Long-term momentum continues to roll along

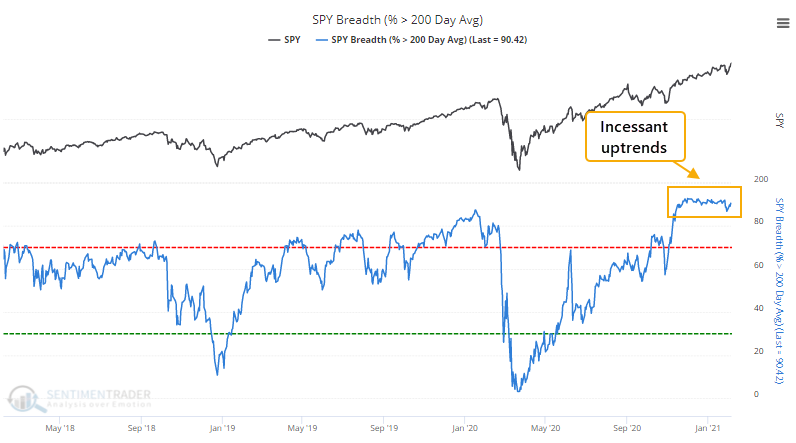

Last November, we finally saw an overwhelming percentage of stocks within the S&P 500 that were able to climb above their 200-day moving averages, after almost all of them had been below. The few other times it cycled from an extremely low percentage to an extremely high one, it indicated long-term recoveries ahead.

So far, so good. And it still hasn't stopped.

A "normal" market sees some oscillations back and forth in the number of stocks in uptrends, but not this one. The percentage of stocks above their long-term averages has been stuck at a high level since that note three months ago.

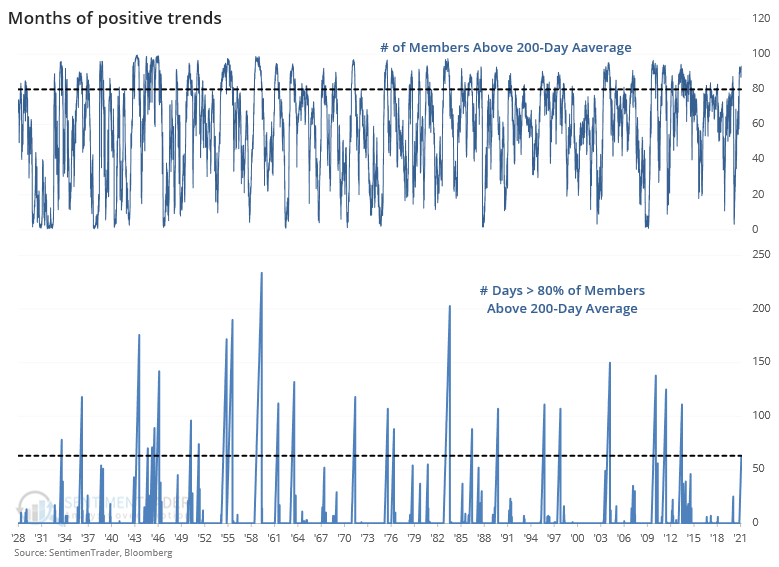

Going back to 1928, this is one of the longest streaks that so many stocks have traded above their 200-day moving averages. While it has continued for nearly 3 times as long, this is the most persistent streak in 7 years.

As we've seen in past comments, especially last April/May and October/November, this kind of momentum has almost always continued to carry forward.

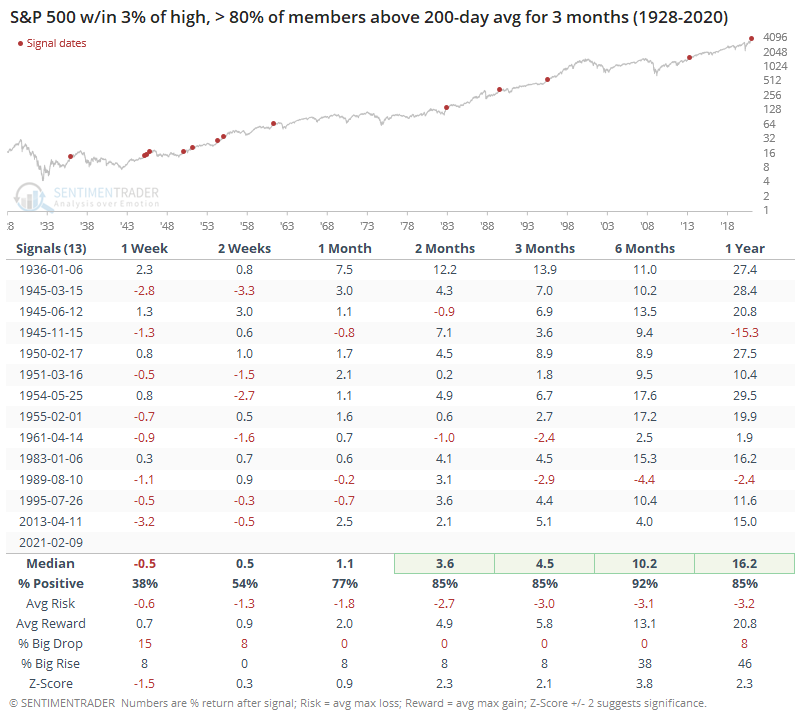

Sometimes, when we see momentum like this, it's only because stocks are climbing out of prolonged declines. It's rarer to see it when stocks are at or near a multi-year high. That didn't dent the results too much, except in the shorter-term. The next 6 months were almost perfect.

We're seeing a market that's recovering from the fastest bear market (and fastest recovery) ever, so there is a mix of readings that we normally see when stocks are well below their highs, as well as readings normally seen after long bull markets.

This is the exact same thing we discussed a few weeks ago. The biggest difference is that there have been more signs of internal cracks now than there were then. They're mostly shorter-term, so the risk/reward over a short- to medium-term time frame still seems skewed to the "risk" side. It's harder to be negative on the longer-term when considering metrics like the above, even with an environment that can be ranked among the most speculative in history.