Large Losses As Volatility Ebbs Amid ETF Outflow

This is an abridged version of our Daily Report.

A scary beginning

Before Friday’s open, stocks were facing another large loss, following three days of 1% declines. That has led to consistent rallies over the short-term, especially if measured from Friday’s open.

We’ve seen this volatility show before

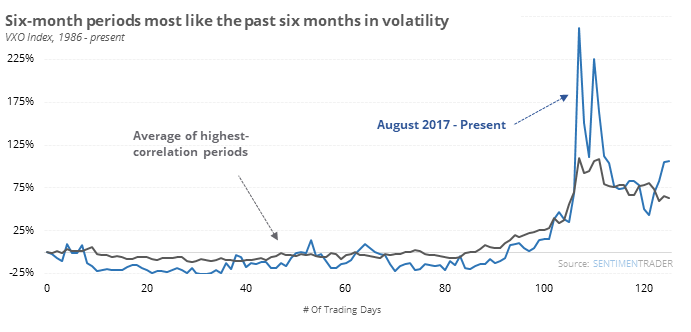

There have been 10 other six-month stretches of volatility that were like the past six months.

Most of them saw a general decline in gauges like the VIX over the following couple of months. Gains in the VIX were limited to about 20% before declining.

Big outflows

February was a terrible month for U.S. focused ETFs, which suffered their worst outflow ever. It was focused on major funds like SPY, but also corporate bond funds like LQD and JNK. Energy and Real Estate funds also saw their largest losses in assets in well over a year.

The latest Commitments of Traders report was released, covering positions through Tuesday

“Smart money” hedgers added to their long exposure in 10-year Treasuries, nearing a record. Their net long position is more than 15% of the open interest. According to the Backtest Engine, when they’ve held this much of the open interest, the TLT fund rallied over the next 12 weeks after 33 of 36 weeks.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.