Looking at the last week of a big quarter

We're nearing the last week of the quarter, and what a quarter it has been. The S&P 500 is on track for a nearly 20% gain, ranking in the top 10 out of 369 quarters since 1928.

We've looked at the concept of window dressing in the past, with inconclusive results. This is the theory that since stocks have done so well during the quarter, funds have an incentive to add to their stock positions before quarter-end, in order to show investors that they're invested.

Like most things market-related, it sounds good in theory, but empirical evidence is almost nonexistent. It might occur in some individual stocks, but for the market as a whole, it's mostly a non-factor.

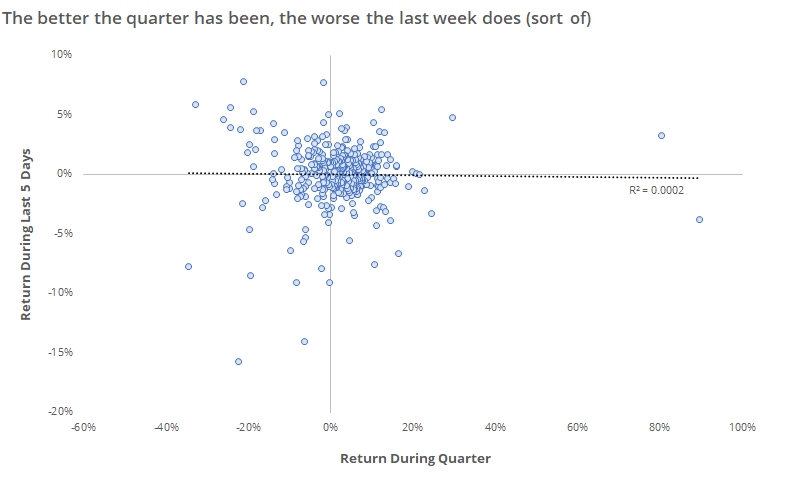

The chart below shows every quarter since 1928. The x-axis is the S&P's return for the quarter, up to the last week of the quarter. The y-axis is the return during that last week of the quarter.

The correlation between them is essentially zero. It's slightly negative but not enough to consider it any kind of edge.

That includes all quarters, even the meek ones. If we restrict our look to the most exceptional quarters - and this is surely one of them - then we can see a bit more of a pattern.

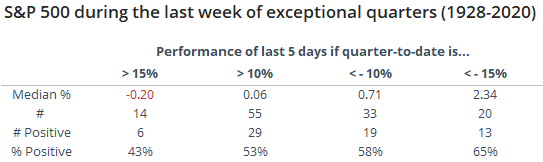

If the S&P had rallied 15% or more up to the last week of a quarter, then that last week returned a median -0.2% and was positive 43% of the time. That's fairly week given an overall positive bias during the study period. Theoretically, if investors are rotating out of stocks near the end of good quarters, then they should be rotating into bonds. And there was some evidence of that - the Bloomberg Barclays U.S. Aggregate Bond Index averaged a return of 0.4% during those weeks and was higher 81% of the time since 1989.

If the S&P had dropped 15% or more during a quarter, then there was a pretty strong bullish bias during the last week, returning a whopping 2.3% on average. That's an enormous return for only a week's worth of work. The Bloomberg bond index averaged a return of 0.2% during these weeks and was higher 64% of the time.

Given the strong rally this quarter, and the (small) inverse correlation between quarter-to-date and last-week returns, it would suggest a minor negative short-term bias for the coming week, potentially as large funds rebalance their asset allocation.