Lopsided Volume Swings As MLPs Suffer Pessimism

This is an abridged version of our Daily Report.

Everybody out, then in, then out again

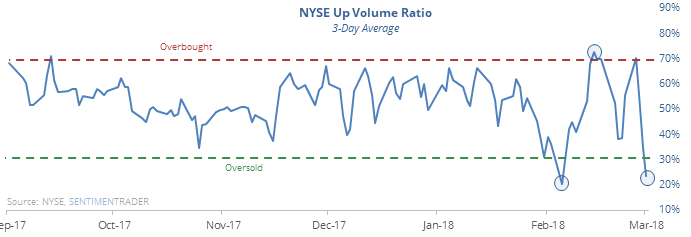

During the past month, volume has been gyrating wildly between losing, winning, then losing securities. A 3-day average of the Up Volume Ratio keeps swinging from one extreme to the other.

During uptrending markets, this has happened only twice in 20 years, and longer-term was a mediocre sign.

A triple hit

The S&P 500 has lost more than 1% during each of the last 3 sessions, while still maintaining its long-term trend. Other times it suffered such selling, it rebounded over the next two months every time but once.

MLPs? OMG

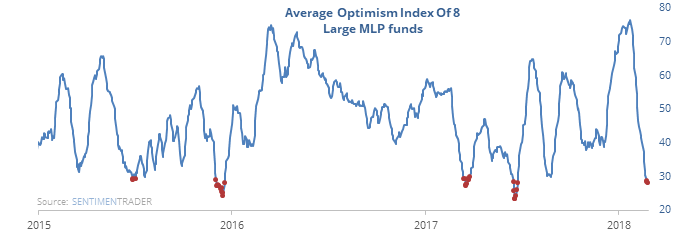

Master Limited Partnerships have seen optimism drop to an extremely low level over the past month.

While history on the funds is limited, dating to 2010, other periods of similar low optimism led to shorter-term rebounds. Most of them ultimately led to a lower low over the next few months, however.

Grain gains

By December it seemed like we’d reached a point of maximum pain in commodities. They’ve tried to recover, with wheat rising 4% the past 2 days.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.