Long-Term Bears; Russell 2000 Bear Market; S&P Drops On Friday/Monday; Spike In 52-Week Lows

This is an abridged version of our Daily Report.

Long-term bears

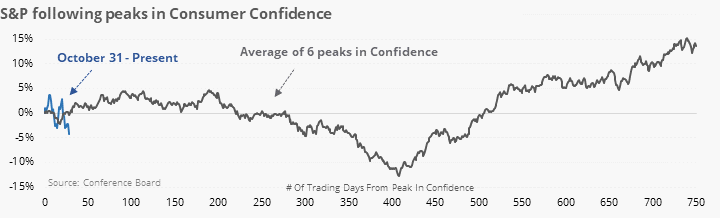

Building on what we looked at last week, we take a longer-term, multi-year look at prior bear markets, including their median loss and standard deviations. We also look at returns following major peaks in Consumer Confidence.

The conclusion doesn’t really change. While it’s sexy to hype up a repeat of 2008, that was a once-in-multiple-generation worldwide financial crisis. The vast majority of bear markets are much less dramatic, and the vast majority of damage had typically already been done by now. There are outliers to the downside – that red line is scary – but there are also outliers to the upside.

A not-so-leading index

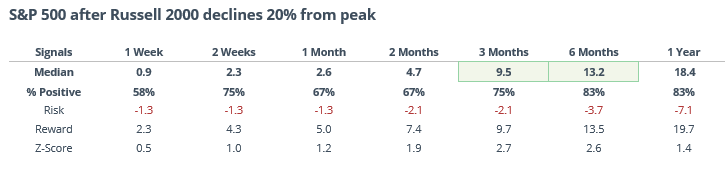

The Russell 2000 has dropped 20% from its peak. No matter what it’s called, it’s a big decline, but it typically didn’t lead to consistent losses going forward for the Russell. For the S&P, those big declines in small-caps led to significantly positive returns over the medium-term.

Bad bookend

The S&P lost more than 1.5% on both Friday and Monday, leading to a new one-year low. Such heavy losses bookending a weekend have occurred near some of market’s major turning points.

And more than 25% of NYSE and Nasdaq securities dropped to a 52-week low on Monday. Almost all of the losses occurred in 2008. In fact, all of them did over the next six months. If we just exclude 2008 from the results and make no other changes, then we get the following. It suggests that outside of a worldwide financial crisis, such a huge spike in wholesale selling pressure led to excellent returns going forward.

New feature

Eric has added the ability to shade charts with bear markets and recessions. There is a button under every chart to do so. Also, it’s now a choice in the Backtest Engine under Market Environment. If you choose to do so, you can restrict any test to ONLY include bull or bear markets, recessions or non-recessions. This is a great tool to give you more information on how indicators perform during different environments.