Major Reversal; Jump In New Lows; Dumb Money Purge

After the big reversal on Tuesday, futures were indicated to gap lower again on Wednesday. In the history of the S&P 500 futures, that had led to rebounds over the next several sessions every time.

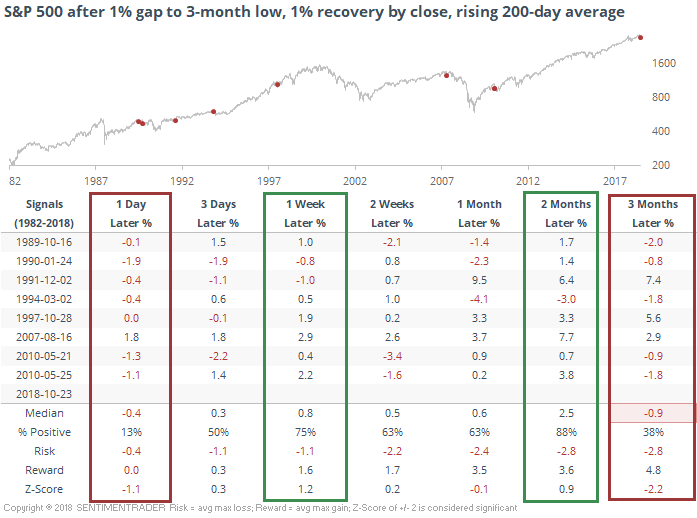

As it stands now, futures have recovered, which dampens the short-term outlook quite a bit. Regardless of what the futures are doing this morning, yesterday's rebound from the large negative open stands as one of the largest during an uptrend, at least when defining "uptrend" as a rising 200-day average, which it still is.

There wasn't usually a lot of very short-term follow-through, but there was from 1-8 weeks later. After two months, there was only a single loss. But high volatility like this during an uptrending market hasn't always been a good longer-term sign, and by three months later we can see that there were quite a few losses.

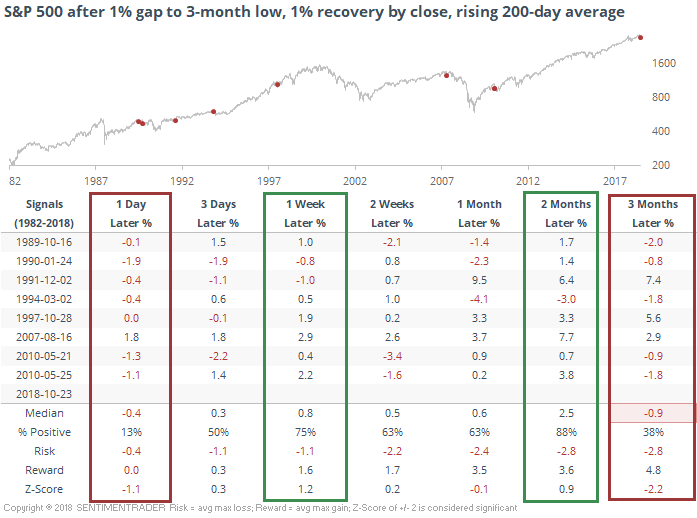

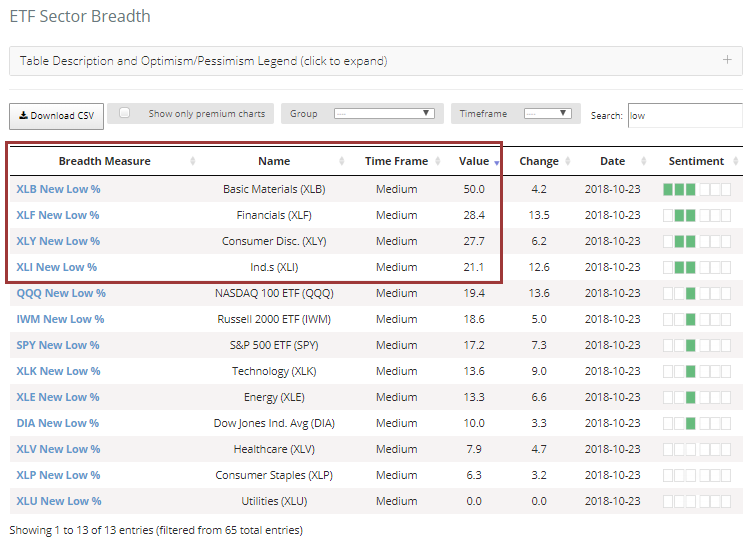

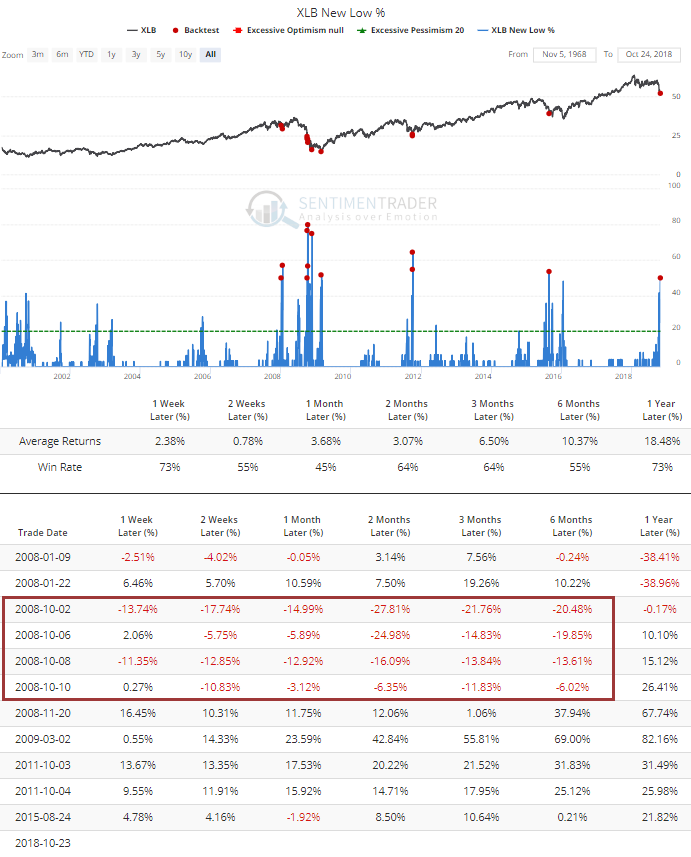

There was also a jump in new 52-week lows on Tuesday, especially focused among a few sectors.

For Basic Materials, it was a really bad day, with half the components in the sector sinking to a new low. Going back to 2000, it has been rare to see this kind of purge. It led to rebounds over the next 2-3 months, except for during the worst of the financial meltdown.

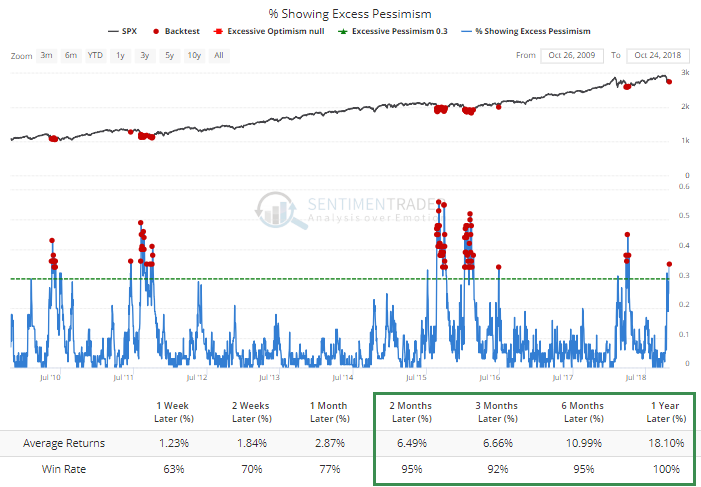

The general malaise led to a jump in our indicators hitting excessive pessimism levels. By the close on Tuesday, more than a third of our core indicators were showing pessimism. Since the 2009 bottom, a reading this high has led to limited downside.

The biggest caveat there is "since the 2009 bottom" - during a bear market, this figure will get much, much higher (like above 50%) before we could conclude there is an overall level of excess pessimism.

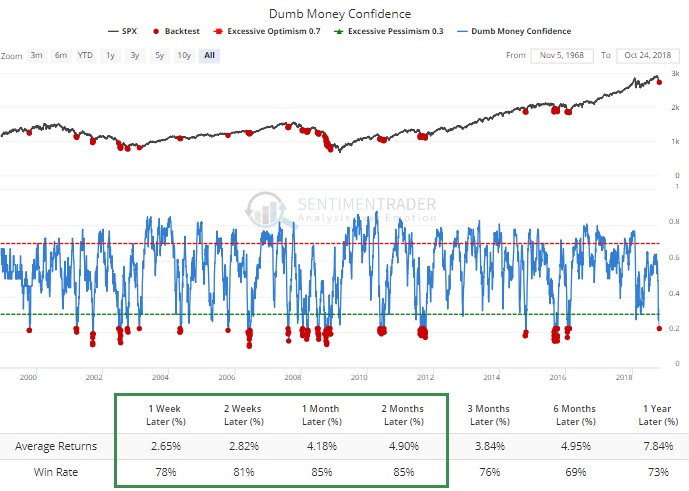

A good sign is that a lot of those indicators reaching extreme pessimism are of the "dumb money" variety, so Dumb Money Confidence has dropped below 23%. We don't often see this during a bull market. Even when we include the bear markets, future returns over the next 1-8 weeks have been very good, and consistently positive.

Tuesday's test of the mini-panic low from earlier this month, and the subsequent reversal, is classic bottoming behavior. In years past, that was a fantastic signal to go long and hold for weeks, at least. I'm less convinced of the merits of classical technical patterns nowadays, though, due to the proliferation of automated trading strategies and the influence of late-day ETF buy/sell pressure. Even so, the setup looks good from the long side in terms of risk/reward over the short- to medium-term, even if we're in the final stages of ultimately rolling over into a bear market.