Large one day crash on both sides of the pond

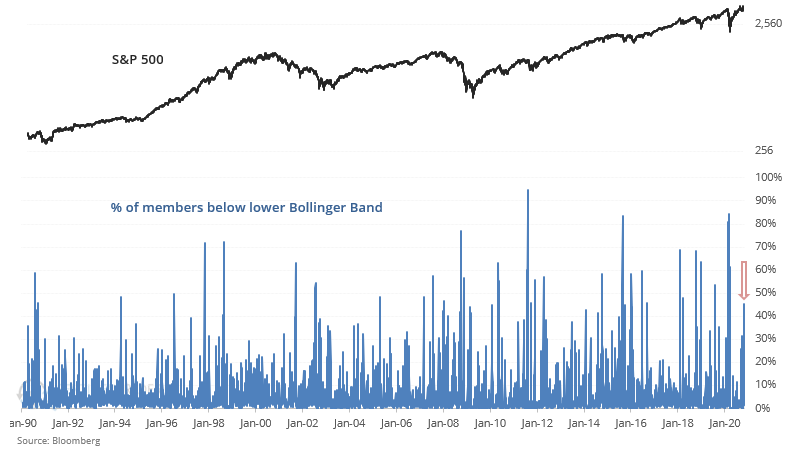

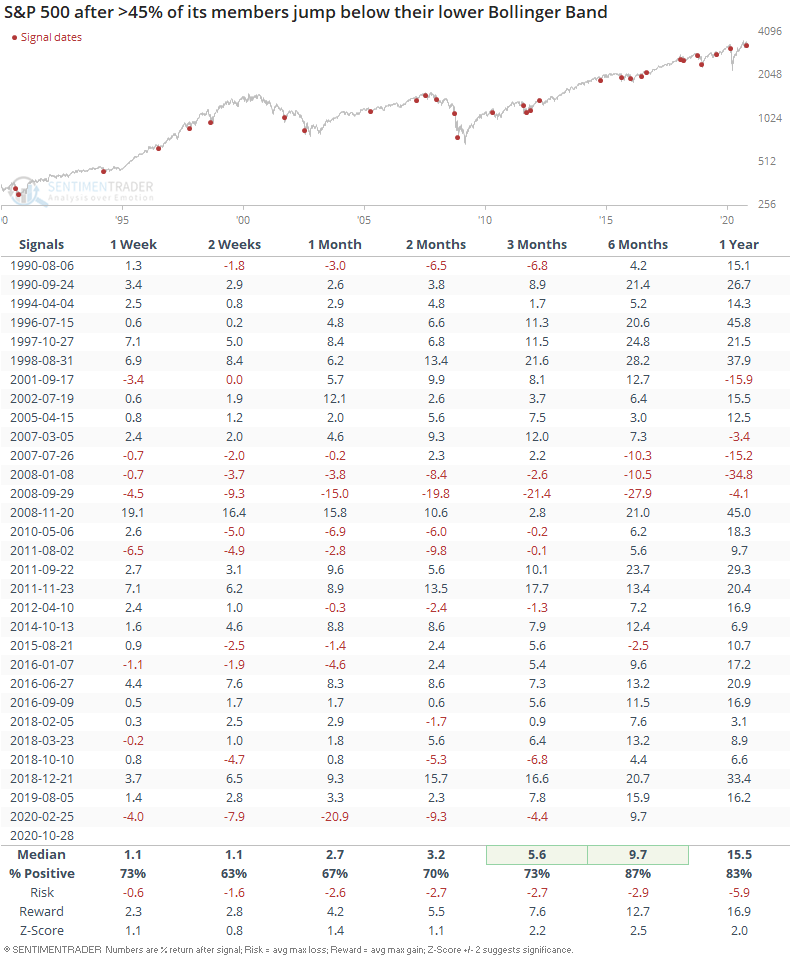

Yesterday's large one day drop in global equities pushed many stocks below their lower Bollinger Bands. More than 45% of the S&P 500's members jumped below their lower BB:

The last time this happened was at the start of the February/March crash. Of course, that was not effective short term BUY signal as stocks crashed at the fastest rate in over a decade. But overall, this consistently led to gains for the S&P over the next 6 months.

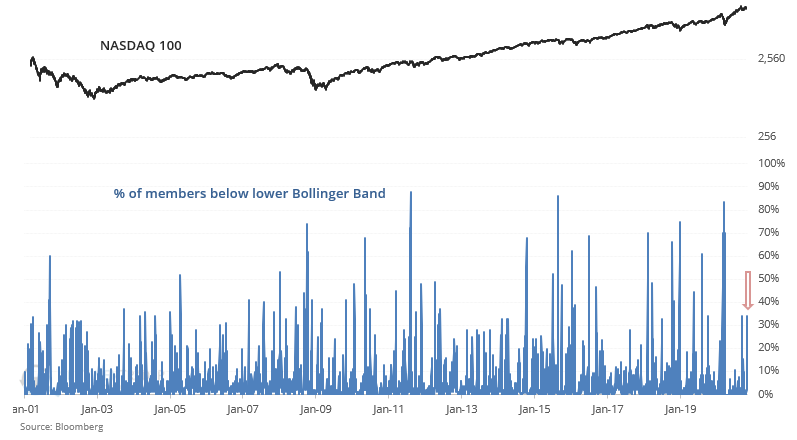

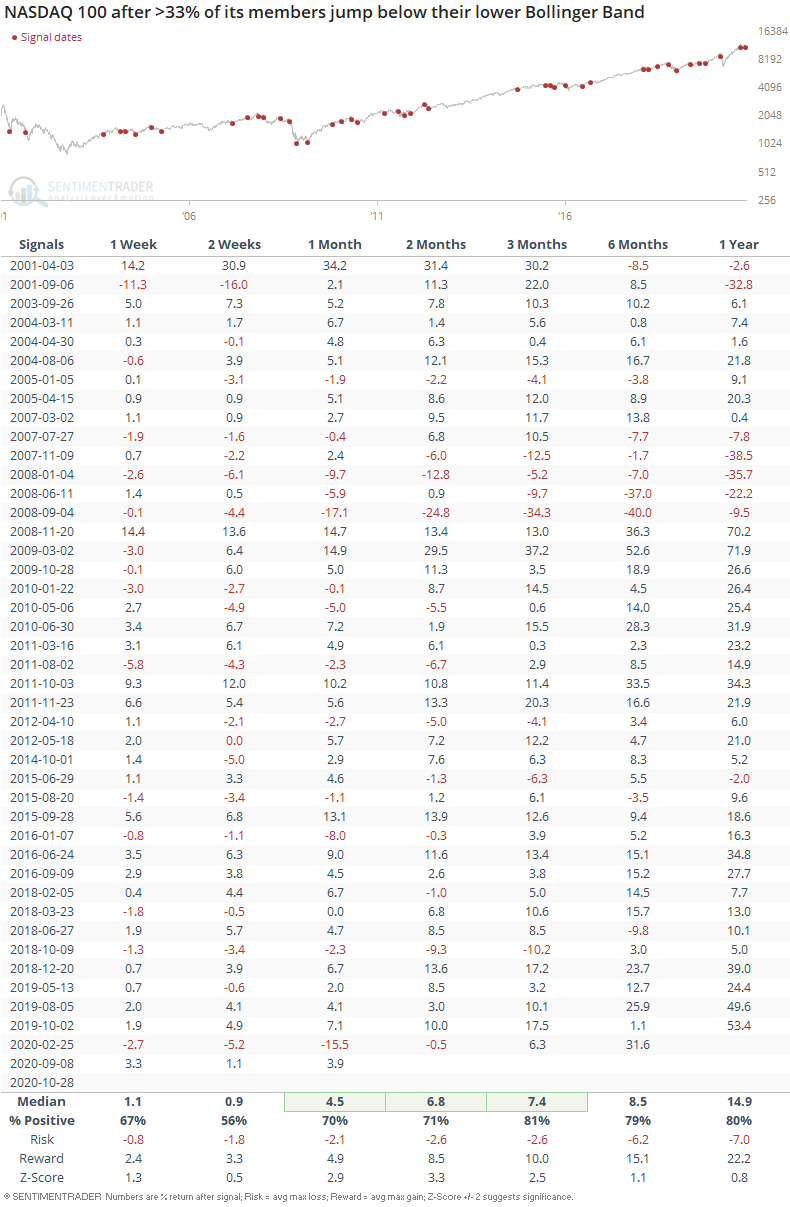

Things are not quite as extreme in tech stocks. A third of the NASDAQ 100 fell below its lower Bollinger Band:

Once again, this mostly led to bullish outcomes over the next 3 months:

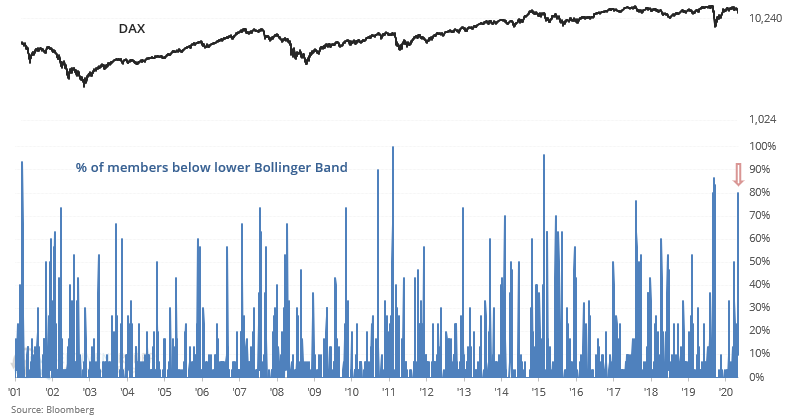

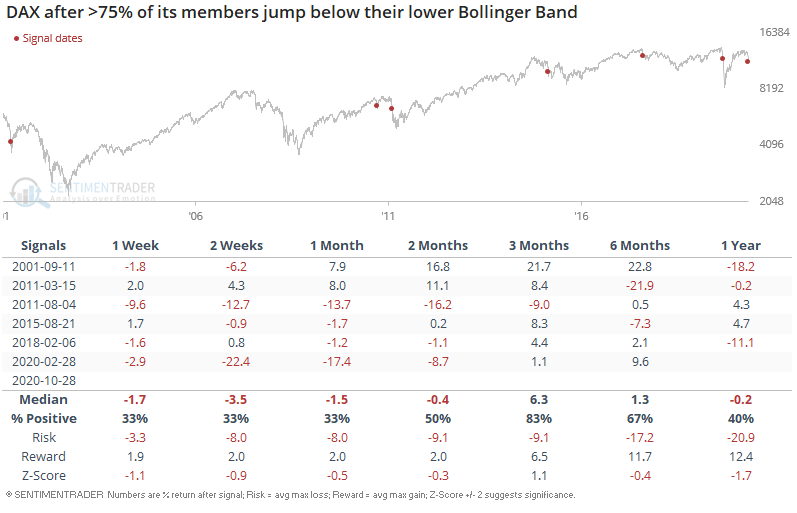

In Europe, a record-nearing 80% of DAX members fell below their Bollinger Bands:

This was a somewhat more bullish-than-random factor for DAX over the next 3 months:

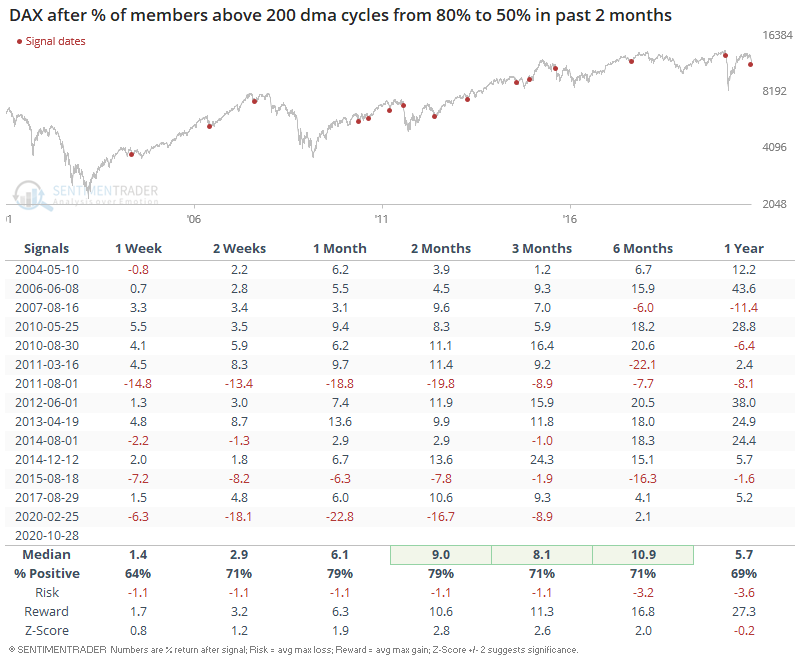

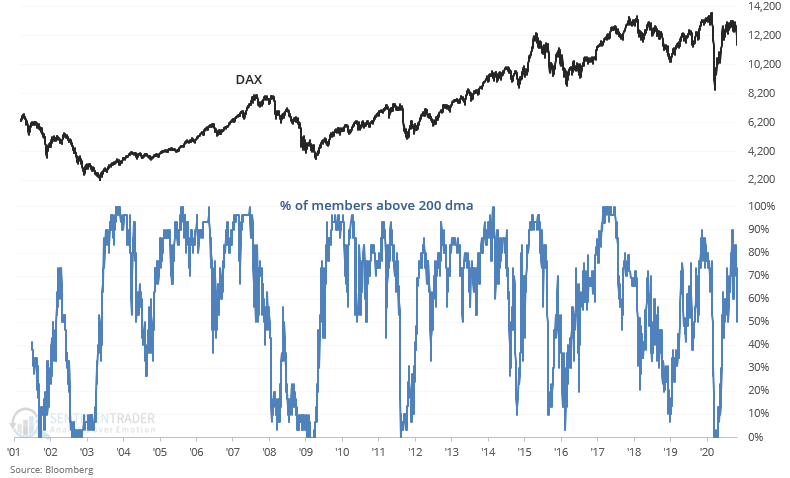

Looking at breadth from a different way, the % of DAX members in a long term uptrend (above 200 dma) plunged from 90% to 50% over the past 2 months:

Historical cases mostly led to gains for the DAX over the next 2 months: