Leveraged ETFs Skyrocket As Junk Funds Ebb

This is an abridged version of our Daily Report.

Never more leveraged

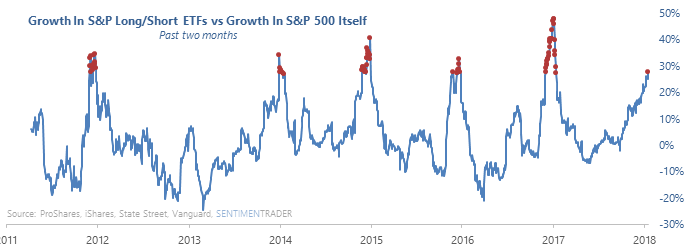

Assets in leveraged long ETFs are going parabolic while leveraged inverse funds dwindle. There is now almost $4 in long funds for every $1 in inverse funds, a record exposure level.

Relative to the gains in the S&P 500, those ETFs are also showing “irrational” growth.

Junk funds see exodus

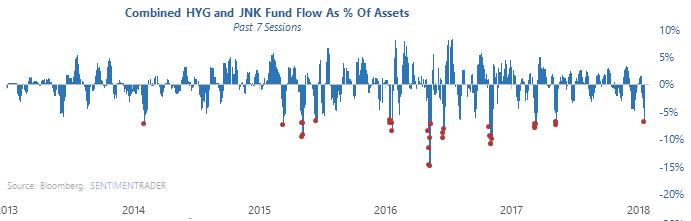

High-yield (junk) bond ETFs have seen the largest outflow of money in almost a year, nearly 7% of assets in a week.

Fund flows can be inconsistent, but work well in these funds. Prior times there was such a large, concentrated outflow, the funds rallied over the medium-term.

Money managers can’t get enough oil

This week, money managers became the most lopsidedly bullish oil they’ve ever been. Previous times they were so aggressive, oil fell back, especially the USO fund.

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers are now at or near record long exposure again in 2-year and 5-year Treasuries. In the past, that has consistently led to rallies in the short end of the Treasury curve, but did not the last time, at the end of October.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.