Last Gasp Gold

Let's face it, for all the attention showered upon gold, it really has been a "dog" so far in 2021. This should probably not come as a total surprise (see here and here).

Still, it has been a disappointment to many traders. Is there any hope remaining? Always. The reality is that no one really ever knows for sure which way price is headed next. As a result, as traders, we must:

- Weigh the evidence that we find most relevant

- Decide whether or not to play

- Make our play (or not)

- Manage risk ruthlessly (in case we are wrong this time around)

FIRST THE BAD NEWS

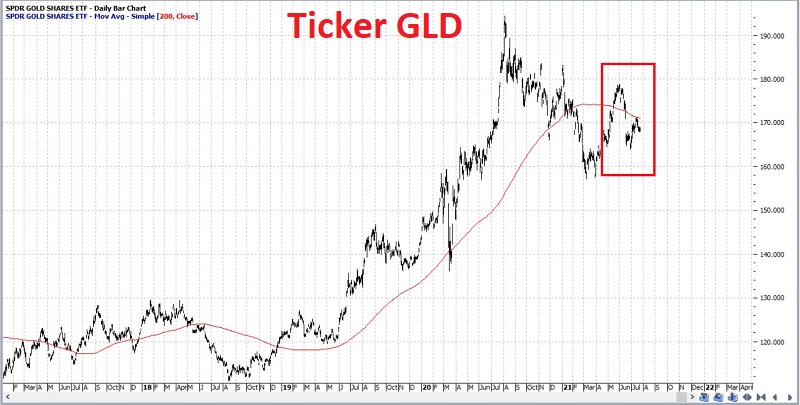

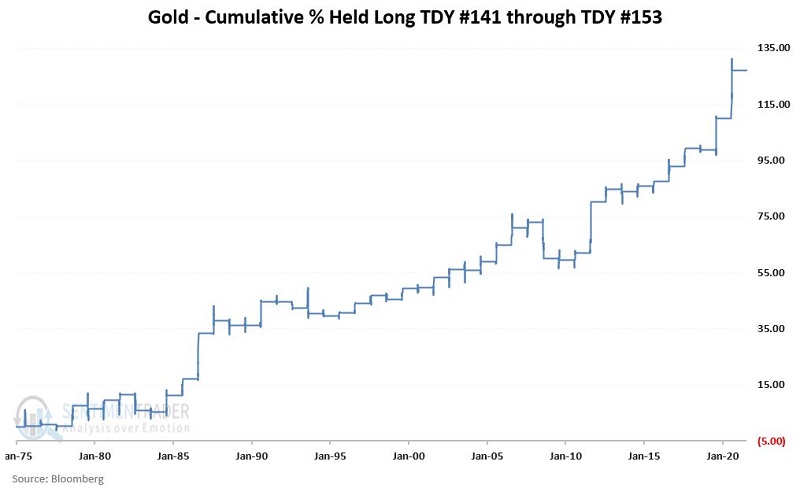

In the chart below (courtesy of ProfitSource), we see that ticker GLD (VanEck Vectors Gold Miners ETF) has dropped below its 200-day moving average and that the moving average has rolled over and is trending lower.

While this may look and sound ominous, the reality is that if one examines a historical chart of gold, you can find numerous instances where price dropped below a given moving average, the moving average rolled over - and voila, the price of gold turned around and rallied again.

Nevertheless, the point here is that one can objectively argue that the price of gold is in a downtrend at this exact moment in time.

THE GOOD NEWS

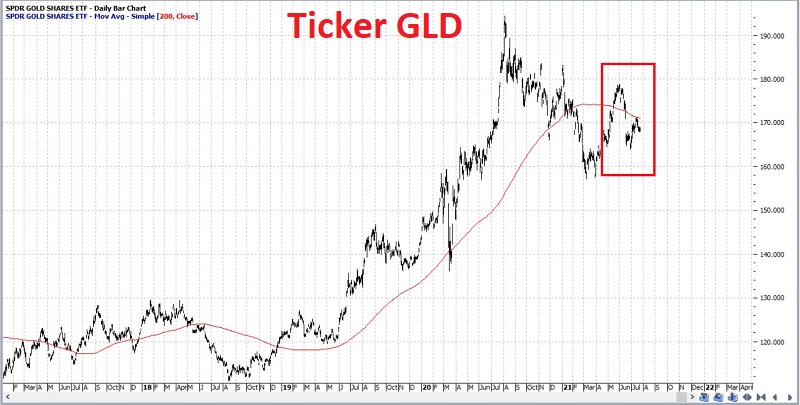

The "Good News" should probably be labeled (more accurately) as "Potential Good News." In the chart below, we see the Annual Seasonal Trend for ticker GLD (SPDR Gold Shares ETF) - and we can note that we are entering a typically favorable period.

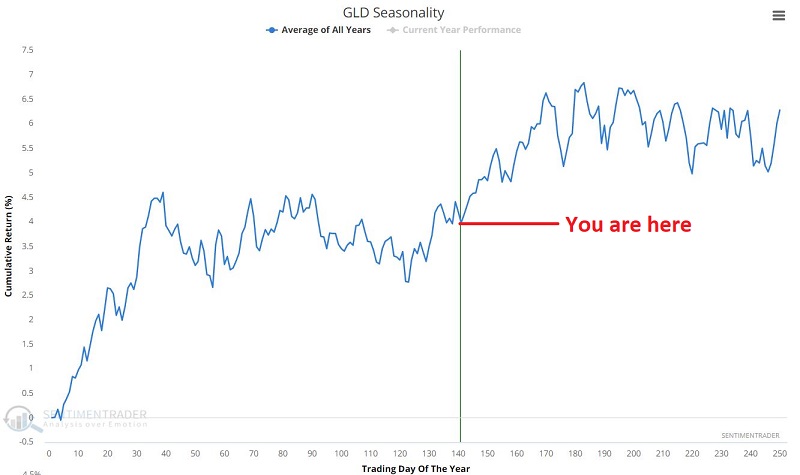

In the chart below, we see the hypothetical % +(-) for the price of gold if HELD ONLY from the close on Trading Day of the Year #141 through the close on Trading Day of the Year #153 since 1975.

During this period since 1975, gold:

- Was UP 30 times

- Was DOWN 15 times

- Was unchanged once

- Showed a median loss during down years was -0.63%

Most importantly, on only two occasions has the loss exceeded -1.5% (1982 down -5.0% and 2008 down -7.5%). In other words, over 95% of the time, gold DID NOT experience a loss over -1.5%.

This sets up a scenario for a potential options trade.

THE TRADE CATALYST

The theory behind the trade below is that - according to historical results during the impending seasonal period - there is a low probability of a sharp decline in the price of gold. In other words, we are looking for gold to - at the very least - hold steady or hopefully move higher in the short term. Below we will detail an example options trade intended to profit if our theory holds true. At the same time, we will need to protect ourselves if our theory proves incorrect.

BULL PUT SPREAD USING OPTIONS ON TICKER GLD

As always, it is essential to point out that the example trade detailed below is just that - an example - and NOT a "recommendation." I am offering no opinion as to whether gold or ticker GLD will actually rise or fall during the life of this hypothetical trade. As I have just pointed out, one can make an equally compelling bullish or bearish case, depending on what market influences they choose to focus on.

In this scenario, we are not necessarily looking to bet on GLD going up. Instead, we are betting on GLD to do something other than decline -2.7% or more in the next several weeks. To make this play, we will use a strategy known as a "bull put spread," which involves:

- Selling a put option at a higher strike price (typically at a strike price below the current price of the underlying security)

- Buy another put option at a lower strike price

Our example trade is as follows:

- Sell 13 GLD Aug06 164 puts @ $0.39

- Buy 13 GLD Aug06 162 puts @ $0.22

The particulars appear in the screenshot below and the risk curves (i.e., the expected P/L as of a given date and price for GLD) in the chart below that (courtesy of Optionsanalysis.com).

Things to note:

- There are 10 days left until the options expire

- The maximum profit potential is $221 (if GLD is above $164 a share at expiration)

- This represents a potential profit of 9.5% in 10 days

- The maximum risk is -$2,379 (if GLD is below $162 a share at expiration)

- GLD is trading at $168.46 a share, and the breakeven price at expiration is $163.83

In a nutshell: As long as GLD does not drop from $168.46 to $163.83 or lower in the next 10 days, we stand to earn 9.3% on capital risked. Mathematically there is better than an 80% probability of profit.

Sounds pretty great, right?

Now let's move on to the realities of trading.

POSITION MANAGEMENT

Mathematical probabilities are all well and good. But in real-world trading, they are really only useful in comparing one trading opportunity to another. Once a trade is entered, and there is risk capital on the line:

- The real question is NOT "what is the probability that I will make money?"

- The real question is, "What the heck will I do if my worst-case scenario unfolds."

The MOST important thing to note about our example trade is that the maximum risk far exceeds the maximum profit. This is fairly typical for this type of trade. However, what it means is that this is NOT a "set it and forget it" kind of trade. In other words, a trader who enters into this position MUST be prepared to act if and when the time comes to cut a loss.

The recent low near $164 a share for GLD is a natural "uncle" point for this particular trade. This price level represents both:

- A "line in the sand" level of support for GLD

- Our short strike price

IMPORTANT NOTE: If you are new to options trading, please note that if GLD drops below $164, our short put may be "exercised," which means we will be required to purchase and deliver 100 shares of GLD stock at $164 a share. Please also note that:

- Before options expiration, exercise is NOT automatic the moment GLD trades at $164 a share. Exercise is most common closer to expiration when there is little to no time premium left in the option price.

- At expiration, exercise IS automatic IF GLD is trading below $164 a share.

So, our position management plan for this hypothetical trade might read something like the following:

- IF ticker GLD trades down below our breakeven price of $163.83, we will close the trade entirely

- IF we can close the trade before expiration and take a profit of at least [your acceptable level of $ profit here], we will do so (rather than risking our profit vanishing with a late decline in GLD closer to expiration)

Note that if our stop-loss price is hit before option expiration, our expected loss can be anywhere from negligible (if close to expiration) to roughly -$760 (if our stop-loss price is hit immediately). Again, this unfavorable reward-to-risk ratio is common for this strategy as it is primarily a play on "probability," i.e., a trader MUST have a high degree of confidence that the probability of getting stopped out is low to justify taking the trade in the first place.

SUMMARY

A lot to chew on. The most important takeaway is understanding that selling option premium is NOT the "easy money" that some tout it to be. A plan to manage risk is essential every time out. No exceptions.