Leaders Become Laggards As Traders Bet On Volatility

This is an abridged version of our Daily Report.

Leaders become laggards

The Nasdaq Composite and Russell 2000 have lost their 50-day averages after months above, a change from June when both were leading the market. Even with the S&P 500 and Dow Industrials above their averages, future returns were muted.

Summer of volatility

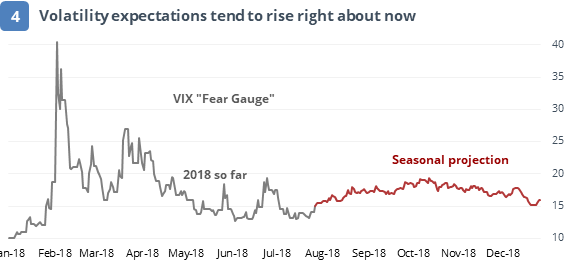

The seasonal pattern between the past 5 and 25 years in the VIX shows a bottom right about now in a typical year.

Hedgers seem to be betting on it, holding more than 20% of the open interest, among their larger positions in nearly 15 years.

New highs in high-yield

The number of new 52-week highs among high-yield funds finally exceeded the number of new lows, as noted in a report from July 23.

Tech troubles

The Nasdaq Composite set a 52-week high four days ago and then dropped more than 1% each day since. It has only done that twice before, on March 15, 2000 and January 22, 2010.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |