Lumber's best time of the year and ways to trade it

Key points:

- Lumber tends to be a surprisingly cyclical commodity

- This market is now in the most favorable time of year period

- Lumber futures are a poor trading vehicle, and traders might consider an ETF or even an individual stock as an alternative

The overview

Lumber enjoyed a pair of parabolic price runs from 2020 into early 2022. As parabolic markets invariably do, lumber has collapsed over -70% in price over the past seven months. Few people understand how cyclical lumber price movements are. This is important because lumber has entered this vital commodity's most favorable time of year.

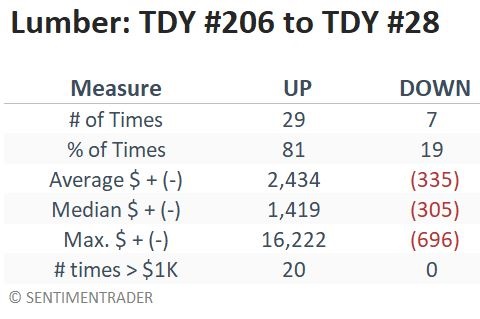

The good news is that lumber futures have shown a gain 81% of the time during this period since 1987. In addition, the average and median gain have dwarfed the average and median loss.

The bad news is there are never any guarantees regarding seasonality. Also, lumber enjoyed its two best seasonal gains in the last two years. With trouble unfolding in the homebuilding sector (due primarily to rising mortgage rates), the likelihood of another outsized gain this time appears unlikely.

The other bad news is that trading in lumber futures is exceedingly thin and not a viable option for many traders. Fortunately, there is an ETF that traders can use as a proxy.

The favorable period has begun

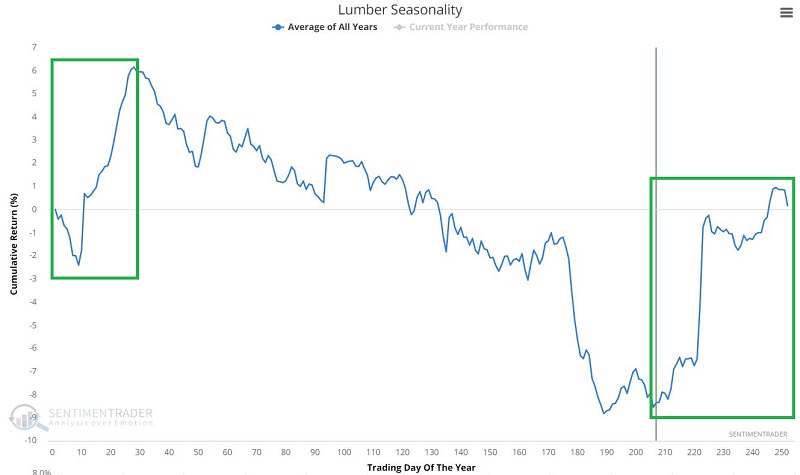

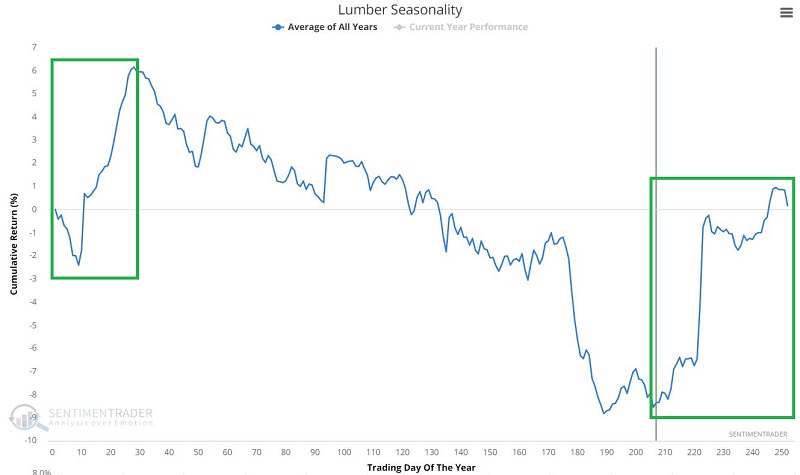

The chart below displays the annual seasonal trend for Lumber futures.

The period we will examine is highlighted in the chart above and extends from the close on Trading Day of Year (TDY) #206 through the close on TDY #28 of next year. For 2022-2023, this period will extend from the close on October 26 through the close on February 10 of next year.

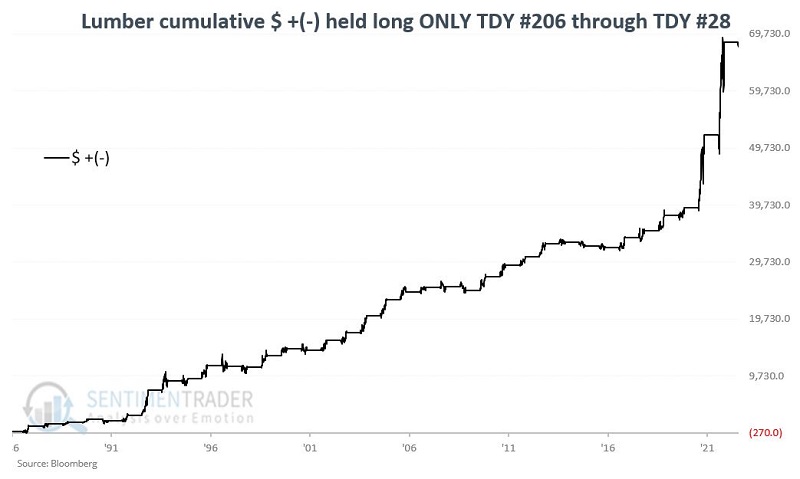

The chart below shows the hypothetical cumulative dollar gain from a long position in lumber futures held only from TDY #206 through TDY #28 every year since 1987.

During these 36 years, lumber rallied 29 times. Its gains during the up years swamped losses during the down years.

An ETF alternative

The numbers above are compelling. That's the good news. The bad news is that lumber futures are thinly traded, highly volatile, and not a good trading vehicle for most traders. In the ETF space, there is no pure play on lumber.

The iShares Global Timber & Forestry ETF (ticker WOOD) correlates roughly 83% with lumber futures. As the name implies, this ETF holds shares of companies in the timber and forestry industry. The largest holding is Weyerhaeuser (WY).

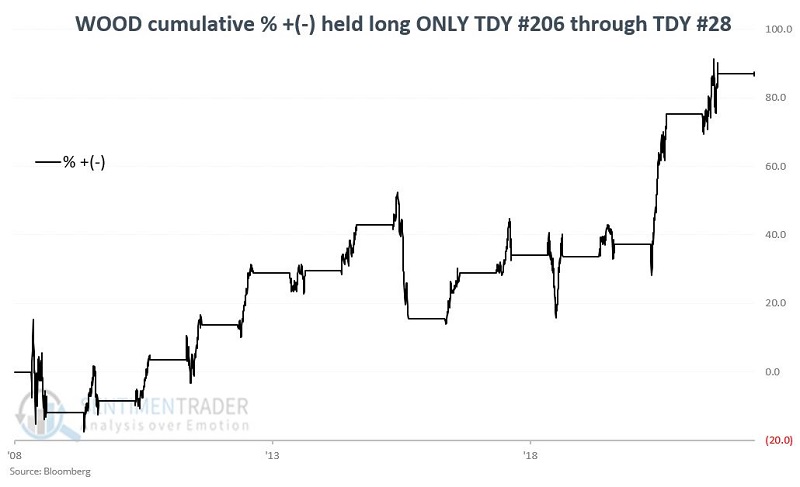

The chart below displays the cumulative percentage return for WOOD held long during the TDY #208 through TDY #28 period since WOOD started trading in 2008.

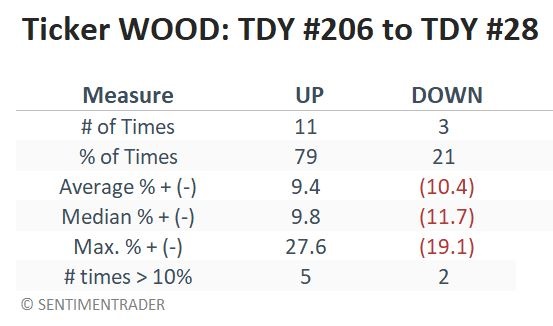

The fund enjoyed a gain during 11 out of 14 years, though losses were quite heavy during the down years.

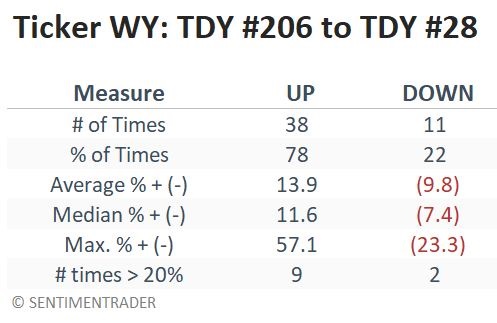

To stretch the example further, let's run the same test using WOOD's largest holding, Weyerhaeuser (WY), going back to 1973. The first chart shows the cumulative percentage return for WY if held during these seasonal windows. The cumulative gain is +3,596%.

The stock rallied during 38 out of 49 years. While the returns during good vs. bad years weren't as skewed as lumber itself, there was still a strong positive bias. The 48-year test using WY shows roughly the same win rate as WOOD and (nearly) as lumber itself. It also shows big winners dwarfing big losers.

The chart below displays the cumulative percentage return for WY only during the rest of the calendar year (i.e., TDY #28 through TDY #208) during the same test period. The cumulative loss is -41%. The contrast between this chart and the one above illustrates lumber and industry-related securities' persistent and repetitive cyclical nature.

Note that WOOD averages roughly 14,000 shares traded daily, and WY averages 3.9 million shares traded daily.

What the research tells us…

As stated initially, few traders know the highly cyclical nature of lumber and lumber-related securities price movement. History suggests a higher probability of success than during the rest of the year by focusing on the long side from late October to early February.

Traders must also consider the relatively low trading volume in this commodity's futures and ETF areas and make a reasonable decision regarding what asset to trade.