Market Breadth Composite Rank Update

The S&P 500 Index closed at a new all-time high on 8/3/21. Whenever an Index registers a new high, I always like to assess the market's internal condition to see if the troops are participating.

Let's review how the new all-time high compares to history as measured by a market breadth composite.

MARKET BREADTH COMPOSITE COMPONENTS

- Percentage of issues above the 10-day moving average

- Percentage of issues above the 50-day moving average

- Percentage of issues above the 200-day moving average

- Percentage Spread Between 21-Day Highs and Lows

- Percentage Spread Between 63-Day Highs and Lows

- Percentage Spread Between 252-Day Highs and Lows

The individual component values are summed and divided by six to arrive at a single composite value. Composite values can turn negative during corrections and bear markets as new lows overwhelm new highs in the spread calculation.

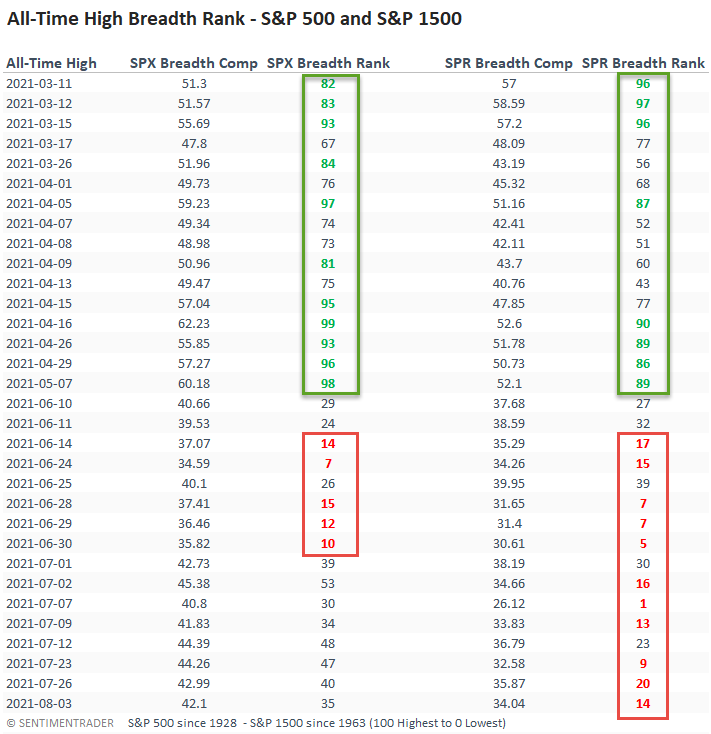

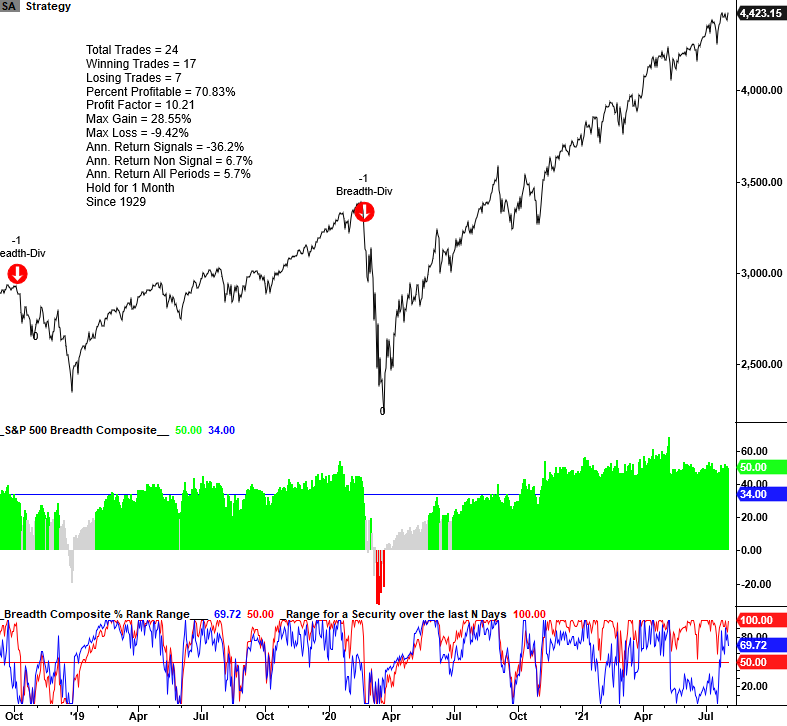

MARKET BREADTH COMPOSITE STUDY

I first identified every single all-time closing high in the S&P 500 Index since 1928. According to my calculation, there are 1,317 instances. I then ranked each breadth composite value on the day of the all-time closing high. Rankings range from 100 (strongest) to 0 (weakest). By ranking each all-time high, I can now make an apples-to-apple comparison throughout history.

I conducted the same study for the S&P 1500 with data starting in 1963.

MARKET BREADTH COMPOSITE TABLE

Since my last update on 6/15/21, the S&P 500 has recorded 13 additional new all-time highs, with the most recent one occurring on Tuesday, 8/3/21. After a string of less than desirable rankings in June, market breadth for the S&P 500 has improved. However, it's not as strong as the data between March and May. Unfortunately, the same cannot be said for the S&P 1500 rankings, as participation remains weak. While short-duration components in the S&P 1500 composite have been soft for some time, we are now seeing some long-duration indicators retreat off the best levels. The percentage of members above the 200-day moving average is one example. I place a lot of weight on the number of 252-day lows in a bull market, and fortunately, they remain nonexistent.

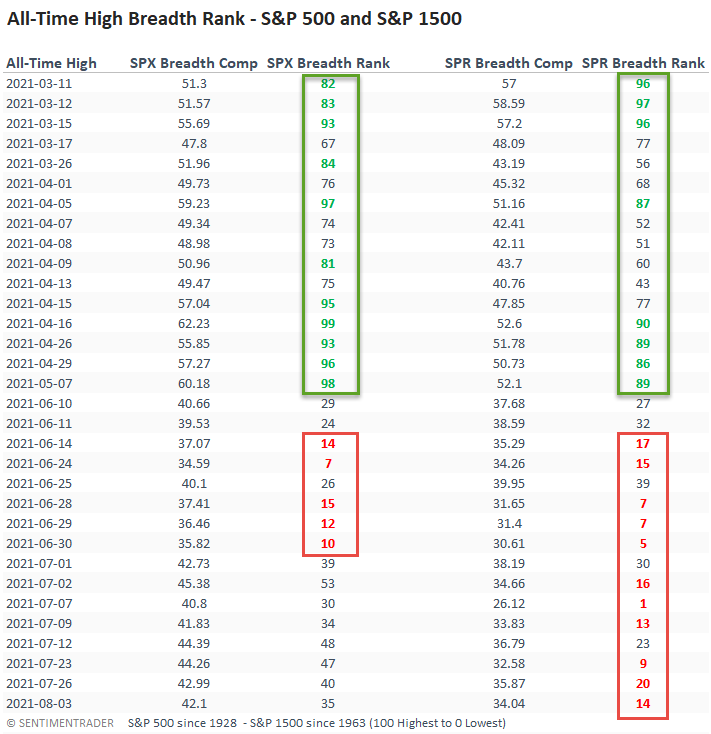

HISTORICAL PERSPECTIVE

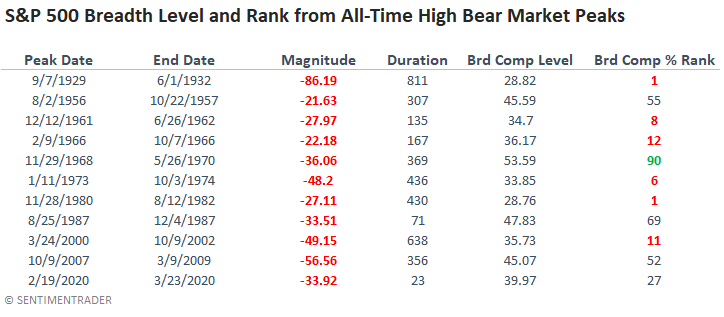

BREADTH COMPOSITE MODEL FOR DIVERGENCE SIGNALS

Suppose we switch our breadth composite to the long-duration model that we use to identify breadth divergences. In that case, we see a significantly different story. Breadth remains firm as the percentage of members above the 200-day average is healthy, and new 252-day lows are nonexistent.

If you were wondering, the blue line in the S&P 500 breadth composite indicator is the trigger level. For a signal to fire, the composite value must be below 34 for an alert.

For more detail on the breadth divergence model, please click here.

Long-term measures of market breadth continue to remain healthy. Therefore, we must respect the trend and stand firm with a constructive outlook on the market.