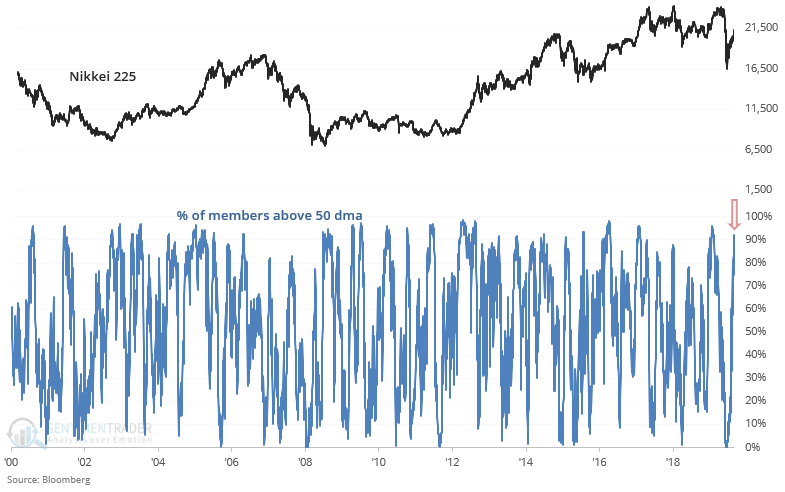

And in Japan, more than 91% of Nikkei 225 members are above their 50 dma:

Returns over the next 6 months were more bearish than random: