Leading indicators are rolling over

Key points:

- The Leading Economic Index is now contracting on an annual basis

- At the same time, the long-term trend for the S&P 500 is bearish

- After similar conditions, the S&P 500 was negative on a medium to long-term basis

- The odds of a recession look more likely with the new LEI signal

The Leading Economic Index measures a diverse group of leading indicators

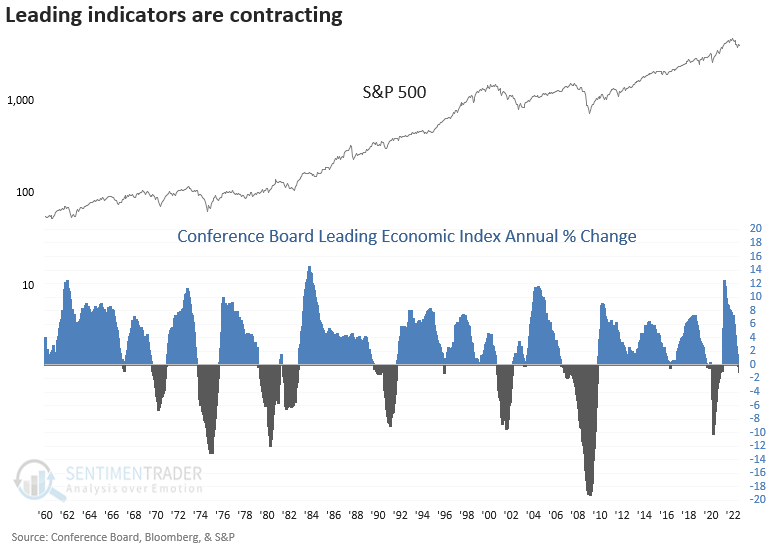

The Conference Board released the August Leading Economic Index (LEI) on Thursday. The composite, which contains ten economic components, registered the first annual decline since the Covid recession.

The contraction triggered a new alert for a member in the TCTM Composite Recession Model. When the LEI contracts annually and the S&P 500 is trading below its 12-month average, the environment for stocks is unfavorable.

Economic data operates with a lag and is subject to revisions. So, it's not an ideal timing mechanism for the stock market. However, it can give investors a general sense of the overall investing environment.

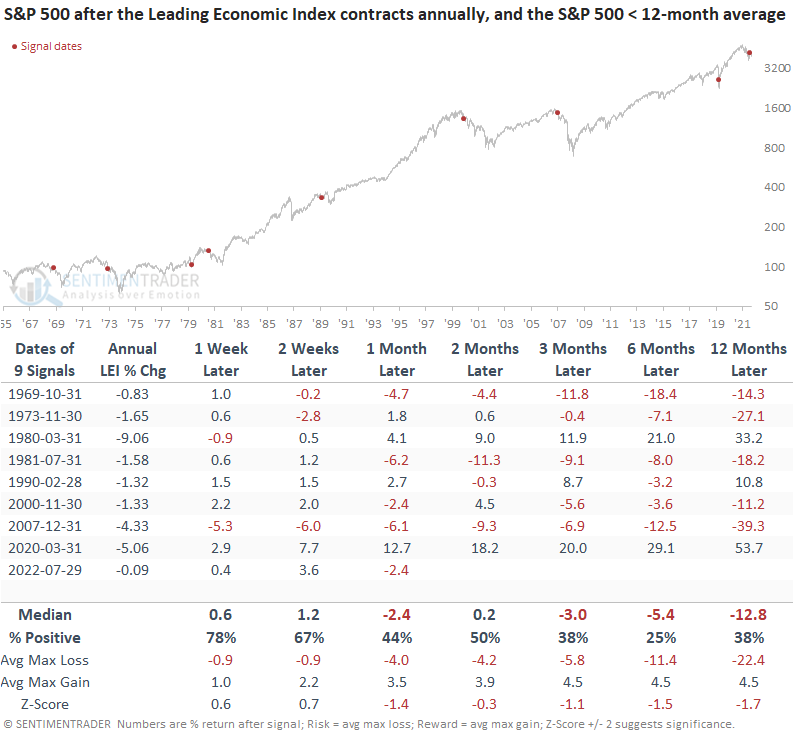

A contraction in leading indicators preceded negative returns for stocks

While the sample size is small, which is the case with most economic data, stocks struggled on a medium to long-term basis, especially 12 months later.

The original data for July did not show a contraction. In the August update, revisions caused the July annual number to turn negative, which is why the signal date occurred in July.

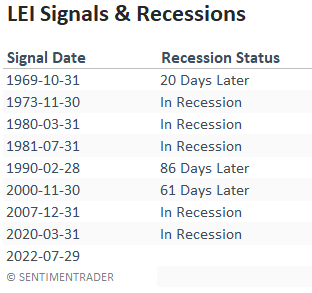

A recession looks more likely with the new LEI signal

Since 1969, the LEI model has generated an alert during a recession in five cases. If a signal occurred before a contraction in the economy, it took, on average, 55 days until the NBER declared a recession.

What the research tells us...

The Leading Economic Index, a broad measure of leading economic indicators, declined annually, with the S&P 500 trading below its 12-month average. Similar conditions preceded negative returns for the S&P 500, especially on a long-term basis. With the new signal, the weight of the evidence continues to build in favor of an economic contraction.