Margin debt has fallen to a multi-year low

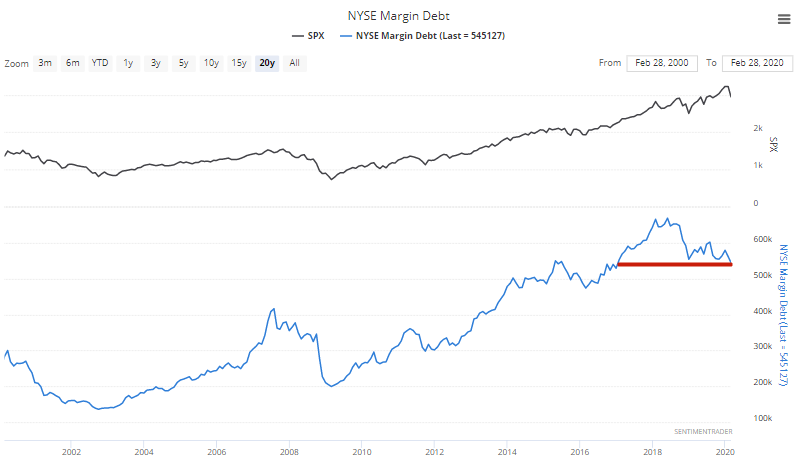

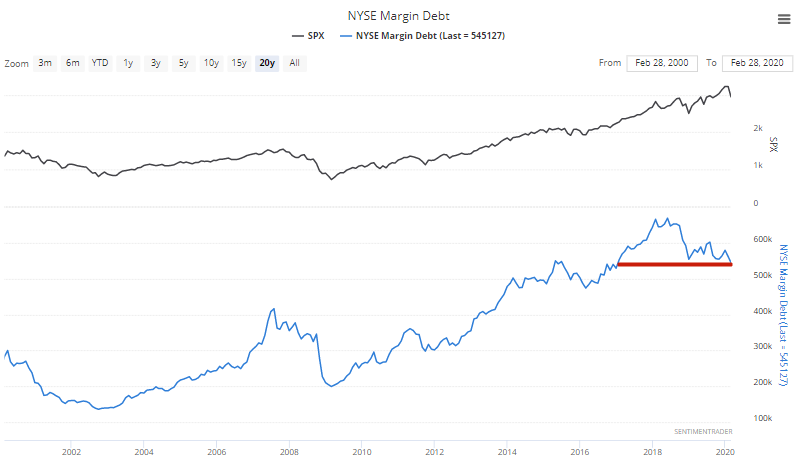

Margin debt tends to move inline with the S&P 500. S&P goes up, margin debt increases. S&P goes down, margin debt decreases. 2019 was abnormal in the sense that while stocks soared, margin debt barely increased. This was clearly the right move in retrospect since ramping up stock purchases with leverage would have been disastrous heading into the stock market's recent crash.

Margin debt fell to a multi-year low along with the stock market:

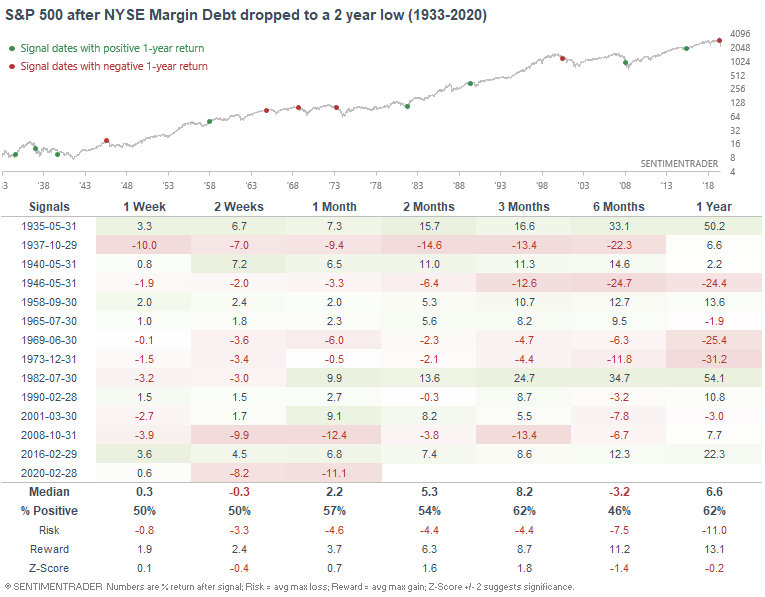

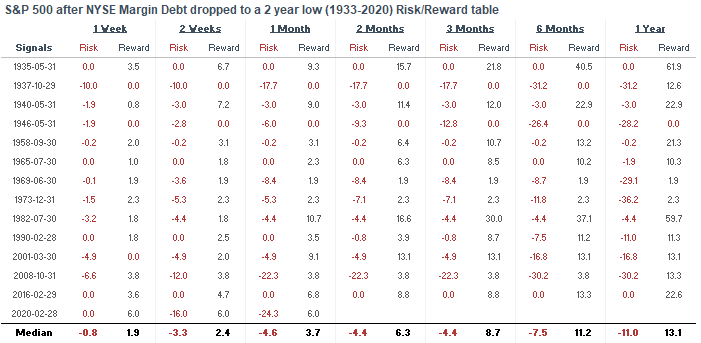

When NYSE Margin Debt dropped to a 2 year low in the past, the S&P's returns over the next 6-12 months were extremely mixed. Some historical cases were extremely bearish, since this often happened within the context of a bear market and economic recession (see 2008, 2001, 1990, 1982, 1973, etc).

I'm not very confident in having a long term outlook right now, particularly a fundamental outlook. Normal fundamental leading indicators weren't very useful on the way down since these indicators do not account for a once in a hundred year pandemic. The outcome of this recession really boils down to a battle between pandemic (which you can't predict) vs. government intervention. Next month we'll see a lot of extreme economic data being released. Headlines and social media will be filled with "IT'S THE CRAZIEST SINCE XYZ YEAR!" hype. Comparisons between today vs. 1929, 2008, 1987, or other terrible years will go flying. But personally, I will shy away from making historical comparisons using fundamental data since this recession is not quite the same as other historical recessions.

So instead of predicting 6-12 months into the future, I'd rather focus on the next 2-3 months. Most evidence still supports a bullish case over the next 2-3 months right now.