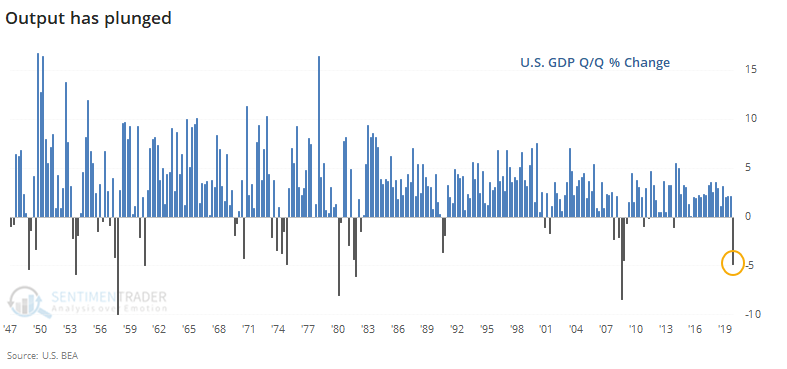

Looking backward, economic data plunge

The latest economic data sound terrible, and they have been. As the Wall Street Journal notes:

"Gross domestic product, the broadest measure of goods and services produced across the economy, contracted at a seasonally and inflation-adjusted annual rate of 4.8% in the first three months, the Commerce Department said Wednesday. The decline marks the beginning of a near-certain recession, economists say, and is the biggest drop in quarterly economic output since the fourth quarter of 2008."

Not only is this the biggest contraction since 2008, but it's also one of the largest on record, going back to the 1940s.

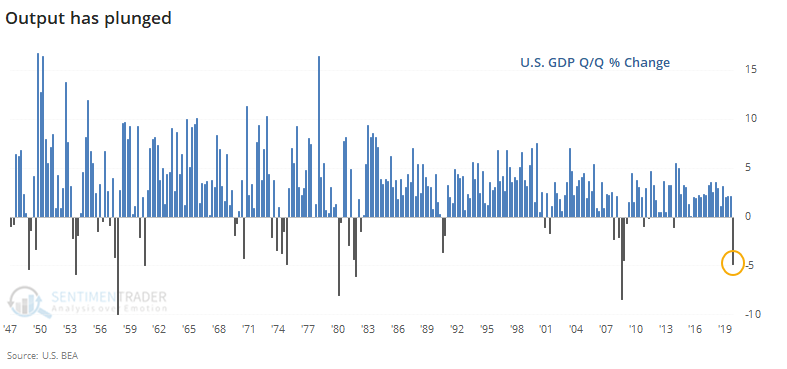

We've seen repeatedly over the years that the economy is not the stock market. More often than not, bad economic data leads to good returns in stocks, and vice-versa.

Below, we can see returns in the S&P 500 after GDP plunges 4% or more. The dates are moved forward one month to account for the lag in release times.

By the time the economy reflected such widespread damage, forward-looking investors had already priced it in. Over the next 3-12 months, stocks showed excellent returns, with extremely low risk relative to reward.

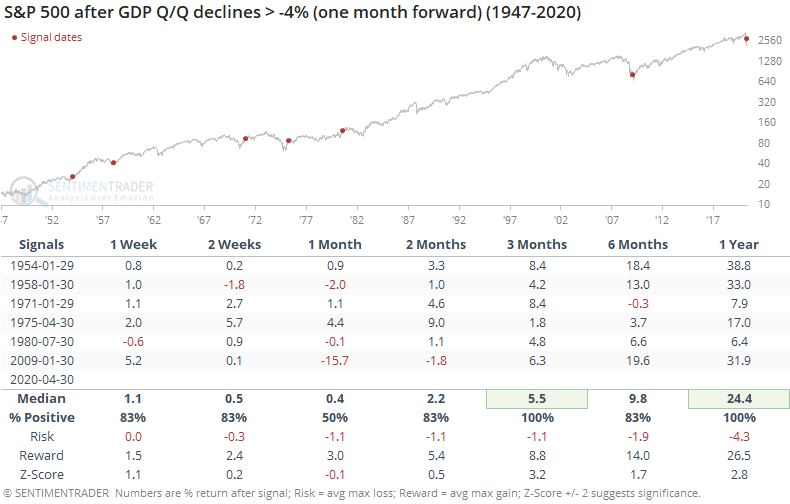

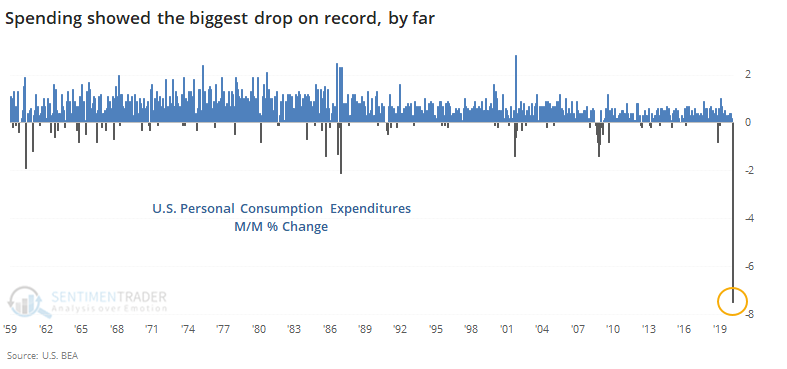

As both a cause and effect, the economic slowdown is being reflected in personal spending habits. Consumers pulled back on spending of almost all types, outside of necessities. The U.S. economy has never seen anything like this before.

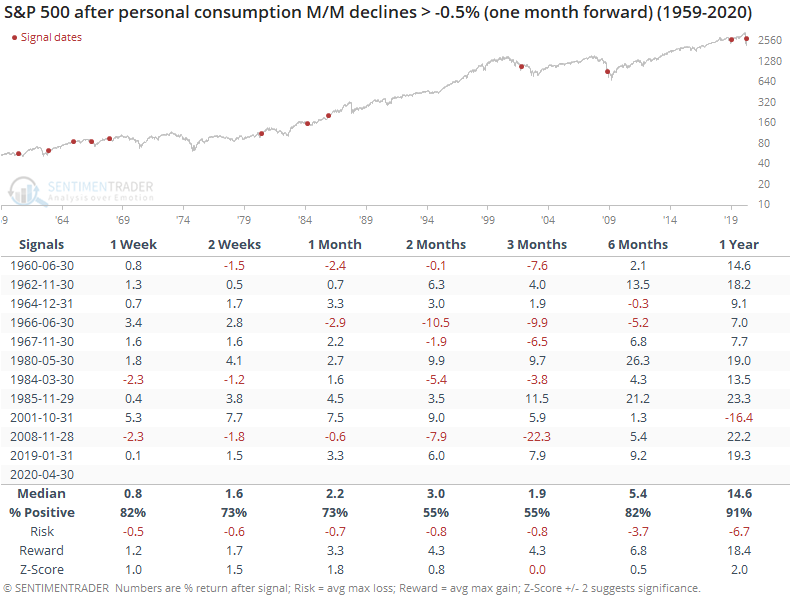

A monthly drop of even 0.5% is severe, at least since 1959. Below, we can see every time it dropped by that much or more, using only the first reading in a cluster and advancing it by one month to account for the delay in release time.

These spending stops led to more of a mixed result over the medium-term, but a year later there was only a single loss, and the overall risk/reward over the long-term was decent.

With anything related to stock movements or economic data during this cycle, there should be a blanket caveat that we've never seen anything quite like this in recorded human history, or at least since the popularization of auction markets. But if we can make the very general assumption that investors behave more or less consistently to terrible economic data, then these readings should be a long-term positive.