Leading up to its recent tumble, gold shot far ahead of fundamentals

Gold had a heck of a run starting about a month ago. It not only generated a massive amount of optimism that the metal will keep rising, it was enough to partially de-couple from one of its main drivers.

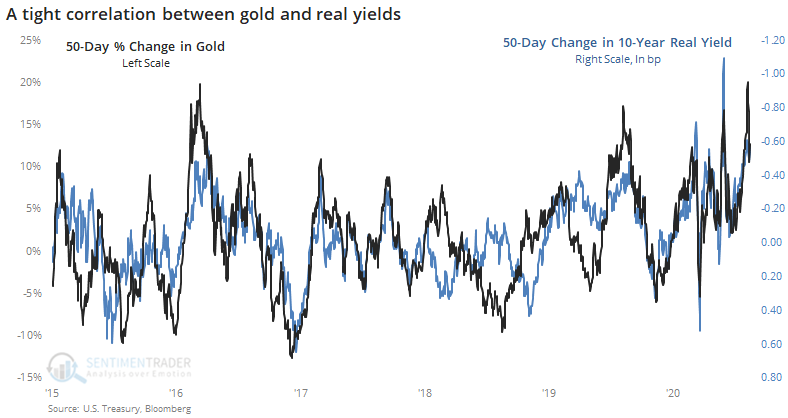

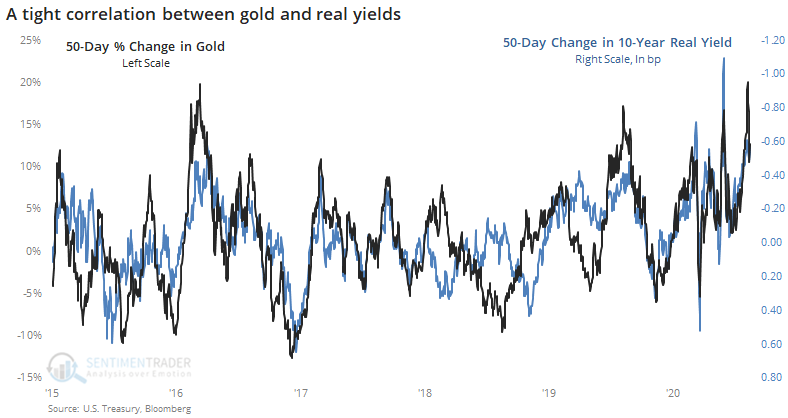

As the Wall Street Journal notes, gold's gain over the past 10 weeks far outpaces the drop in real 10-year Treasury yields. There is a tight inverse correlation between the two, so as real rates dropped, gold should have rallied. It just rallied A LOT.

We always apply two questions when seeing a development like this:

- Is it true?

- So what?

As for the first, yes, it's accurate. Over a 50-day span, gold rallied more than 20% while real rates dropped about 50 basis points. That's normal over the past decade, but it's on the higher end of jumps in the price of gold given that level of decline in real yields. For a drop of 50 or more basis points in real yield, gold has rallied a median of 13%, so the 20%+ spike is quite a bit higher than average.

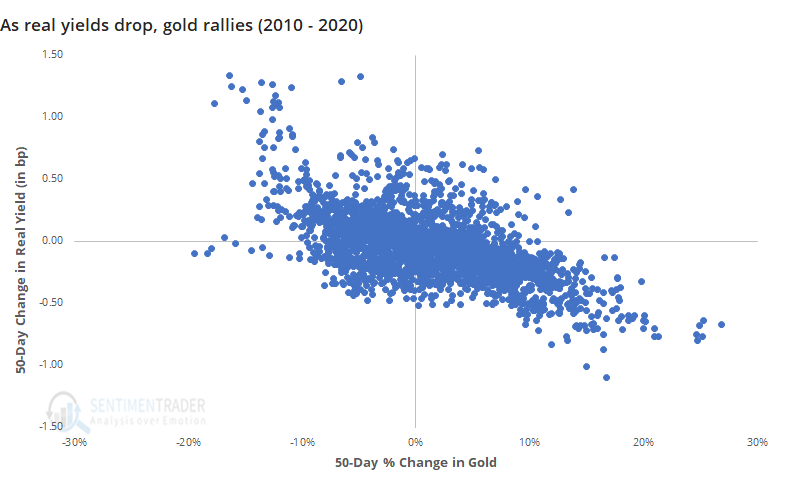

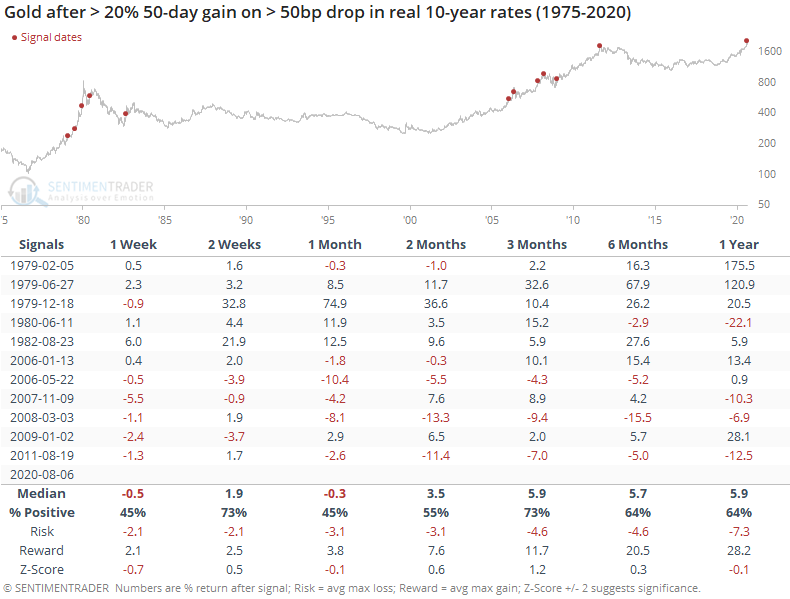

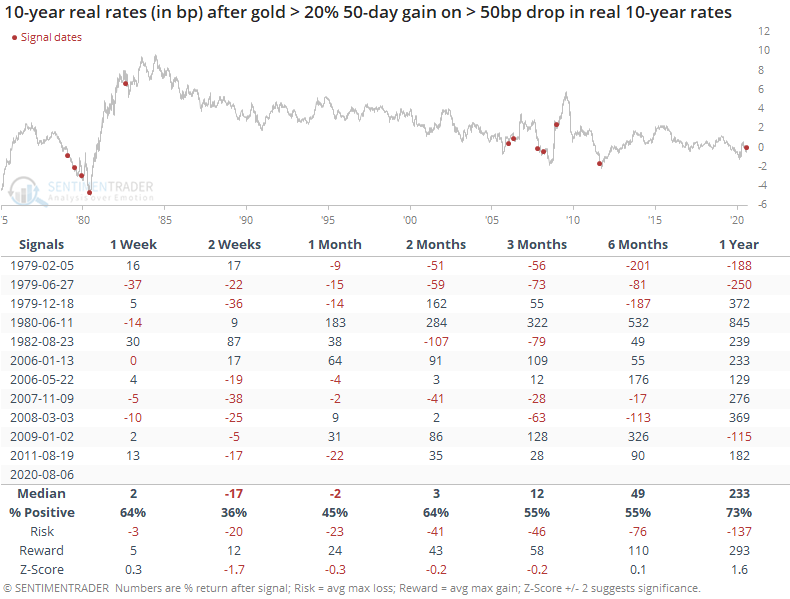

As for whether it matters, that's less certain. Below, we can see every time since 1975 when gold rallied at least 20% over a 50-day span while real yields declined 50 basis points or more.

Over the next month, gold struggled a bit. It did not at all during the late 70s bull market, but during the protracted 2000s bull, gold did tend to rest over the medium-term after getting so far ahead of one of its main fundamental drivers.

As for rates, there was a modest tendency to see further weakness over the shorter-term but strength over the medium- to long-term. It was not a strong edge.

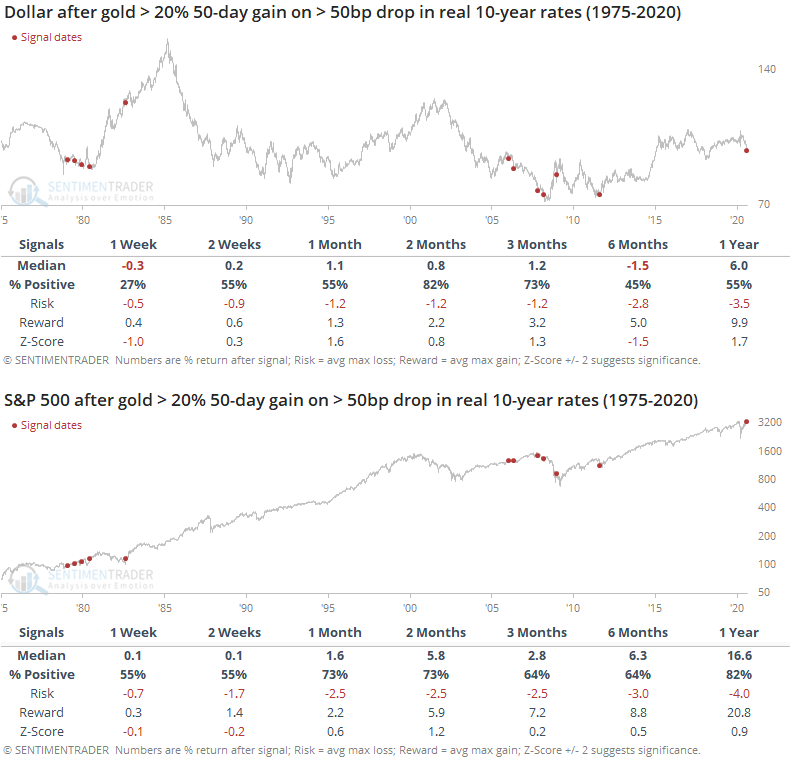

There was no strong edge in either the U.S. dollar or S&P 500, either.

Bottom line, it's interesting that gold has moved so far ahead of one of its main reasons for rallying. The extreme optimism it generated makes sense, too. There is a tendency for the metal to drop after bouts of extremes like it saw in late July, with its more recent history of decoupling from real rates being minor support to that idea as well.