McClellan Summation Crosses 500

With the surge in many breadth-related indicators that we've looked at in reports over the past few weeks, it's no surprise that the long-term McClellan Summation Index has finally made it to its upper threshold level of +500. The originators of the McClellan indexes, especially their son Tom, have for years argued that how markets react when the Summation gets to +500 is an important measure of the market.

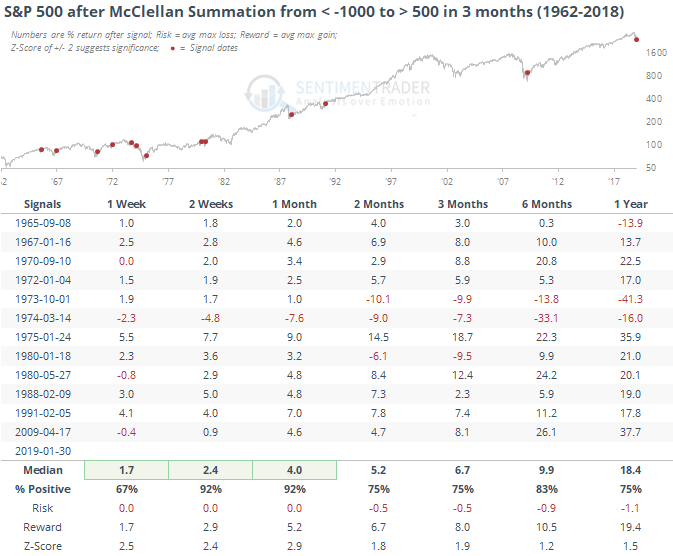

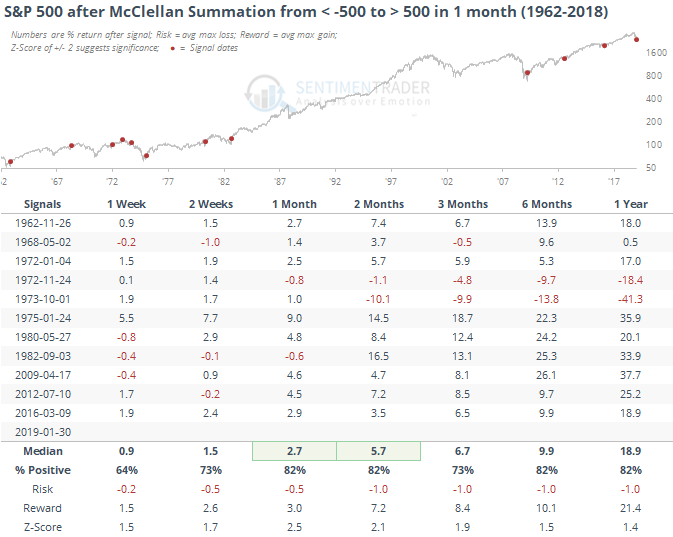

What's most notable about this is how fast it's gone from a very low level of below -1000 to +500 now. Only January 1975 can match it, which was an important low. The tables below show every time it went from -1000 to +500 within three months, and from -500 to +500 within one month. Both are very positive over the medium-term.