Market Rising Into Memorial Day

As we prepare to recognize the sacrifices of the soldiers who perished protecting our country, stocks have steadily moved higher on summer-type trading volume. Many have already left trading desks to get a head-start on the long weekend.

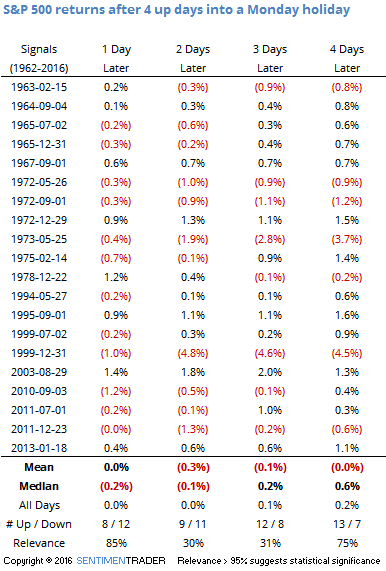

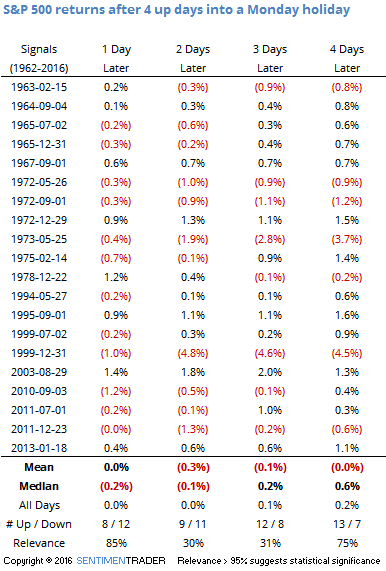

Behavior like this most often leads to a dip once traders return. When the S&P 500 has risen 4 days in a row heading into a Monday holiday, the day after the holiday led to 8 winners out of 20 instances. Only 3 of those were prior to Memorial Day. The one from 1994 led to gains during the week, but then a failure in the week(s) after that.

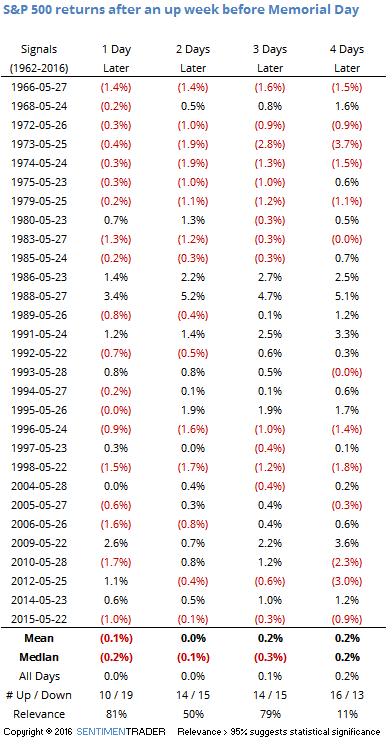

If we focus specifically on Memorial Day, there were 29 times the S&P rose by any amount the week prior to the holiday. Again, there tended to be some give-back in the days immediately after the holiday.

These aren't big edges, but it confirms the typical pattern of post-holiday weakness and it doesn't seem to be any different when it occurs at Memorial Day.

Thank you to those who have served, or continue to serve, in all capacities protecting our great nation.