Liquidity premium

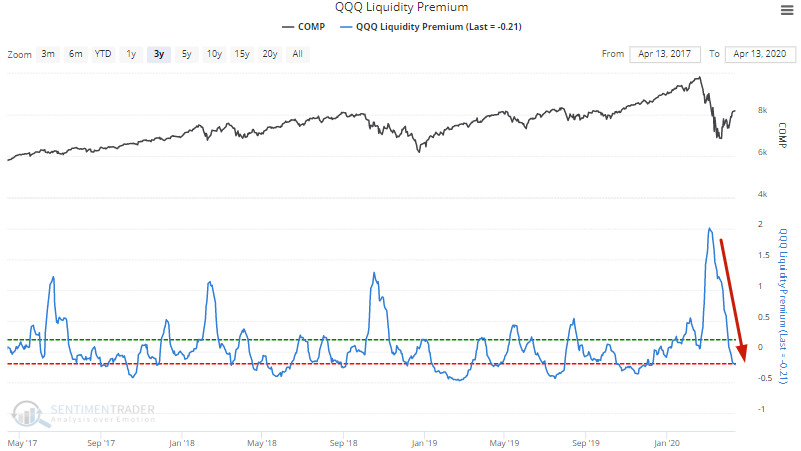

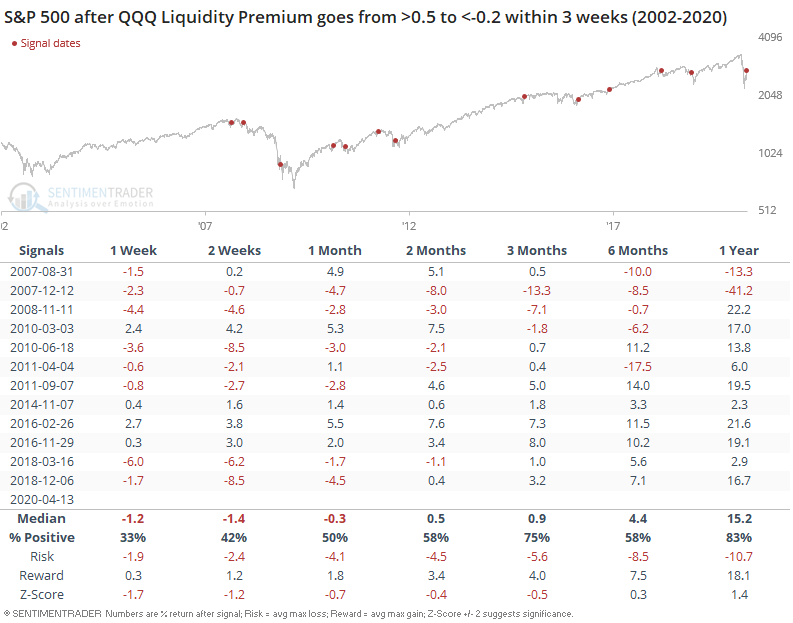

Investors and traders' desire for liquidity surged as the stock market crashed. This pushed many of them to abandon their individual stock holdings and rush into more liquid ETFs. But now that the stock market is rebounding, investors are once again chasing individual stocks. This is particularly true for tech, which isn't surprising given that some tech names (e.g. Netflix, Amazon) have done well under the current lockdown environment. Our QQQ Liquidity Premium has fallen below -0.2, our threshold for excessive optimism:

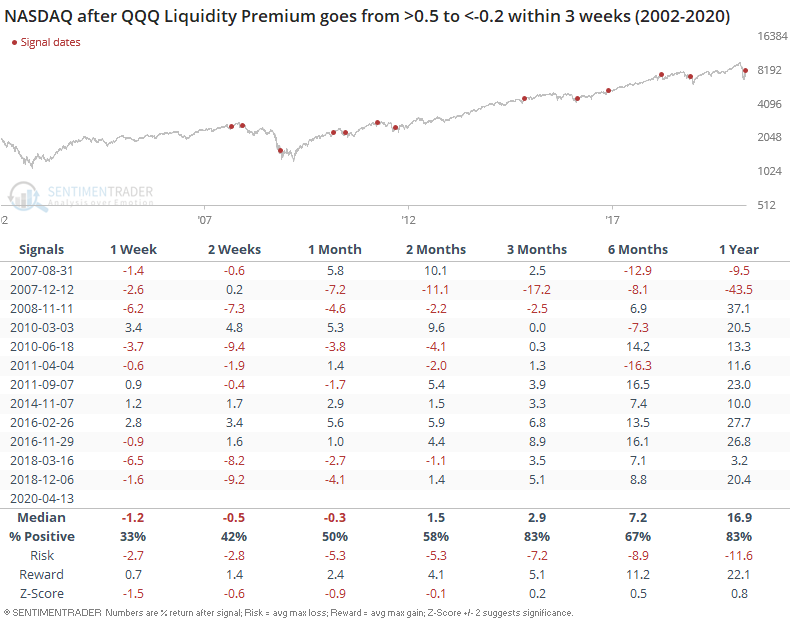

When QQQ Liquidity Premium cycled from excessive pessimism (>0.5) to excessive optimism (<-0.2) within 3 weeks, the NASDAQ Composite's returns over the next week were bearish:

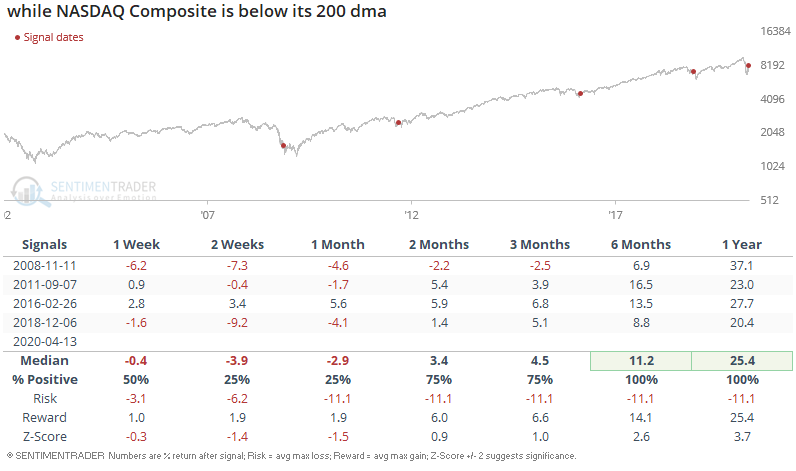

Many of these historical cases occurred when the NASDAQ Composite was closer to all-time highs. So perhaps this isn't bearish? The following table isolates for cases when the NASDAQ was below its 200 dma:

Sample size is small, but this still isn't a good sign for the NASDAQ Composite in the short term. Here's what the S&P 500 did next:

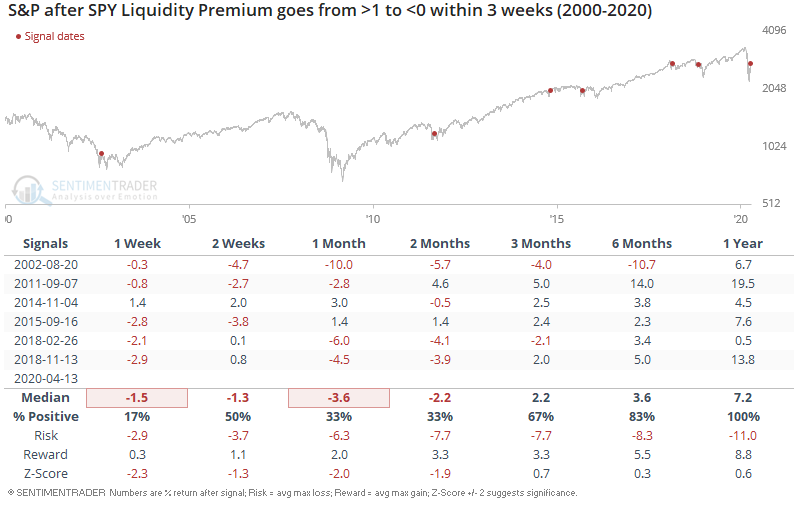

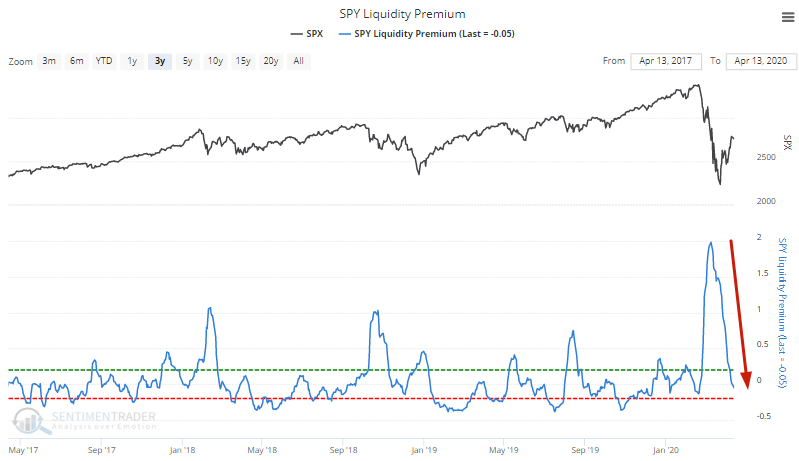

SPY Liquidity Premium has also fallen from a high of 2 to less than 0.

When SPY Liquidity Premium cycled from >1 to <0 within 3 weeks, the S&P 500's returns over the next week were decidedly bearish: