Low Asset Volatility As Gold Nears Correction

This is an abridged version of our Daily Report.

Not much movement

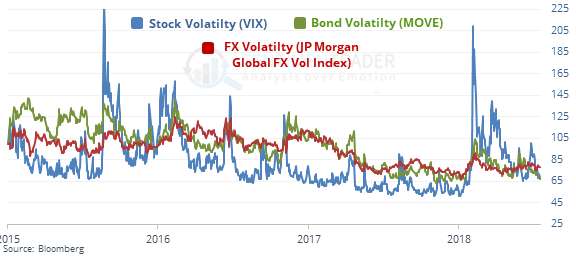

Volatility in stocks, bonds, and currencies is among the lowest in 25 years.

All three have declined over the past month and collapsed since February. The few other similar periods led to gains in stocks, gold, while the dollar declined.

A yellow-tinted correction

Gold is close to tipping into a correction for the first time since late 2016, as another small down day will push it 10% below its peak from the past six months. Other corrections preceded more short-term weakness, medium-term strength.

Java jive

Coffee can’t hold a rally, and investors have given up. The 10-day average of the Optimism Index has dropped below 17 for only the 2nd time in 5 years. Since 1991, there have been 74 days when it was this low.

Low flow

According to the ICI, investors have withdrawn funds from non-U.S. ETFs for 8 straight weeks.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |