Market Breadth Composite Rank Update

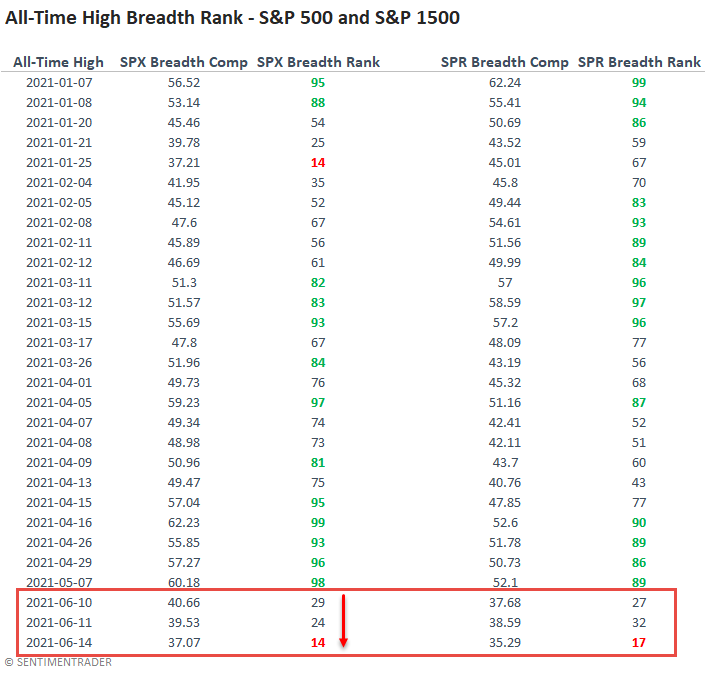

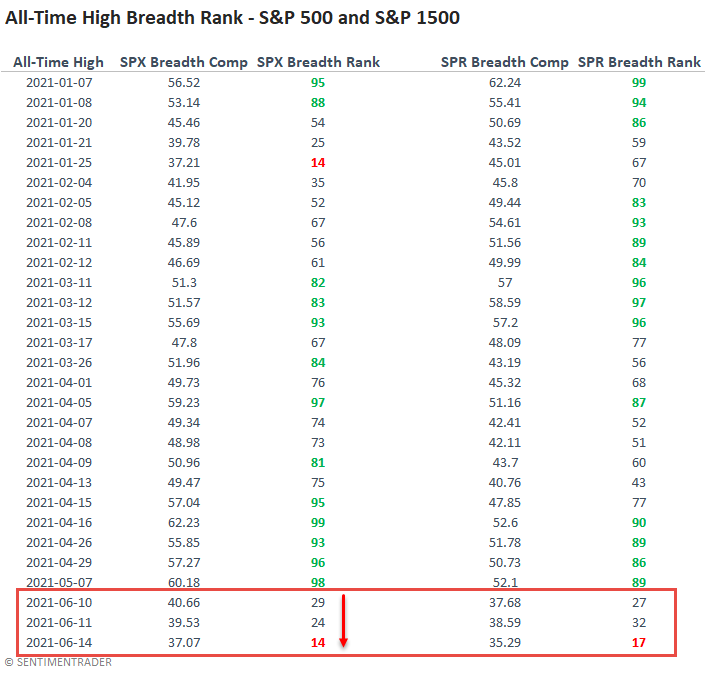

The S&P 500 Index closed at a new all-time high on 6/11/21 and 6/14/21. Whenever an Index registers a new high, I always like to assess the market's internal condition to see if the troops are participating.

Let's review how the new all-time highs compare to history as measured by a market breadth composite.

MARKET BREADTH COMPOSITE COMPONENTS

- Percentage of issues above the 10-day moving average

- Percentage of issues above the 50-day moving average

- Percentage of issues above the 200-day moving average

- Percentage Spread Between 21-Day Highs and Lows

- Percentage Spread Between 63-Day Highs and Lows

- Percentage Spread Between 252-Day Highs and Lows

The individual component values are summed and divided by six to arrive at a single composite value. Composite values can turn negative during corrections and bear markets as new lows overwhelm new highs in the spread calculation.

MARKET BREADTH COMPOSITE STUDY

I first identified every single all-time closing high in the S&P 500 Index since 1928. According to my calculation, there are 1,304 instances. I then ranked each breadth composite value on the day of the all-time closing high. Rankings range from 100 (strongest) to 0 (weakest). By ranking each all-time high, I can now make an apples-to-apple comparison throughout history.

I conducted the same study for the S&P 1500 with data starting in 1963.

MARKET BREADTH COMPOSITE TABLE

With two more record closing highs in the S&P 500 since my last update on 6/10/21, the internal condition of the market has continued to deteriorate. The short-duration components are driving the weak conditions in the composite as the long-duration indicators remain healthy. In the absence of other alarm bells, I will continue to give the market the benefit of the doubt.

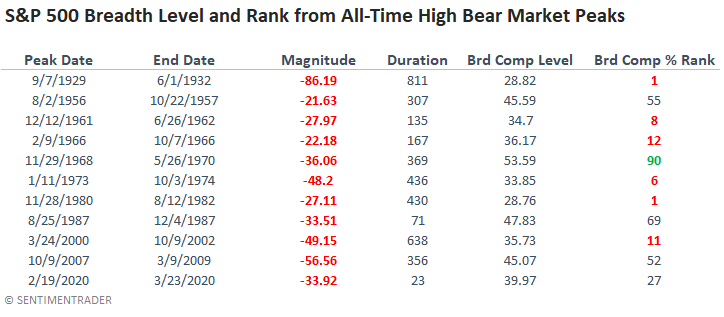

HISTORICAL PERSPECTIVE