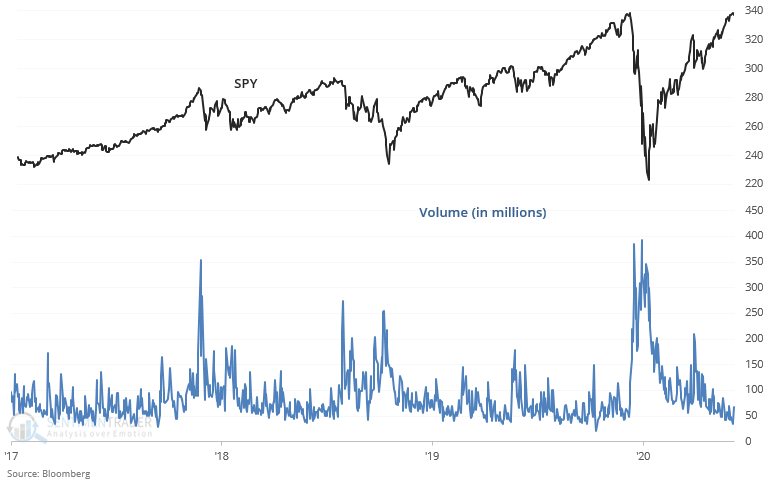

Low volume

Summer doldrums have caused the U.S. stock market's volume to drop. Standard technical analysis teaches us that rallies that occur on low volume are bearish because there's a lack of confirmation. Data and facts suggest that this is not always the case:

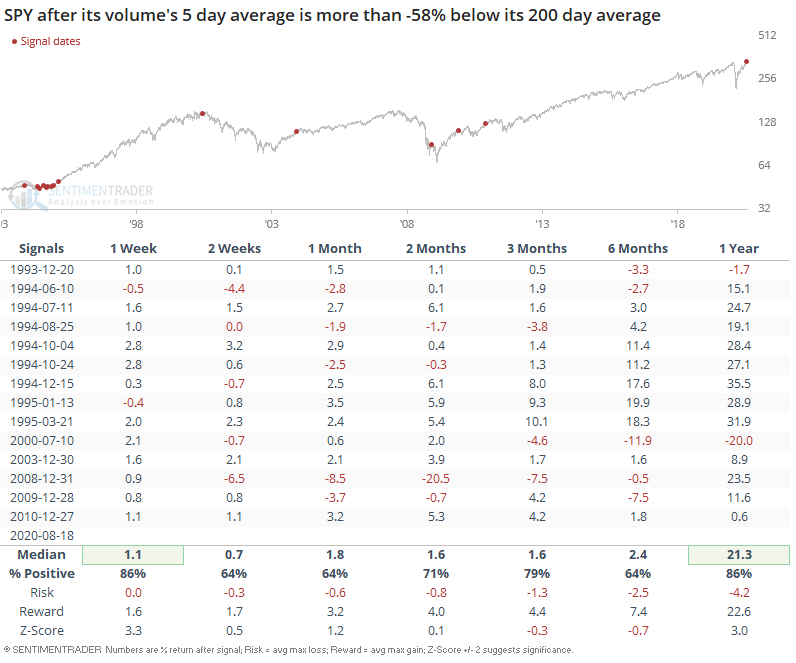

SPY volume's 5 day average is now more than -58% below its 200 day average. When this happened in the past, it wasn't a clear bearish sign for the U.S. stock market on any time frame. There were a few notable bearish examples (e.g. July 2000 and December 2008), but outside of that this was not a consistently bearish factor for the U.S. stock market.