Largest Gap Since '11; Presidential Services

Most of the time, participants have no idea why markets move. Reasons are given during and after the fact, but they're just guesses that sound good, really.

A handful of times each year, though, the reasons are clear. Based on the way markets have been trading in recent weeks and the reaction late Sunday into early Monday, the biggest reason for the moves has been worries (and relief) over tariffs and a larger geopolitical skirmish.

That means Sunday's announcement has a chance to be historic, making it harder to rely on historical precedents. If this truly leads to an improved relation between the world's two largest economies, then it's going to overwhelm any technical or behavioral setup in the short-term.

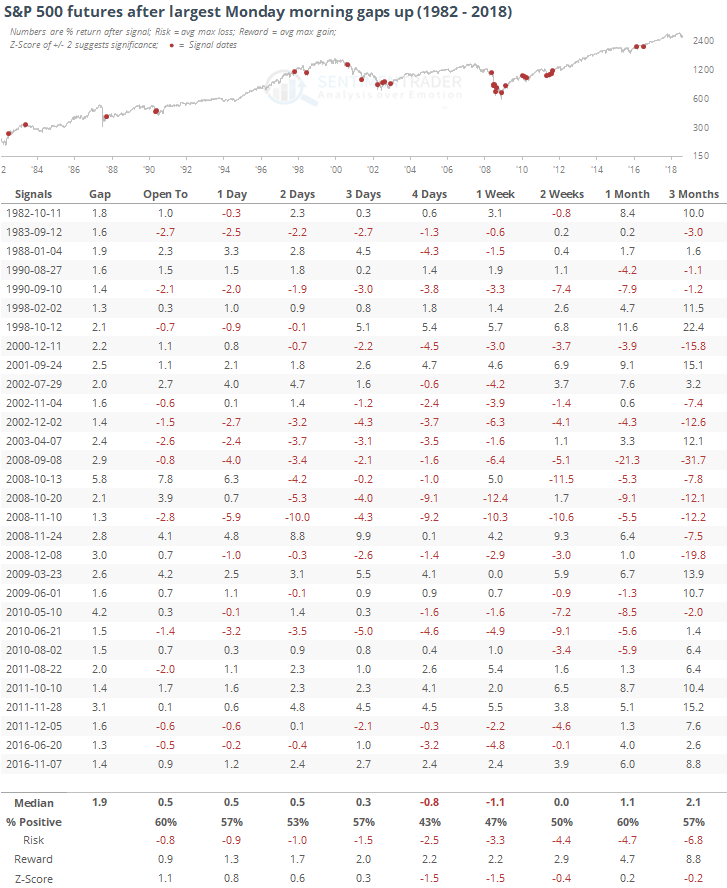

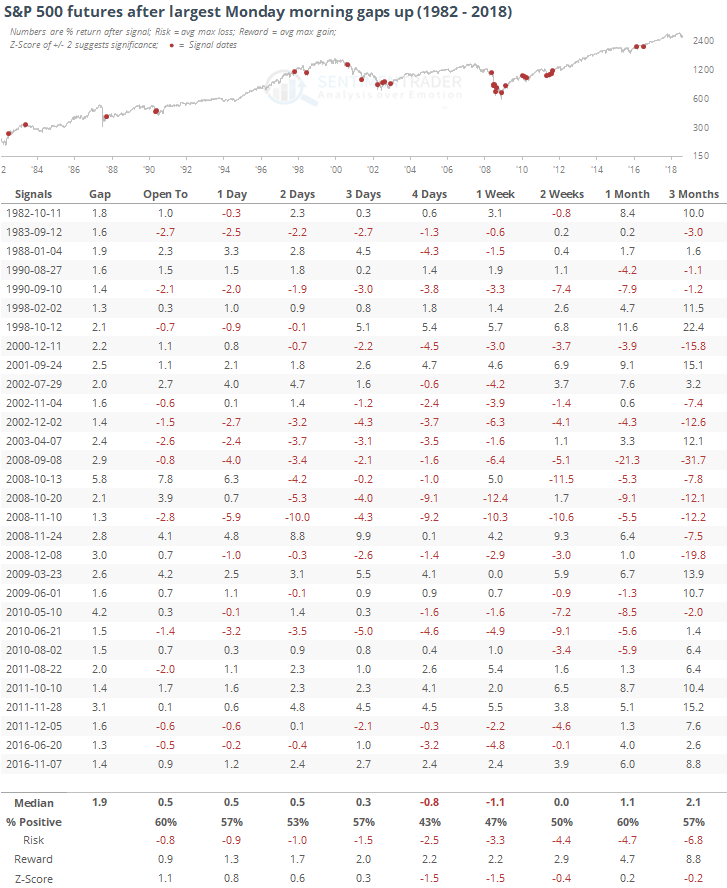

With that in mind, we're setting up for the largest Monday gap up opening in equity futures since 2011.

There was a modest tendency to see further gains in the very short-term as traders feared missing out after the big gap up. But we had already rallied hard last week, so let's see if enjoying a large gain in the prior week adjusted those expectations at all.

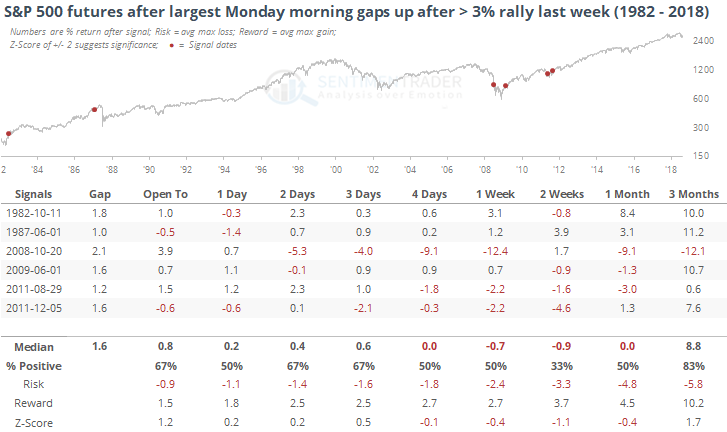

The sample size shrunk dramatically, but there was actually more of a tendency to see further gains in the very short-term, but also more of a tendency to see those gains slip back over the next 1-2 weeks.

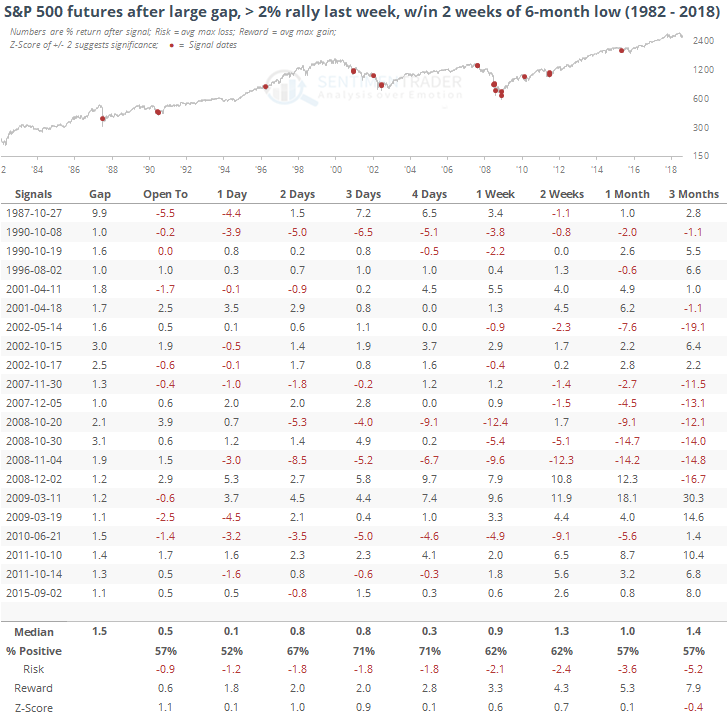

To provide a little more context, let's forget that it's Monday, and only look at gaps of 1% or more that follow a rally of at least 2% during the past week, coming within two weeks of a 6-month low.

These were a little more positive, especially in the shorter-term. The blast-off from a low helped to improve the probability that the gains would last for a bit, at least over the next 2-3 days.

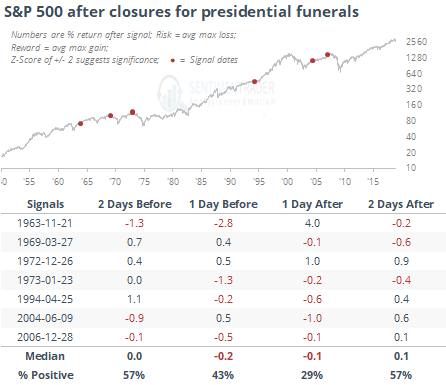

One wrinkle this week is that markets will be closed on Wednesday to pay respects to President George H.W. Bush. There is little reason why markets would behave consistently around these services, so for what it's worth, here is how the S&P reacted after other times the NYSE closed to pay respects to a president's passing.

Some weakness the day before and after the market was closed for the service, but again that's probably spurious.

Overall, we've seen mostly positive biases from our indicators and studies lately, so Monday's push should help improve the technical picture even more and change sentiment from risk-off to risk-on. If we can rely on historical reactions to gaps like we're seeing this morning, the good feelings have a slight tendency to continue for the very short-term, but ease back in the days ahead.