Materials, Info Tech New High Surge

Among the major S&P 500 sectors, the two biggest winners so far year-to-date have been materials and information technology. Both have gained upwards of 5% already in 2017.

The push to multi-year highs in those sectors have been accompanied by a surge in their component stocks trading at 4-week, 12-week and 52-week highs. In both sectors, the surge in buying pressure have pushed nearly two-thirds of their component stocks to fresh 4-week highs, half to 12-week highs and a third to 52-week highs.

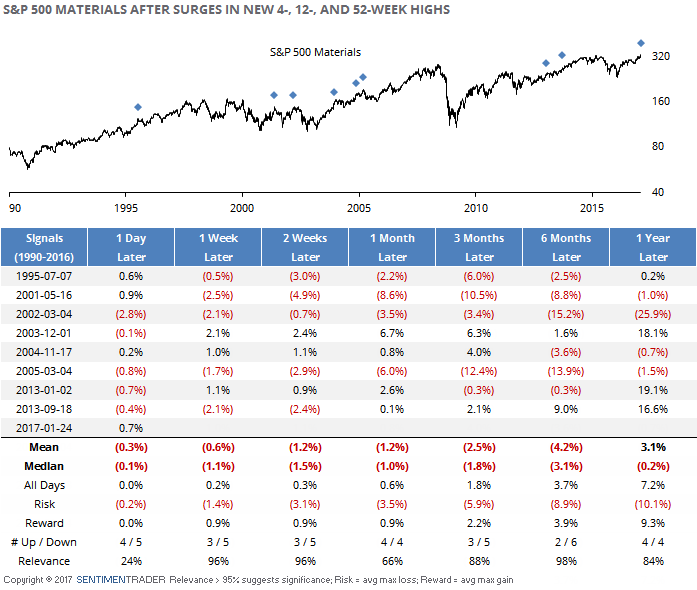

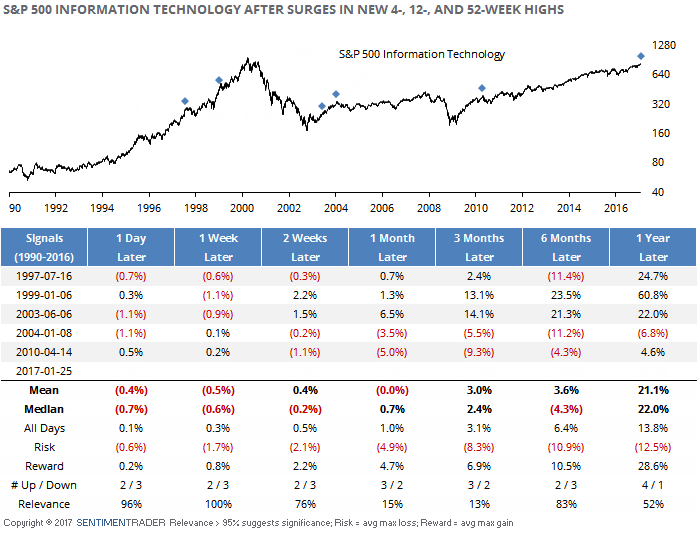

The tables below show the future performance in both the materials and info tech sectors after similar pushes to short-, medium-, and long-term new highs among the stocks that make up the indexes.

For the most part, returns were muted, especially in the shorter-term but in the case of materials, the next six months tended to be a tough slog. For info tech, the best returns were during the final blow-off in 1999-2000, and again in 2003 as the sector saw an initial thrust from the bear market low.