Low Vol (Again) As Tech Love Rises

Stocks are struggling to hold modest gains. Ranges are contracting and volume is sagging. Same as yesterday - historically, this has been a negative pattern for future short-term returns, but it's hard to know just how much we can rely on these given this:

Low Vol, Again

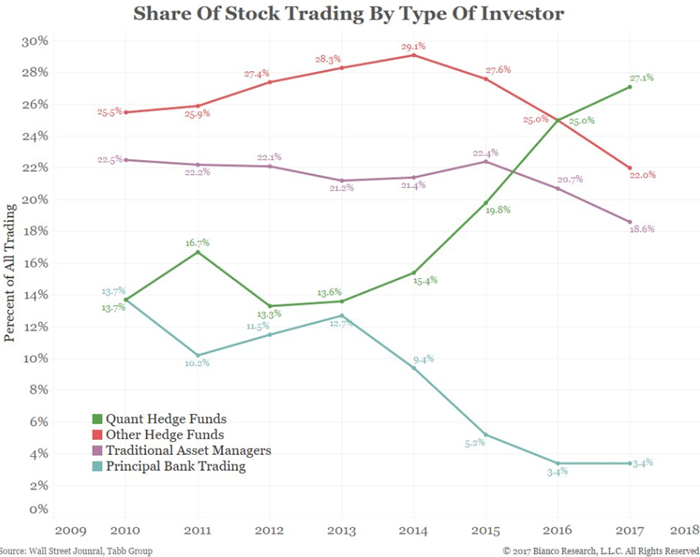

Bloomberg is out with an article similar to the one posted in the WSJ the other day about the rising equity exposure among risk parity types of funds. Among so-called low volatility funds, exposure is at an all-time high.

Like with the others, I overlaid the S&P 500 against the funds' stock exposure. Not a perfect correlation, and there were only 3 occurrences, but other than in late 2013/early 2014 when so many things failed other than blind buying, stocks got a little rocky.

Tech Love

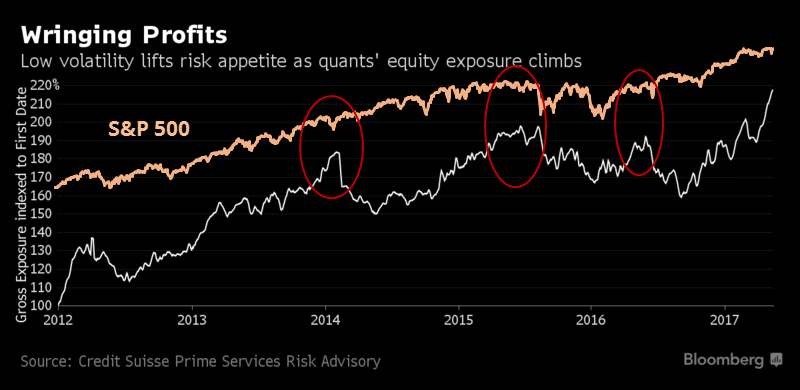

The folks who trade the Rydex family of mutual funds have rushed into the Technology fund, pushing assets above $100 million for only the 2nd time since the bubble burst.

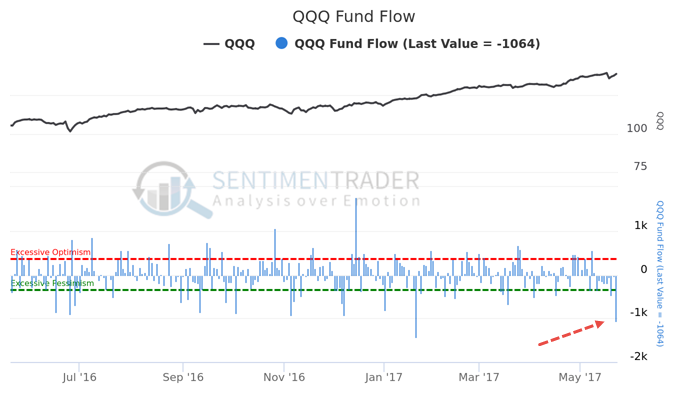

Interestingly, assets in the main Nasdaq 100 ETF, QQQ, dropped heavily on Monday. The fund lost over $1 billion in assets, on a day the fund rallied.

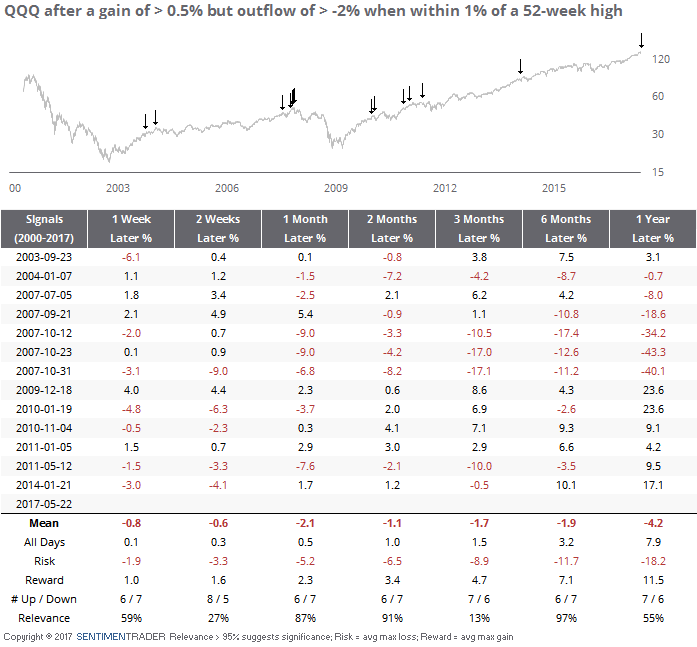

This is highly odd, especially when it's been near a high. The table below shows returns in QQQ going forward after it rallied at least 0.5% on the day but the fund leaked at least 2% in assets, and it was within 1% of a high.

We can see that there was some struggles over the next 1-2 months. QQQ suffered a bad average return and risk/reward ratio after these signals. About the only time it managed to rally almost uninterrupted was in 2011. The others all showed losses or a tiny gain over the short- to medium-term.